Ripple Price Forecast: XRP bears tighten grip as Ripple, Absa Bank eye crypto custody in Africa

- XRP decline persists as bulls across the crypto market struggle amid elevated volatility.

- Ripple and Absa Bank collaborate to expand crypto custody in South Africa, leveraging institutional-grade XRL Ledger infrastructure.

- Retail interest in XRP remains largely suppressed as the futures Open Interest dips further.

Ripple (XRP) is facing overhead pressure, trading below $2.50 at the time of writing on Wednesday. The cross-border money transfer token recovery attempt in the wake of last week's flash crash was rejected at around $2.63 on Monday, affirming the short-term bearish outlook.

With a persistent bearish outlook, the odds of sustaining an uptrend toward the $3.00 psychological level are shrinking significantly. Key areas of interest include the next tentative support at $2.40, which was tested on Tuesday, and $2.20, last tested in early July.

Ripple joins hands with Absa Bank, advancing crypto custody in South Africa

Ripple has announced a strategic partnership with Absa Bank, aiming to provide digital asset custody services in South Africa. The bank is expected to leverage Ripple's institutional-grade crypto custody technology, ensuring its customers have access to scalable and secure storage for tokenized assets, including cryptocurrencies.

Absa Bank is the first African financial institution to tap Ripple's institutional-grade digital asset custody infrastructure. Ripple stated that the collaboration stems from growing demand for secure, regulatory-compliant digital custody services across emerging markets.

Ripple's Managing Director for the Middle East and Africa, Reece Merrick, stated that "Africa is experiencing a major shift in how value is stored and exchanged, and our partnership with Absa underscores Ripple's commitment to unlocking the potential of digital assets on the continent."

Ripple has been expanding its footprint in Asia and the Middle East regions, building on partnerships with financial institutions and government agencies. The company's entrance into Africa, the continent with the second-largest crypto ownership, according to Chainalysis, underscores its efforts to bring more institutions and people on-chain.

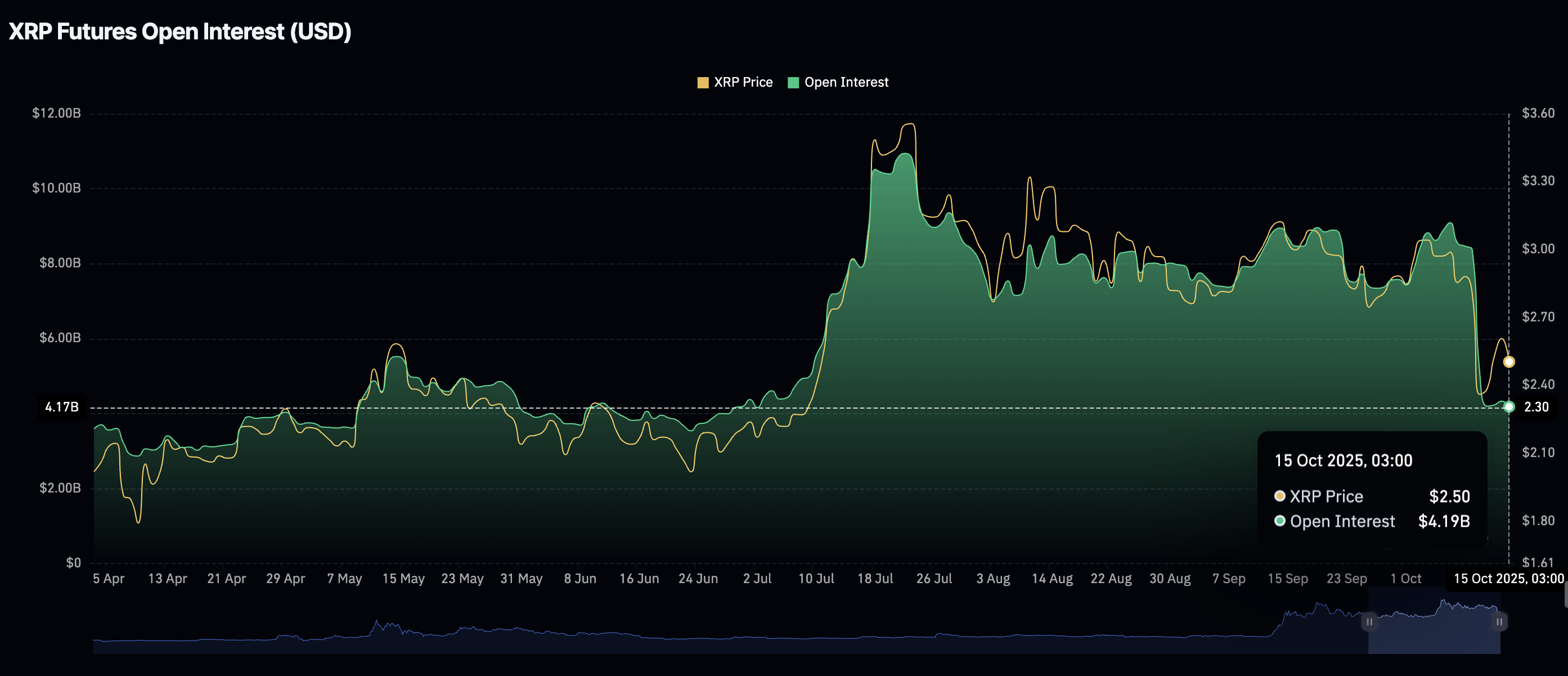

Meanwhile, retail interest in XRP briefly stabilized on Tuesday but resumed its downtrend, averaging $4.19 billion on Wednesday. With the futures Open Interest (OI) significantly below levels seen during last week's deleveraging event, which triggered massive liquidations, the odds of a significant increase in the XRP decline are high.

XRP Open Interest | Source: CoinGlass

Technical outlook: Losses linger as XRP offers bearish signals

XRP has declined, trading below $2.50 at the time of writing on Wednesday. Its technical structure on the daily chart shows a significant bearish inclination, reinforced by key indicators.

A sell signal from the Moving Average Convergence Divergence (MACD) indicator on the same daily chart has been maintained since Thursday, encouraging investors to reconsider risk exposure. The red histogram bars below the mean line suggest that bearish momentum is increasing, with further decline lingering.

The Relative Strength Index (RSI) upholds a general downtrend below a descending trendline. Furthermore, the RSI, facing downward at 36, underlines the increasing bearish pressure.

XRP/USDT daily chart

Key areas of interest include $2.40, which served as support on Tuesday, and $2.20, previously tested in early July. Still, if traders buy the dip, a reversal could occur above the short-term $2.40 support, moving toward the 200-day Exponential Moving Average (EMA) at $2.63.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.