Ripple Price Forecast: XRP falls below $2.50 after Fed rate cut, Trump-Xi trade deal

- XRP extends its correction below $2.50 as investors ‘sell the news’ on Fed rate cut and US-China trade deal.

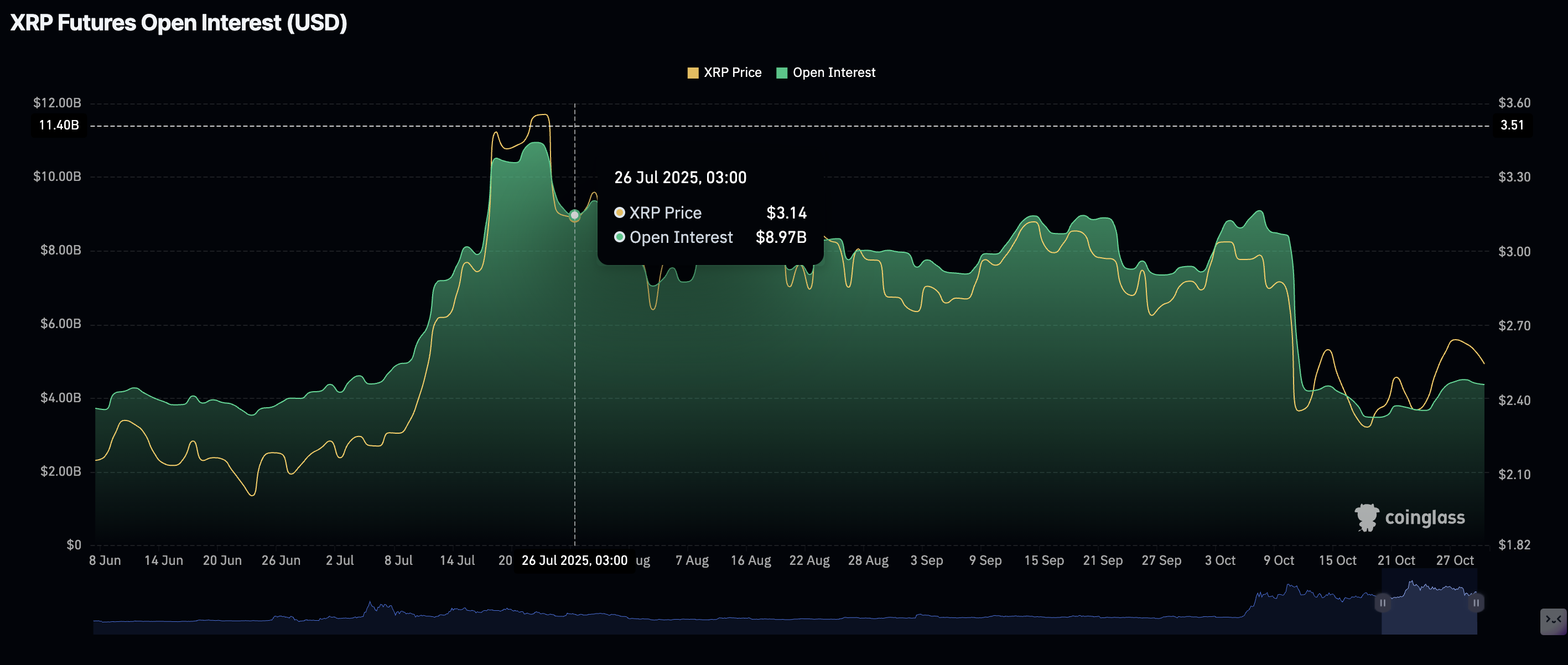

- XRP faces a weakening derivatives market, with futures Open Interest remaining below $5 billion.

- The RSI slides into bearish region amid a potential profit-taking and broader risk-off sentiment.

Ripple (XRP) declines alongside crypto majors such as Bitcoin (BTC) and Ethereum (ETH), trading below $2.50 at the time of writing on Thursday. The selling pressure in the broader cryptocurrency market followed the Federal Reserve (Fed) lowering interest rates by 25 basis points to a range of 3.75% to 4.00%.

XRP downside risks surge after Fed Chair Powell’s remarks

Although the rate cut was largely expected, Fed Chair Jerome Powell’s comments following the Federal Open Market Committee (FOMC) meeting on Wednesday spooked markets that had priced in at least three rate cuts this year. Powell’s outlook dampened sentiment across the crypto market, extending the correction since Monday.

“In the committee’s discussions at this meeting, there were strongly differing views about how to proceed in December,” Powell stated. “A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it.”

Meanwhile, markets briefly reacted to United States (US) President Donald Trump’s meeting with Chinese President Xi Jinping in South Korea, rising before erasing the gains.

President Trump called the meeting with President Xi “amazing,” announcing several outcomes, including a 10% reduction in tariffs to 47% from the current 57%, the removal of bottlenecks on rare-earth metals, and the resumption of soybean exports to the Asian economic giant, among others.

President Trump said they signed a one-year agreement that will be extended. Trump added President Xi will visit the US next year, while President Trump will head to China in April.

Sentiment in the broader cryptocurrency market appeared to worsen despite the US and China easing trade tensions. XRP remains below $2.50 at the time of writing, with key technical indicators hinting at a continued correction in the short term.

Meanwhile, XRP futures Open Interest (OI) is down approximately 41% to $4.37 billion from $7.43 billion on October 1. Although OI has improved from a monthly low of $3.49 billion, general interest in the token remains significantly suppressed compared to July, when XRP rallied to $3.66, its current record high.

XRP futures Open Interest | Source: CoinGlass

Technical outlook: XRP bears tighten their grip

XRP holds its position below key moving averages, including the 200-day Exponential Moving Average (EMA) at $2.60, the 50-day EMA at $2.67, and the 100-day EMA at $2.72, suggesting a top-heavy technical structure.

The Relative Strength Index (RSI), at 43 and falling, indicates that bearish momentum is increasing, which could accelerate the pullback toward support at $2.18, last tested on October 17.

XRP/USDT daily chart

Still, if investors buy the dip, seeking new entry positions after the drawdown and XRP closes the day above $2.50, a trend reversal could occur. Moreover, the Moving Average Convergence Divergence (MACD) has maintained a buy signal since last Friday, encouraging investors to increase exposure and contributing to buying pressure.

Key milestones traders will watch for include a sustained break above the 200-day EMA at $2.60, the 50-day EMA at $2.67 and the 100-day EMA at $2.72. If bulls push above the trendline resistance on the daily chart, the path of least resistance would remain upward, increasing the odds of a rally toward the record high of $3.66.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.