Monero Price Forecast: XMR bulls aim for a rebound as retail demand increases

- Monero sustains above $500, with the 50-day EMA limiting the downside.

- A surge in XMR Open Interest and a new long positional buildup reflect a bullish bias among traders.

- The technical outlook for Monero remains mixed as the profit-taking phase flipped the momentum to bearish.

Monero (XMR) hovers above $500 at press time on Friday, with the 50-day Exponential Moving Average (EMA) providing dynamic support. An increase in XMR futures Open Interest and the long-side positional buildup suggest renewed demand among traders anticipating a rebound. Still, the technical outlook for Monero remains mixed near $500 as momentum indicators flash bearish bias.

Monero’s retail demand is warming up

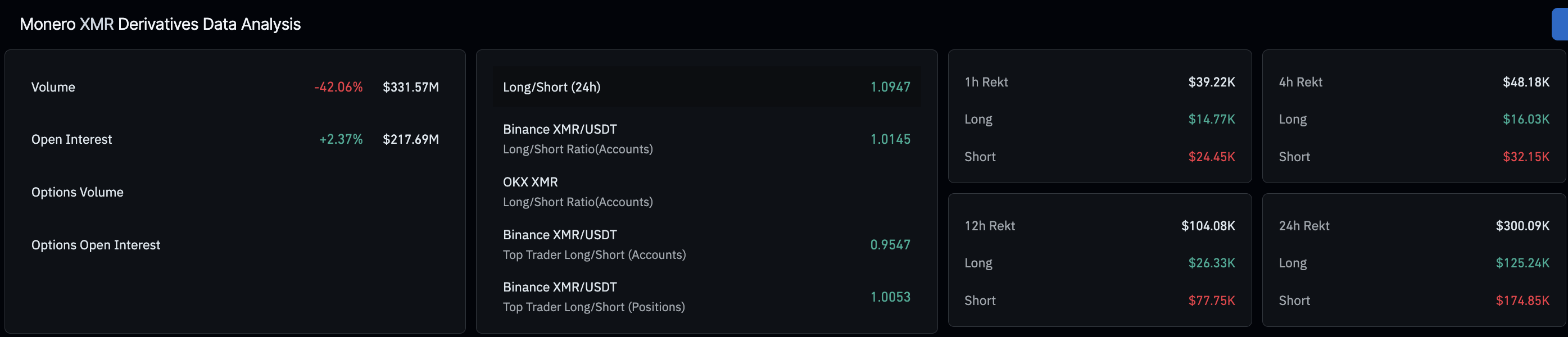

Monero is regaining retail strength as investors anticipate a rebound in the privacy coin narrative. CoinGlass data shows a 2.37% rise in XMR futures Open Interest (OI) to $217.69 million over the last 24 hours, reflecting fresh capital inflows that are boosting the total value of outstanding contracts.

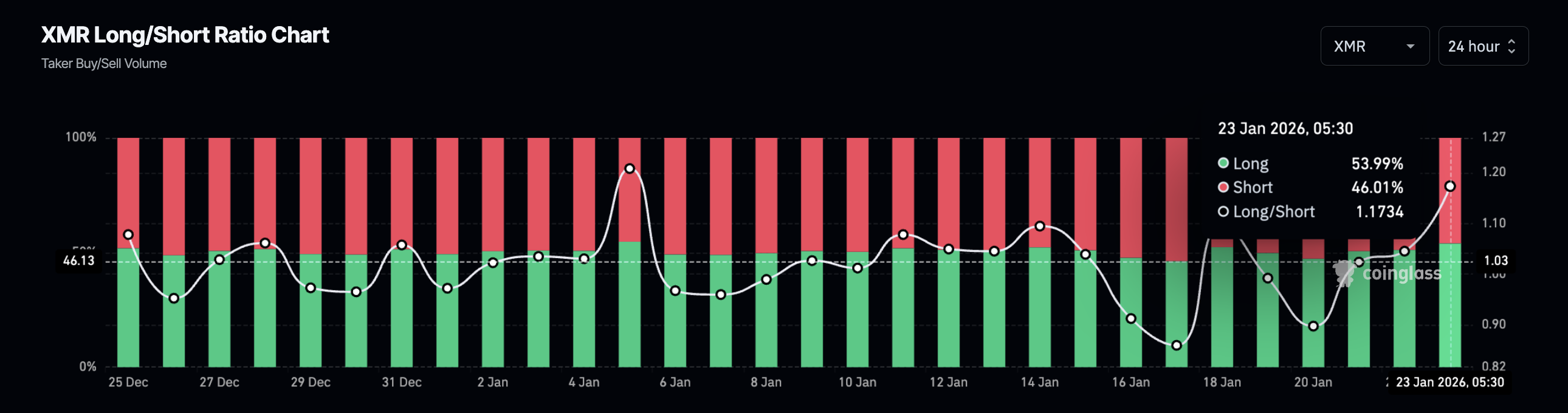

The bullish trend in capital inflows is evidenced by a positive funding rate of 0.0128% and by long positions accounting for 53.99% of the total contracts created in the same time frame.

