Ripple Price Forecast: XRP recovery cools despite increasing derivatives volume, Open Interest

- XRP corrects after testing the confluence of the 50- and 200-day EMAs at $2.58.

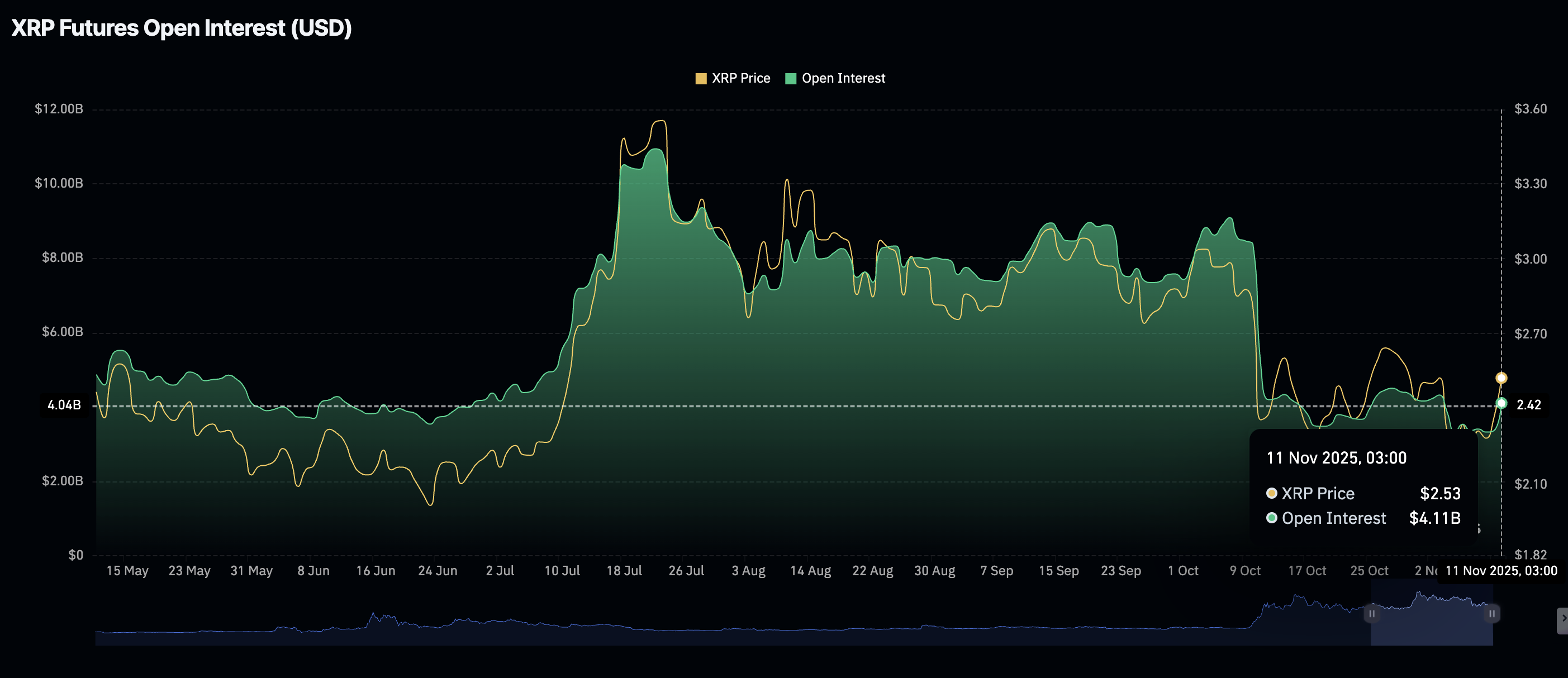

- XRP derivatives market rebounds slightly as the futures Open Interest reclaims the $4 billion mark.

- The MACD indicator maintains a buy signal, reinforcing XRP’s short-term bullish outlook.

Ripple (XRP) has pulled back to $2.43 at the time of writing on Tuesday, after rising for two consecutive days. The minor sell-off from an intraday high of $2.57 reflects a bearish outlook in the broader crypto market, as investors book early profits.

Macroeconomic uncertainty and the absence of strong bullish triggers within the industry continue to weigh on sentiment. Still, if the derivatives market holds recent gains, XRP could stabilize and resume its move toward $3.00.

XRP derivatives market rebounds

The XRP derivatives market has experienced a notable increase in retail interest, with Open Interest (OI) climbing to $4.11 billion on Tuesday from $3.36 billion the previous day.

This uptick occurred alongside a move in the price of XRP to a weekly high of $2.58, underscoring the influence retail traders have in driving prices higher.

OI is critical in gauging investor interest in XRP, as it represents the notional value of outstanding futures contracts. A steady uptrend suggests that investors are confident that the XRP price will keep rising in the short term and are willing to increase their risk exposure.

A subsequent increase in the trading volume to $10.58 billion indicates that fresh money is entering the market. The volume and OI should increase in tandem to support a short-term bullish trend.

Technical outlook: XRP recovery in jeopardy amid mixed signals

XRP edges lower, down nearly 3% to $2.45 at the time of writing on Tuesday. The cross-border remittance token is also positioned below key moving averages, including the 50-day EMA at $2.56, the 200-day EMA at $2.58, and the 100-day EMA at $2.64, all of which highlight key resistance levels.

The Relative Strength Index (RSI) currently sits at 48, down from Monday’s reading of 52. This suggests easing bullish momentum, which may curtail the short-term bullish outlook toward $3.00. Key areas of interest for traders are $2.24, tested on Sunday and $2.07, tested on November 4.

XRP/USDT daily chart

On the other hand, the Moving Average Convergence Divergence (MACD) indicator has maintained a buy signal since Monday, suggesting investors increase their risk exposure. However, recovery above the 50-day and 200-day EMAs may help uphold a bullish outlook, with an eye on $3.00.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.