Bitcoin Price Forecast: BTC recovers as 90% chance of Fed rate cut in September, ETF inflows boost sentiment

- Bitcoin price holds near $111,000 on Wednesday after reclaiming the 100-day EMA the previous day.

- Institutional and corporate demand strengthen the recovery.

- CME FedWatch tool shows more than a 90% chance that the Federal Reserve will cut interest rates, fueling a risk-on appetite.

Bitcoin (BTC) is holding steady near $111,000 on Wednesday after reclaiming its 100-day Exponential Moving Average (EMA) the previous day. BTC’s recovery is supported by renewed institutional demand and corporate accumulation, which is strengthening market sentiment. Meanwhile, the growing expectations of a 90% probability of a Federal Reserve (Fed) rate cut in September are fueling risk-on appetite, supporting the largest cryptocurrency by market capitalization recovery.

High chances of Fed rate cut boost risk-on sentiment

Bitcoin price started the week on a positive note, recovering slightly and hovering around $111,100 mid-week, after extending its three-week trend of lower lows from its record high of $124,474.

According to the CME Group's FedWatch tool, traders are pricing in an over 90% chance that the US Federal Reserve will lower borrowing costs by 25 basis points at the end of the two-day policy meeting on September 17. This development had triggered a mild risk-on sentiment in the market, supporting Bitcoin's recovery.

Furthermore, market participants expect the central bank to deliver at least two rate cuts by the end of 2025, which could further boost riskier asset prices such as BTC.

Traders now look forward to the release of the US JOLTS Job Openings report on Wednesday, followed by the ADP report on private-sector employment and the ISM Services PMI on Thursday, ahead of the Nonfarm Payrolls (NFP) report on Friday.

These key economic data releases would provide more clues about the Fed’s rate-cut path and a fresh directional impetus for the largest cryptocurrency by market capitalization.

Institutional and corporate demand for BTC strengthens

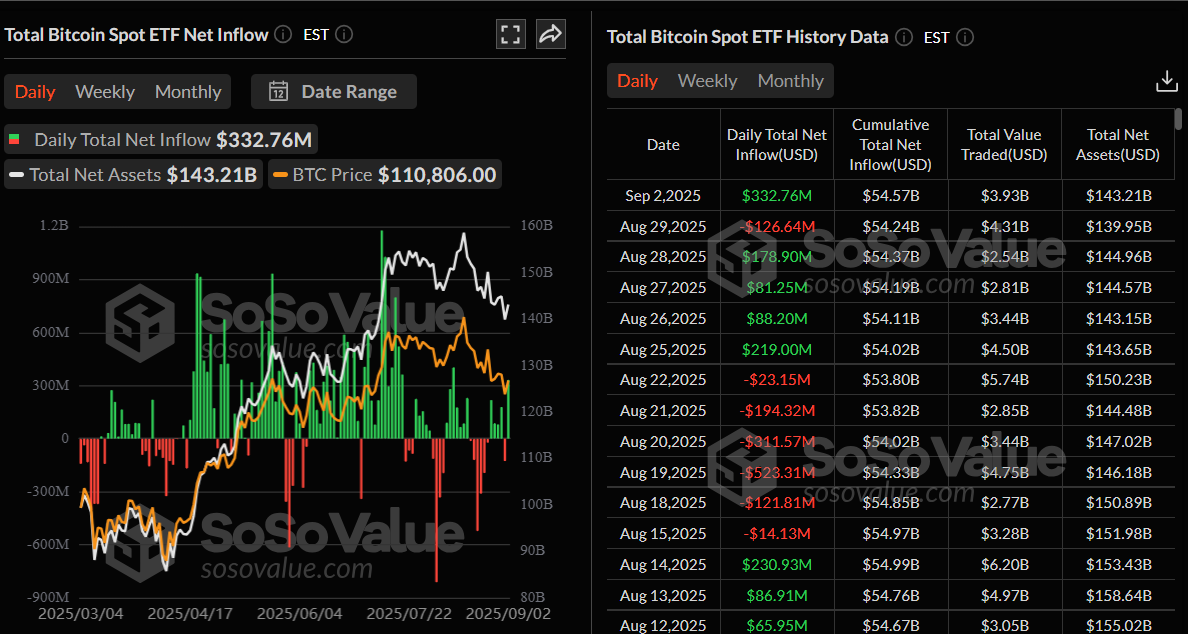

Bitcoin price recovery has been supported by institutional and corporate investors so far this week. The SoSoValue data below shows that Bitcoin spot Exchange Traded Funds (ETFs) recorded a fresh inflow of $332.76 million on Tuesday.

