Bitcoin Price Forecast: BTC edges below $112,000 as US-China trade war escalates ahead of Powell’s speech

- Bitcoin price edges below $112,000 on Tuesday after facing rejection from key resistance level.

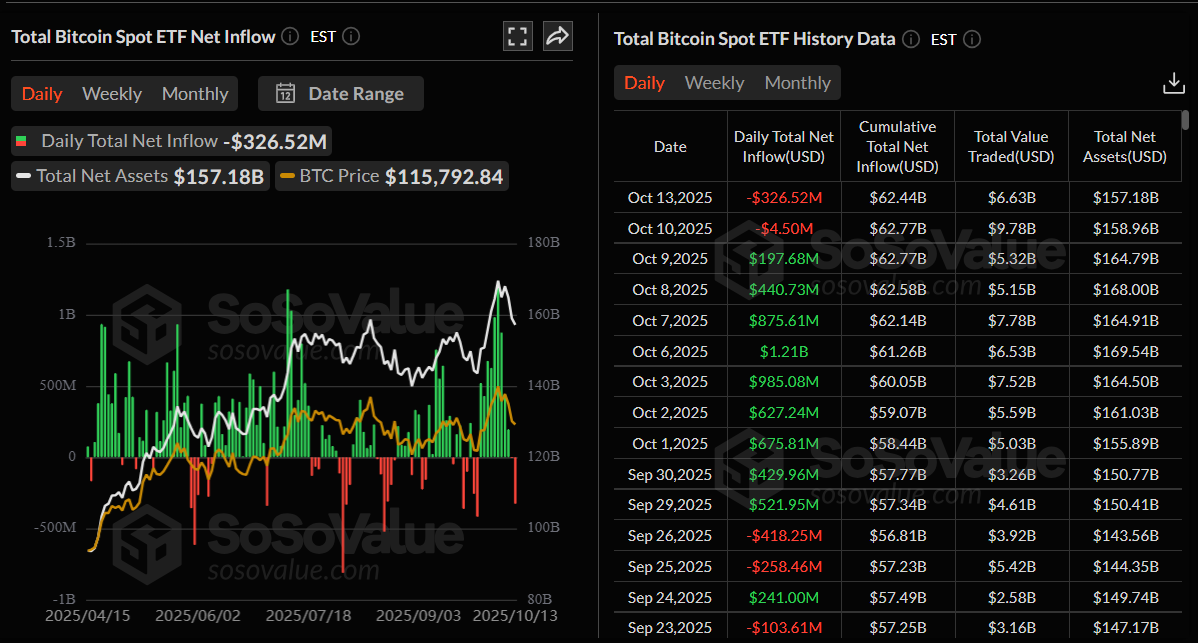

- US-listed spot ETFs record an outflow of $326.52 million on Monday, marking the second consecutive day of losses.

- US-China trade war escalates, triggering risk-off sentiment in the market.

- Market participants await Fed Chair Powell’s speech for fresh volatility in riskier assets such as BTC.

Bitcoin (BTC) price trades below $112,000 at the time of writing on Tuesday as it struggles around a key resistance zone. Weakness in BTC comes amid the rising US-China trade conflict, which further supports a bearish view and triggers a risk-off sentiment in the market. Moreover, the spot Bitcoin Exchange Traded Funds (ETFs) recorded an outflow of over $320 million on Monday, signaling cautious sentiment among institutional investors. Market participants now turn their focus to Federal Reserve (Fed) Chair Jerome Powell’s speech, which could spark fresh volatility across risk assets, such as Bitcoin.

US-China trade tension weakens BTC recovery

Bitcoin price started the week on a positive note and extended its weekend recovery on Monday, closing above $115,000 after a massive dip last week. However, this recovery weakens on Tuesday, with BTC sliding below $112,000 as US-China trade tensions escalate. The world's two largest economies are set to start charging new port fees on each other's ships, according to a BBC report.

China says its levies aim to safeguard the country's shipping industry from "discriminatory" measures and apply to US-owned, operated, built, or flagged vessels but not Chinese-built ships. This comes in retaliation for US fees on Chinese ships, which Washington says are designed to support American shipping companies.

Moreover, on Tuesday, new US tariffs came into effect on imported timber, kitchen cabinets and upholstered furniture, much of which comes from China.

Adding to this, China’s Commerce Ministry confirmed early Tuesday that it had notified the US in advance of its new rare earth export controls and held working-level talks on Monday under existing trade consultation channels.

Meanwhile, US Treasury Secretary Scott Bessent said on Monday that US President Donald Trump remains on track to meet Chinese leader Xi Jinping in South Korea in late October.