Technical outlook: Is Monero ready for a bullish comeback?

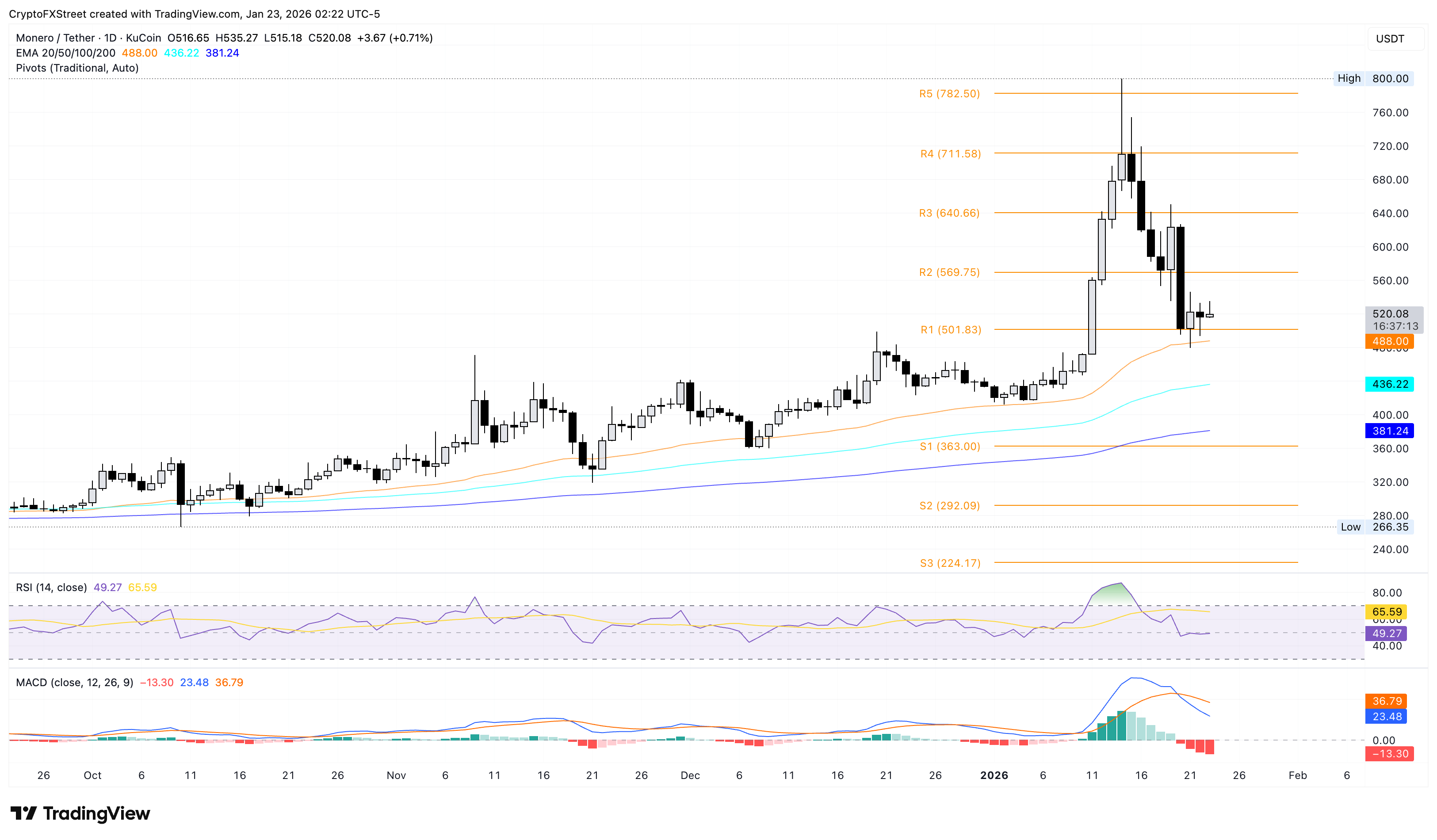

Monero is holding above $500 after a rebound from the 50-day EMA at $488 on Wednesday, keeping the privacy coin buoyant. The positive trend in the 50-day, 100-day, and 200-day EMAs continues to slope higher, supporting the broader uptrend.

The Moving Average Convergence Divergence (MACD) approaches the zero line after crossing below the signal line on the daily chart, resulting in an expansion of negative histogram bars, which suggests bearish momentum is building.

At the same time, the Relative Strength Index (RSI) is at 49, near-flat close to the midline, reflecting a consolidative impulse after the prior overbought phase.

The immediate support for XMR stands at the 50-day EMA at $488. However, a daily close below it would expose the 100-day EMA at $436, and the 200-day EMA at $381 underpins the medium-term bias.

On the upside, a potential rebound from $500 could target the R2 Pivot Point at $569 and a higher zone at the R3 Pivot Point at $640.

(The technical analysis of this story was written with the help of an AI tool.)