Bitcoin Price Forecast: BTC steadies as winter storm drops hashrate, BlackRock files for Premium Income ETF

- Bitcoin hovers above $88,000 on Tuesday after bouncing from a key support trendline the previous day.

- Bitcoin hashrate dropped roughly 25% as a cold winter storm affects US BTC mining companies.

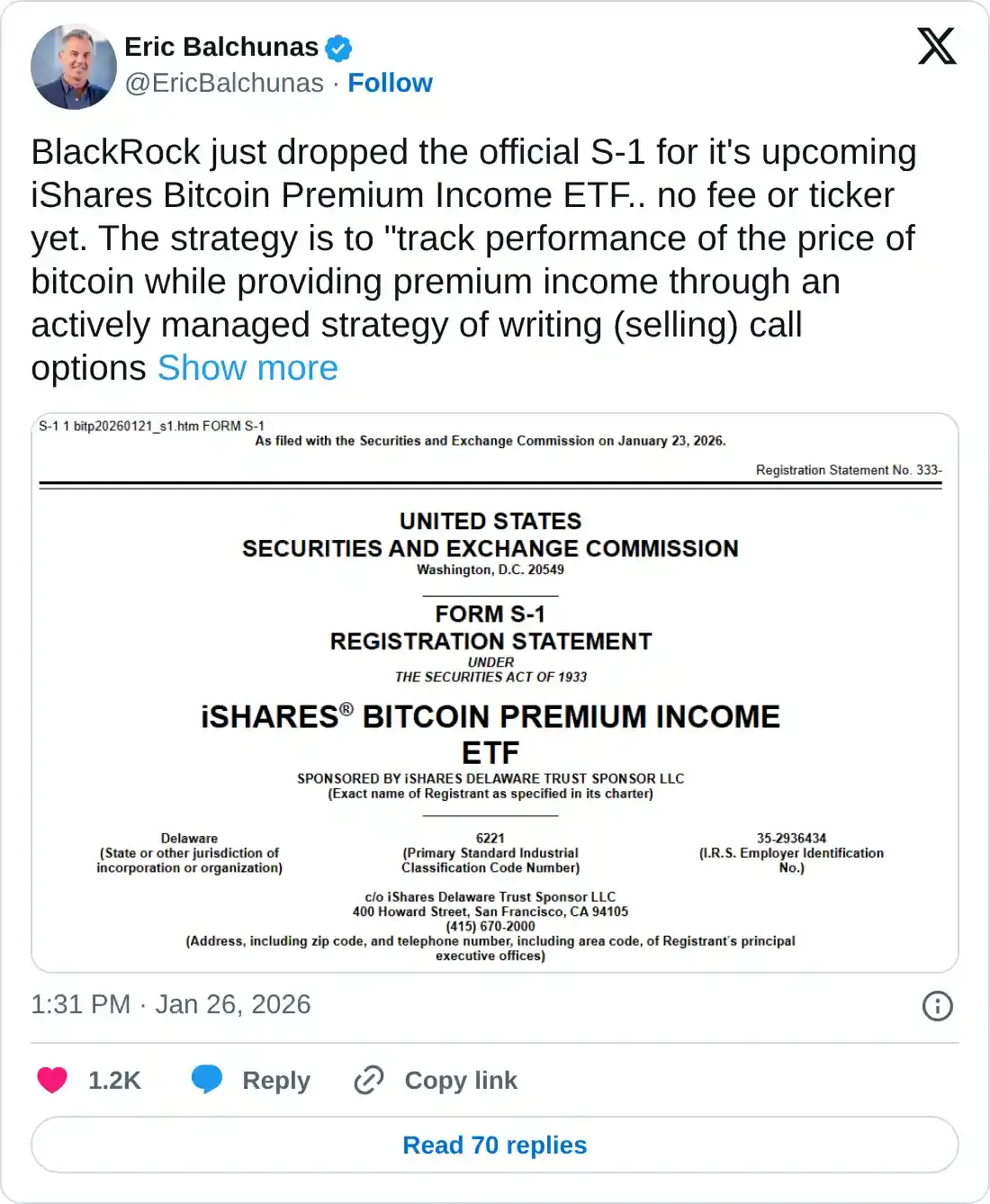

- BlackRock filed an S-1 form for the iShares Bitcoin Premium Income ETF, introducing an active options strategy.

Bitcoin (BTC) trades near $88,000 at press time on Tuesday, after reaching an intraday high of $89,010, and reflects an ease in buying pressure after Monday’s 2% rise. The stagnancy aligns with declining difficulty to mine BTC as US miners voluntarily shut down amid cold winter storms, while BlackRock filed an S-1 form for Premium Income Exchange Traded Fund (ETF), bringing an active options strategy to monetize Bitcoin’s volatility.

On the other hand, declining market capitalization of stablecoins, weak ETF inflows, and Michael Saylor's Strategy adding more Bitcoin to its portfolio could fuel volatility.

US Bitcoin miners at a halt amid shifting crypto landscape

Bitcoin miners in the US are voluntarily shutting down to reduce electricity consumption, supporting power grids amid intense cold winter storms. Data shows Bitcoin hashrate – total computational power required to mine one Bitcoin – dropped to 808.99 exahashes per second on Monday, from 1.077 zettahashes per second on Friday, a roughly 25% decline in three days. This drop in hashrate, to ease the strain on power grids, makes Bitcoin mining easier and profitable for miners online.