This ongoing trade tension between the two largest economies has triggered uncertainty and a risk-off sentiment in the market, which doesn’t bode well for riskier asset prices such as BTC.

Jerome Powell’s speech could bring fresh volatility in Bitcoin

The US government shutdown appears set to extend into a third week, weighing on investor confidence with no resolution in sight. The stalemate over how to reopen the US government extends as Democrats and Republicans continue to trade blame for the shutdown that began on October 1. The Senate returns on Tuesday and is expected to vote again on the funding plan, which has fallen short of the necessary 60-vote threshold seven times.

Meanwhile, market participants look forward to a slew of speeches from Fed officials, including Chairman Jerome Powell on Tuesday, for fresh hints on the scope of interest rate cuts by year-end, which could bring new volatility to riskier assets such as BTC.

However, with the ongoing US government shutdown limiting new economic data releases, Fed Chair Powell’s speech may echo last Thursday’s remarks, offering little in the way of fresh monetary policy guidance.

Institutional demand shows mild signs of weakness

Institutional demand weakened as the week started. SoSoValue data shows that Bitcoin spot ETFs recorded an outflow of $326.25 million on Monday, marking the second consecutive day of withdrawals since Friday. If these outflows continue and intensity, the BTC price could see further correction.

Total Bitcoin Spot ETF Net inflow daily chart. Source: SoSoValue

OG wallets shorting BTC again

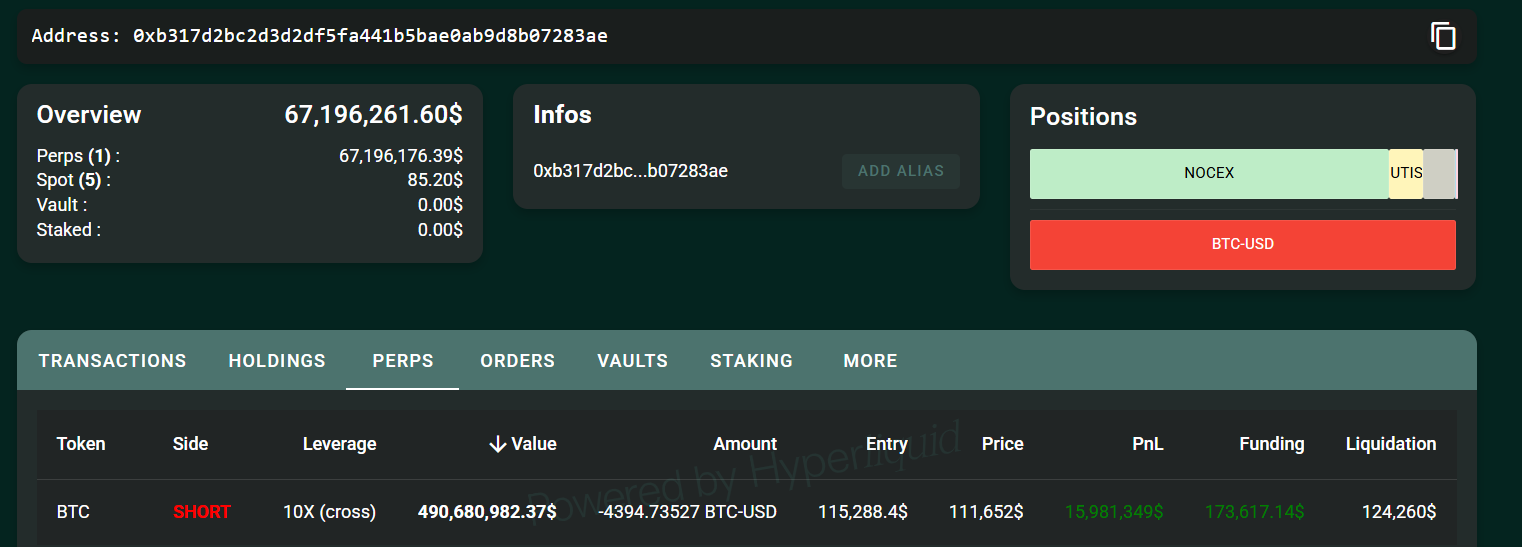

On-chain data shows that the wallet, referred to as BitcoinOG, which shorted BTC right before Friday’s dump last week, has increased its open short position on Tuesday, bringing the total short position to over 4,394 BTC.