On the corporate front, Nasdaq-listed CIMG Inc. announced on Tuesday the completion of the sale of 220 million common shares, raising a total of $55 million in exchange for 500 Bitcoins, as part of its long-term holding strategy to establish a Bitcoin reserve.

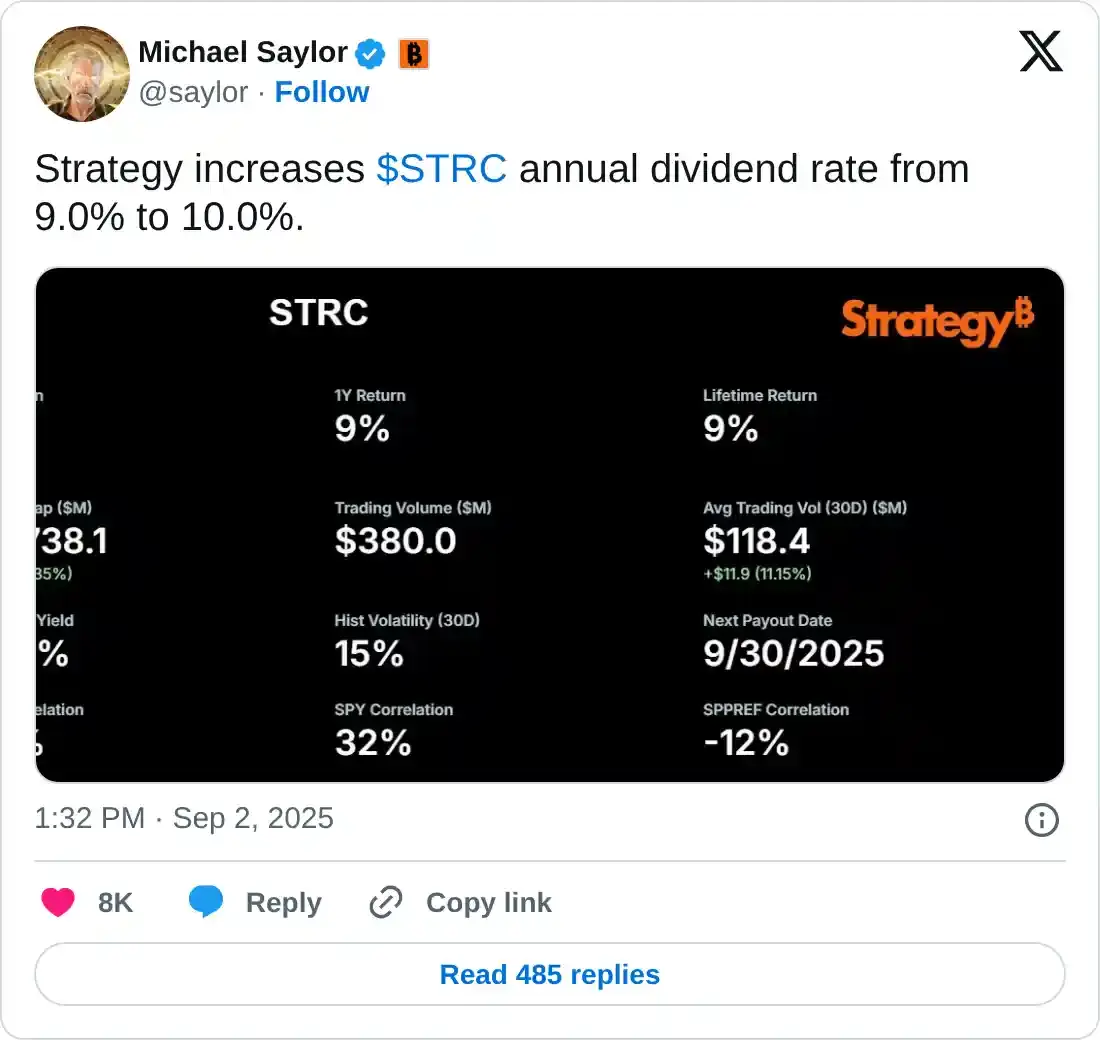

Earlier on Monday, Japanese investment firm Metaplanet purchased an additional 1,009 BTC, bringing the firm’s total holdings to 20,000 BTC. Additionally, on Tuesday, Michael Saylor announced a dividend increase for STRC preferred stock from 9% to 10%, a strategic move by Strategy (formerly MicroStrategy) to leverage its Bitcoin holdings.

