Gold plunges below $3,350 as Powell pushes back on rate cuts

- XAU/USD drops over 1.5% on hawkish Fed tone and easing Middle East tensions.

- Powell signals no rush to cut rates, citing tariff uncertainty and still-restrictive policy stance.

- De-escalation between Iran and Israel dampens safe-haven demand for Bullion.

- US Consumer Confidence slips; markets await Powell’s Senate testimony and key data releases.

Gold price tumbled below $3,350 on Tuesday amid broad US Dollar weakness, as US Federal Reserve Chair Jerome Powell pushed back against reducing borrowing costs, reiterating that the impact of tariffs on inflation remains uncertain. At the time of writing, XAU/USD trades at $3,315, down over 1.50%.

Bullion prices had recovered some ground, even though Powell was hawkish at his testimony at the US House of Representatives. He said that rates are modestly restrictive, acknowledging that if inflation pressures are contained, the central bank could cut rates.

Aside from this, the de-escalation of the conflict in the Middle East between Iran and Israel prompted investors to move away from haven assets, as depicted by the three major indices in the United States posting gains of more than 1% each.

Other data revealed that China’s central bank loosened monetary policy and injected liquidity into the markets. In the US, Consumer Confidence unexpectedly deteriorated in June, according to the Conference Board.

Ahead this week, the US economic docket will feature further Fed speakers, led by Chair Jerome Powell's appearance at the US Senate on Wednesday. On the data front, Durable Goods Orders, Gross Domestic Product (GDP) figures and Initial Jobless Claims are eyed.

Daily digest market movers: Gold price pulls back amid weak US Dollar, falling US yields

- Gold prices suffered substantial losses as the markets cheered a ceasefire between Israel and Iran. US President Donald Trump posted on his social network that "Both Israel and Iran wanted to stop the War, equally! It was my great honor to Destroy All Nuclear facilities & capabilities, and then, STOP THE WAR!"

- Bullion failed to print gains despite the decline in US Treasury bond yields and the US Dollar. The US 10-year Treasury note is yielding 4.30%, falling four basis points (bps). The US Dollar Index (DXY), which tracks the performance of the Buck’s value against a basket of six peers, is also down 0.56% at 97.79.

- The CB revealed that Consumer Confidence in June came at 93.0, down from 98.0 a month ago and also missed forecasts of 100. “The decline was broad-based across components, with consumers' assessments of the present situation and their expectations for the future both contributing to the deterioration,” said Stephanie Guichard, senior economist for global indicators at the Conference Board.

- Further Fed speakers crossed the wires. Cleveland Fed President Beth Hammack said that she sees rates “on hold for quite some time,” even though the latest inflation readings are encouraging. New York Fed John Williams commented that tariffs will boost inflation to 3% this year and expects inflation to reach the 2% goal in 2026. Furthermore, it was added that the economy will grow at a slower pace, though it will not be tipped into a recession.

- On Monday, US Flash PMIs remained in expansionary territory, suggesting that the economy remains solid. Next week, traders will be watching the release of the Institute for Supply Management (ISM) figures for June.

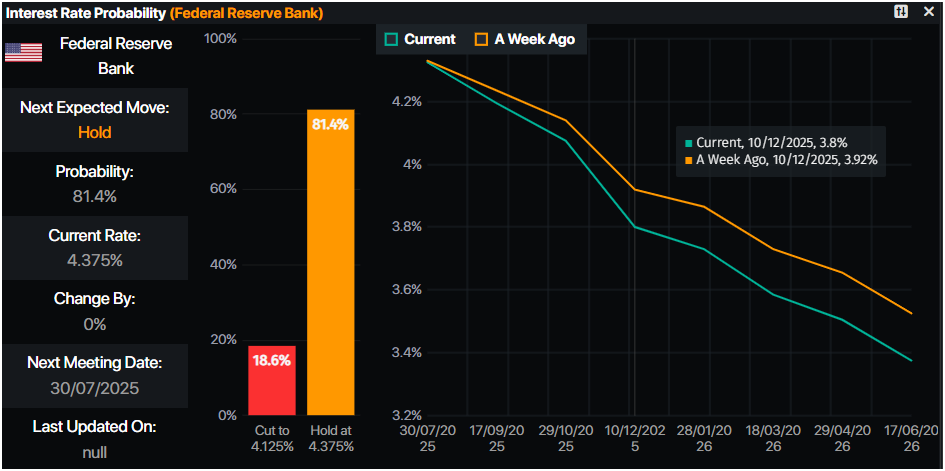

- Money markets suggest that traders are pricing in 58 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price plunges towards $3,300

Gold has fallen sharply and is testing the 50-day Simple Moving Average (SMA) at $3,317, which serves as the first level of support. Momentum seems tilted to the downside as depicted by the Relative Strength Index (RSI). Therefore, further downside is seen in the near term.

Support lies at $3,300, followed by the June 24 low of $3,295. Once cleared, the next support will be the May 29 low of $3,245.

For a bullish resumption, XAU/USD must clear $3,400. Once hurdled, the following key resistance levels, the $3,450 mark and the record high of $3,500, lie ahead.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.