On the other hand, Santiment data shows that the combined market capitalization of top 12 stablecoins has lost $2.24 billion in valuation over the last 10 days, signaling a potential capital shift from Bitcoin and underperforming altcoins to commodities such as Gold, Silver and Copper. This outflow of capital from the market reduces the short-term buying pressure, limiting the topside bias.

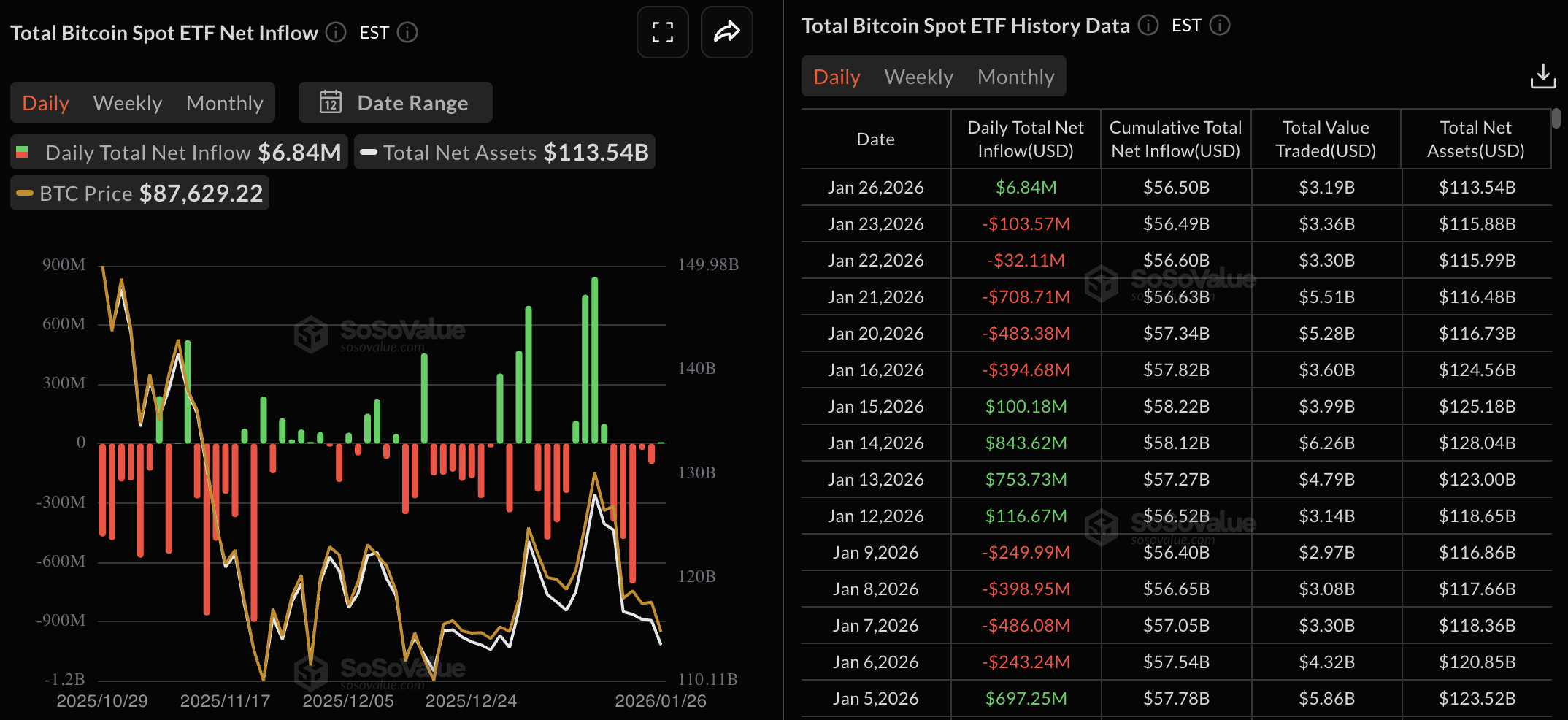

In line with reduced dry powder, the US spot Bitcoin ETFs recorded mild $6.84 million in inflows on Monday after five consecutive days of outflows, which peaked at $708 million on Wednesday.

To capitalize on Bitcoin volatility, BlackRock filed an S-1 form for iShares Bitcoin Premium Income ETF on Monday, without finalizing the ticker code or fees. The new ETF will offer Bitcoin exposure while also generating yield by actively writing call options on the iShares Bitcoin Trust (IBIT), which is valued at over $68 billion.

Adding to the confidence, Strategy continues to expand its Bitcoin treasury as announced on Monday, by adding 2,932 BTC for roughly $264.1 million. As of Tuesday, the corporation holds 712,647 BTC, acquired for over $54 billion, at an average price of around $76,037 per Bitcoin.

Technical outlook: Will Bitcoin revisit $80,000?

Bitcoin trades below the 50-day, 100-day, and 200-day Exponential Moving Averages (EMAs), reflecting the broader bearish tone. The major crypto struggles to surpass the 50% Fibonacci retracement level at $88,840, measured from the November 21 low at $80,600 to the January 14 high at 97,924.

A decisive close above this level could extend the BTC recovery to the 50-day EMA at $91,369.

The Moving Average Convergence Divergence (MACD) slips below the signal and zero line on the daily chart, while the negative histogram widens, suggesting strengthening downward momentum. The Relative Strength Index (RSI) is at 42, indicating a gradual bearish shift away from a neutral bias.

A potential reversal in BTC could threaten the rising support trendline connecting the November 22 and December 18 lows near $86,000. If Bitcoin ends a session below this level, it would confirm the bearish breakout, risking a decline to $80,600 and further down to $80,000.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.