Gold plunges over 3% as US-Iran talks boost USD demand

- Gold slides as progress in US-Iran talks reduces demand for bullion as a haven.

- Strong payrolls and firmer regional data trim expectations for Federal Reserve rate cuts.

- Dollar firms near 97.25 on DXY, while yields stabilize and pressure non-yielding assets.

Gold (XAU/USD) price dives more than 3% on Tuesday as the Greenback rebounds amid Washington-Tehran talks that, according to a senior White House official quoted by Axios, are showing signs of progress. At the time of writing, XAU/USD trades at $4,869 after reaching a daily high of $5,000.

XAU/USD tumbles below $4,900 as easing geopolitical tensions and firmer US data temper Fed cut bets

Market mood remains mixed, yet broad US Dollar strength and US Treasury yields paring earlier losses are weighing on the yellow metal. The US Dollar Index (DXY), which measures the buck’s performance versus six currencies, is up 0.17% to 97.25 as of writing. At the same time, the US 10-year Treasury note is yielding 4.052%, flat after dipping nearly four basis points earlier.

Solid US data, reduced traders' Fed dovish bets

Meanwhile, last week’s strong Nonfarm Payrolls figures and investors’ indecision on whether priced in further easing by the Federal Reserve, have kept Gold fluctuating around the $5,000 milestone.

Earlier, economic data in the US continued to show the jobs market strength, as the ADP Employment Change 4-week average showed the economy added 10.3K jobs, up from the prior week upward revised 7.8K.

This and the improvement in manufacturing activity in the region of the New York after revealing the February NY Empire State Manufacturing Index, trimmed investors' dovish bets during the day.

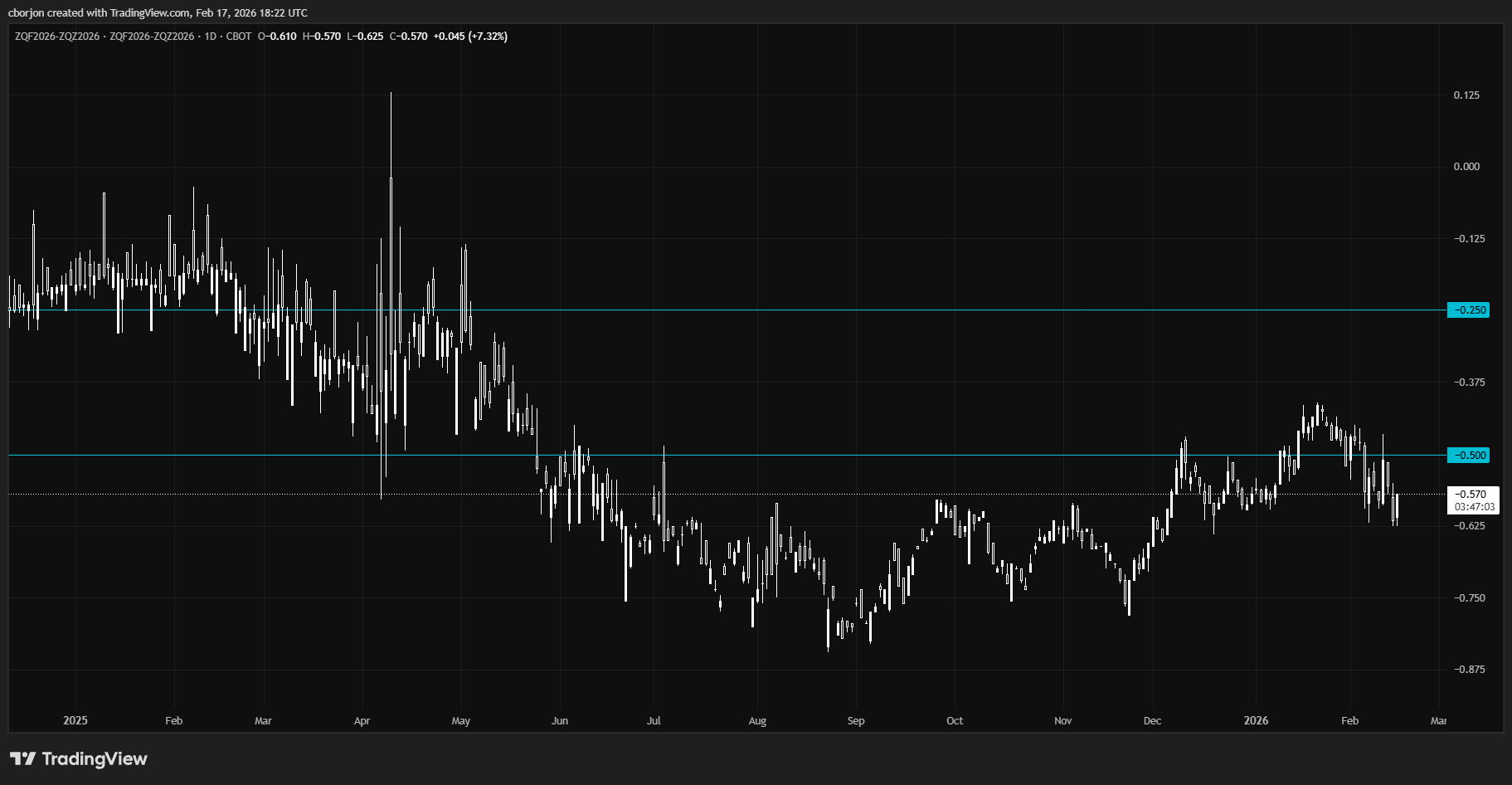

A day ago, traders expected 62 basis points (bps) of Fed easing, as of writing, they priced 57 bps, according to CBOT data.

In the meantime, discussions between the US and Iran kicked off, and both sides reached an understanding on the main “guiding principles” during the second round of nuclear talks in Geneva.

Regarding the tri-lateral meeting between the US, Russia and Ukraine, peace talks were moved to Wednesday.

Chicago Fed President Austan Goolsbee commented that recent declines in inflation were driven by base effects, adding that further easing could be warranted if inflation pressures continue to moderate. He estimates the Fed’s R-star rate at around 3% and stressed the need for clearer evidence that inflation is moving sustainably back toward the Fed’s 2% target.

Looking ahead, US markets will focus on housing data, remarks from Fed officials, GDP figures for Q4 2025, and the release of the Fed’s preferred inflation measure, the core Personal Consumption Expenditures (PCE) Price Index.

XAU/USD Technical outlook: Struggles at $5,000, collapses below $4,900

Gold’s technical picture turned bearishly biased in the near term, after achieving a successive series of lower highs for the last three straight days and falling to a six-day low of $4,841.

Additionally, failing to clear $5,000 exacerbated Gold’s drop below the $4,900 figure, opening the door for further losses. If Bullion extends its losses past $4,800, the next support would be the 50-day Simple Moving Average (SMA) at $4,632.

Conversely, if Gold rallies past $5,000, the next resistance would be the $5,100 figure.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.