Gold holds firm near $4,770 as Trump softens Greenland stance

- Gold edges higher after Trump rules out military action and backpedals on Europe tariffs.

- Lingering political uncertainty and Supreme Court developments sustain underlying safe-haven demand.

- Traders await US GDP, Jobless Claims and Core PCE for fresh macro direction.

Gold (XAU/USD) advances during the North American session on Wednesday, up by 0.25% after retreating from a fresh all-time high of $4,888 earlier in the day following US President Donald Trump's moderation of his tone regarding Greenland. Trump said that the use of military force is not on the table. At the time of writing, XAU/USD trades at $4,772.

Bullion steadies after retreating from record highs as geopolitical risks ease, but uncertainty keeps haven demand alive

In his speech at the World Economic Forum in Davos, Trump refrained from mentioning tariffs or military actions over Greenland. Nevertheless, he warned that if he did not get an agreement over Greenland, he would weigh Europe’s response to his demands.

Across the Atlantic, the Supreme Court failed to rule on Trump's case to fire Federal Reserve (Fed) Governor Lisa Cook. Bloomberg reported that US Supreme Court justices suggested they are wary of Trump’s effort to fire Governor Cook over alleged mortgage fraud allegations.

Recently, US President Donald Trump backpedaled on the tariffs imposed on eight European countries over Greenland, which were supposed to take effect on February 1. He said that he formed a framework for a future deal with NATO.

Data-wise US Pending Home Sales in December disappointed investors, as the inventory of previously owned houses hit a five-month low, according to the National Association of Realtors.

What’s next in the US docket?

On Thursday, the US docket will feature the release of Gross Domestic Product (GDP) figures, Initial Jobless Claims and the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

Daily digest market movers: Gold rally tempers on Trump’s TACO trade

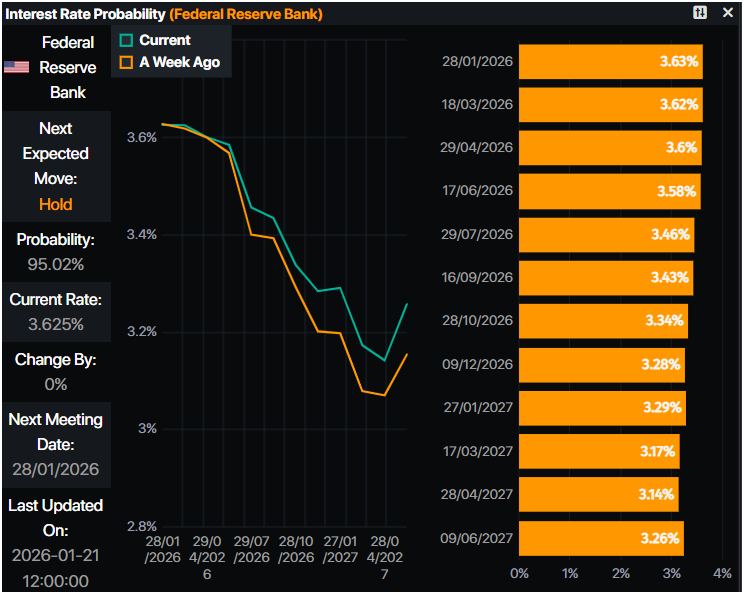

- A Reuters poll revealed that the Federal Reserve might hold rates unchanged at the January 27-28 meeting. The survey added that most economists do not expect a cut until Chair Jerome Powell ends his term as the top voice at the US central bank in May.

- The polls showed that economists expect the economy to grow strongly, an indication that inflation is not near easing as expected, with prices remaining above the Fed’s 2% target. Nevertheless, money markets expect at least two rate cuts.

- Economists are worried about Fed independence as the White House is threatening Powell with an ongoing investigation into the Federal Reserve’s building renovation.

- US Pending Home Sales tumbled 9.3% in December, its lowest level since July. The report showed that the inventory of previously owned houses remained low due to homeowners having mortgage rates below 5%, hence reducing the chances of listing their properties.

- US Treasury yields dipped on Tuesday, a tailwind for Gold prices. The US 10-year Treasury note is down nearly three and a half basis points at 4.261%. At the same time, the US Dollar Index (DXY), which tracks the American currency's performance versus six peers, recovers some ground and is up 0.27% up at 98.82, capping Gold’s advance.

- Data by Prime Market Terminal shows that the swaps markets are expecting 46 basis points of Fed easing towards the end of the year.

Technical analysis: Gold price remains bullish despite retreating below $4,800

Gold price reached a new all-time high of $4,888 before retreating to current spot price levels, but the uptrend remains intact. Bulls are gathering momentum as depicted by the Relative Strength Index (RSI), which, despite not surpassing the latest peak as price action has done, its slope points upwards as an indication of strength despite being in overbought territory.

If XAU/USD ends the day above $4,800, this could open the door to challenge $4,900. A breach of the latter will open the door to test the $5,000 milestone. On the flipside, if Gold dives below $4,800, the first support would be the January 20 high at $4,766. Once surpassed, the next stop would be $4,700.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.