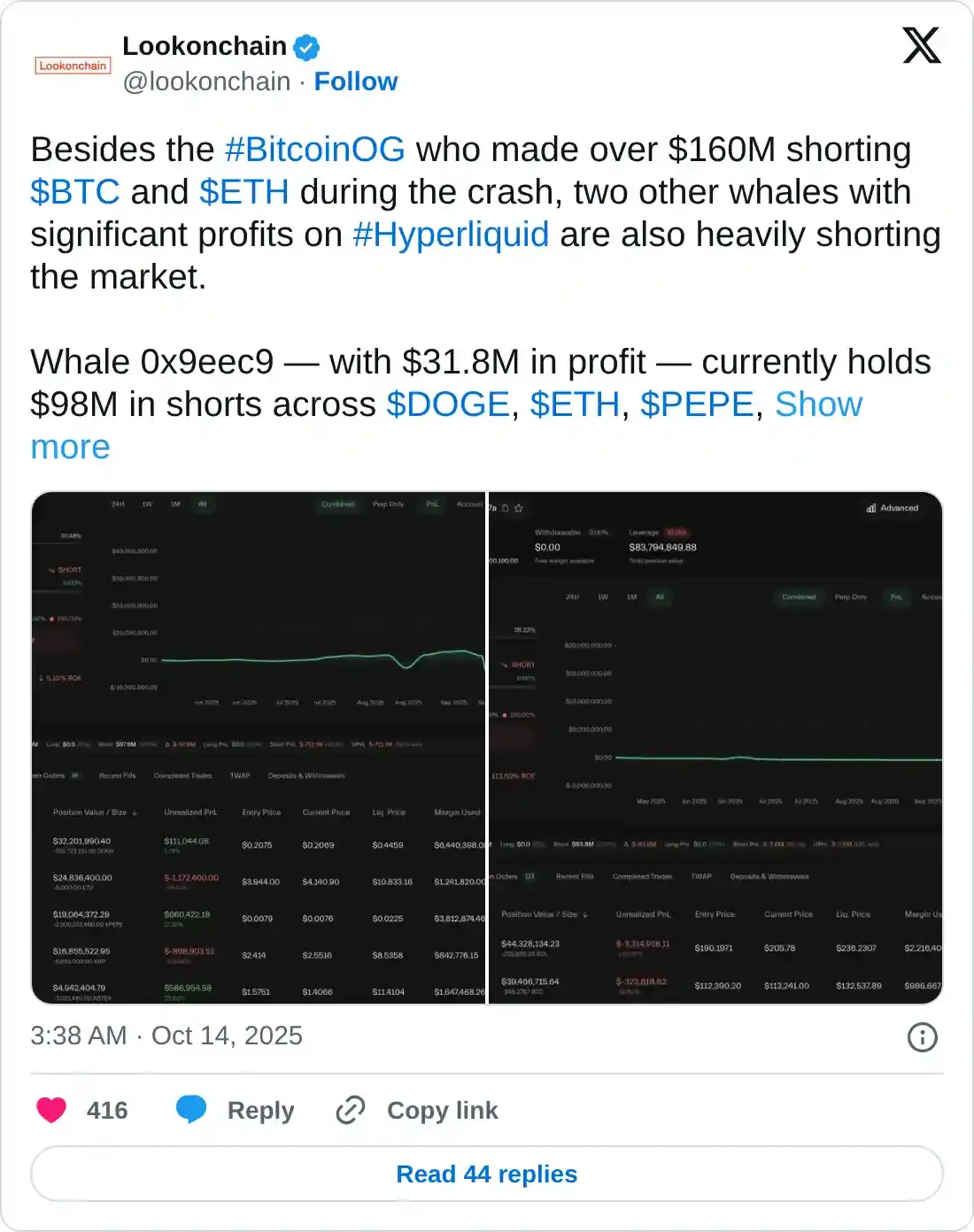

Lookonchain data shows that, besides the BitcoinOG, which made over $160 million shorting BTC and ETH during the crash, two other whales with significant profits on Hyperliquid are also heavily shorting the market.

Bitcoin Price Forecast: BTC bears control the momentum

Bitcoin price recovered slightly on Sunday, closing above $114,900 after a sharp fall on Friday. BTC continued its recovery on Monday and retested the 78.6% Fibonacci retracement level at $115,137 (drawn from the April low of $74,508 to the October 6 high of $126,199). This level roughly coincides with the 50-day Exponential Moving Average (EMA) at $115,472, making it a key resistance zone. At the time of writing on Tuesday, BTC trades down at $112,000, being rejected from the above-mentioned resistance zone.

If BTC continues its correction, it could extend the decline toward the daily support level at $107,245.

The Relative Strength Index (RSI) reads 42 on the daily chart, which is below its neutral level of 50, indicating bearish momentum is gaining traction. Additionally, the Moving Average Convergence Divergence (MACD) showed a bearish crossover on Friday, which still holds, further supporting the bearish view.

BTC/USDT daily chart

On the other side, if BTC recovers, it could extend the recovery toward the 50-day EMA at $115,472.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.