Ray Dalio, founder of Bridgewater Associates, said in an interview with the Financial Times, “Crypto is now an alternative currency that has its supply limited, so, all things being equal.”

Dalio continued that if the supply of US Dollar money rises and/or the demand for it falls, it would likely make crypto an attractive alternative currency. He believes that most fiat currencies, especially those with large debts, will have problems being effective storeholds of wealth and will go down in value relative to hard currencies. This is what happened in the 1930s to 1940s period and the 1970s to 1980s period.

Some signs of concern

Despite BTC recovering slightly so far this week, a Glassnode report highlights some signs of concern to watch for. The report indicates that the market is now at the cost basis of short-term holders and has historically served as a battleground between buyers and sellers, making the current positioning particularly critical for near-term sentiment.

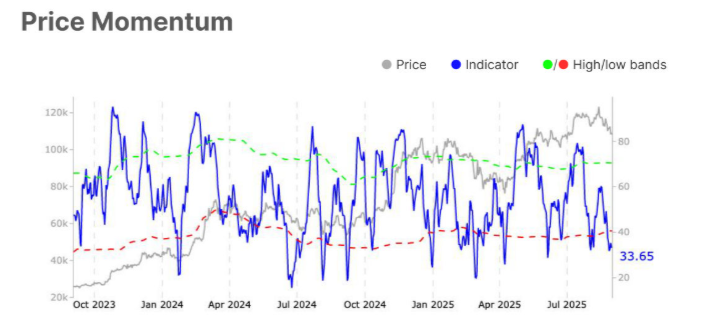

The report further explains that in the spot market, price momentum weakened further as RSI slipped into oversold territory, indicating waning conviction. However, historically, such low-level RSIs have sometimes preceded short-term stabilization or reversals, making the current conditions critical to monitor.

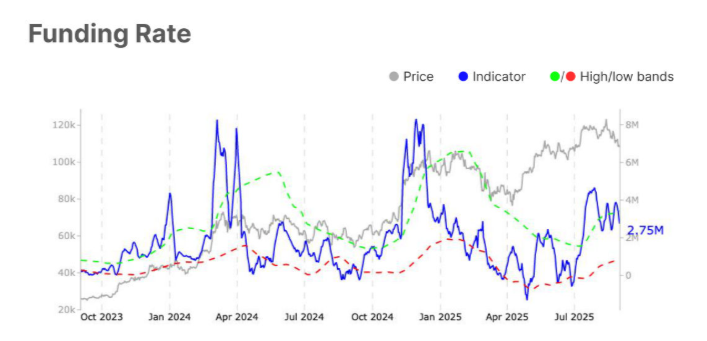

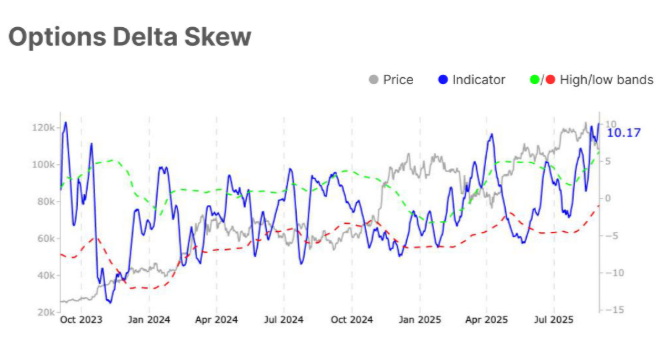

In the futures market, cautious positioning was evident, while in the options market, participation contracted as open interest declined, and volatility spreads narrowed, indicating a sense of complacency.

However, 25-delta skew surged above historical extremes, highlighting strong demand for downside protection and reinforcing a defensive tilt among options traders.

Bitcoin Price Forecast: BTC close above 100-day EMA

Bitcoin price started the week on a positive note, recovering slightly on Monday after a nearly 5% correction the previous week. BTC closed above the 100-day Exponential Moving Average (EMA) at $110,723 on Tuesday. At the time of writing on Wednesday, it hovers at around $111,100.

If BTC continues its recovery, it could extend the rally toward its daily resistance at $116,000.

The Relative Strength Index (RSI) on the daily chart reads 45, approaching its neutral level of 50, which indicates a fading of bearish momentum. The Moving Average Convergence Divergence (MACD) lines are also nearing each other with decreasing red histogram bars, suggesting a bullish crossover is likely.

BTC/USDT daily chart

However, if BTC faces a correction, it could extend the decline toward its daily support level at $105,573.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.