USD/JPY edges higher as US core PCE rises and risk-on sentiment reduces demand for the Yen

- USD/JPY firms above 144.00 as investors weigh US inflation data and softer Japanese CPI.

- Trade optimism between the US, China, and EU lifts global sentiment, pressuring safe-haven flows into the Yen.

- BoJ seen holding rates in July, while the Fed faces policy tension amid mixed US data.

The Japanese Yen (JPY) is weakening against the US Dollar (USD) on Friday as markets weighed fresh inflation figures and a shift in risk appetite.

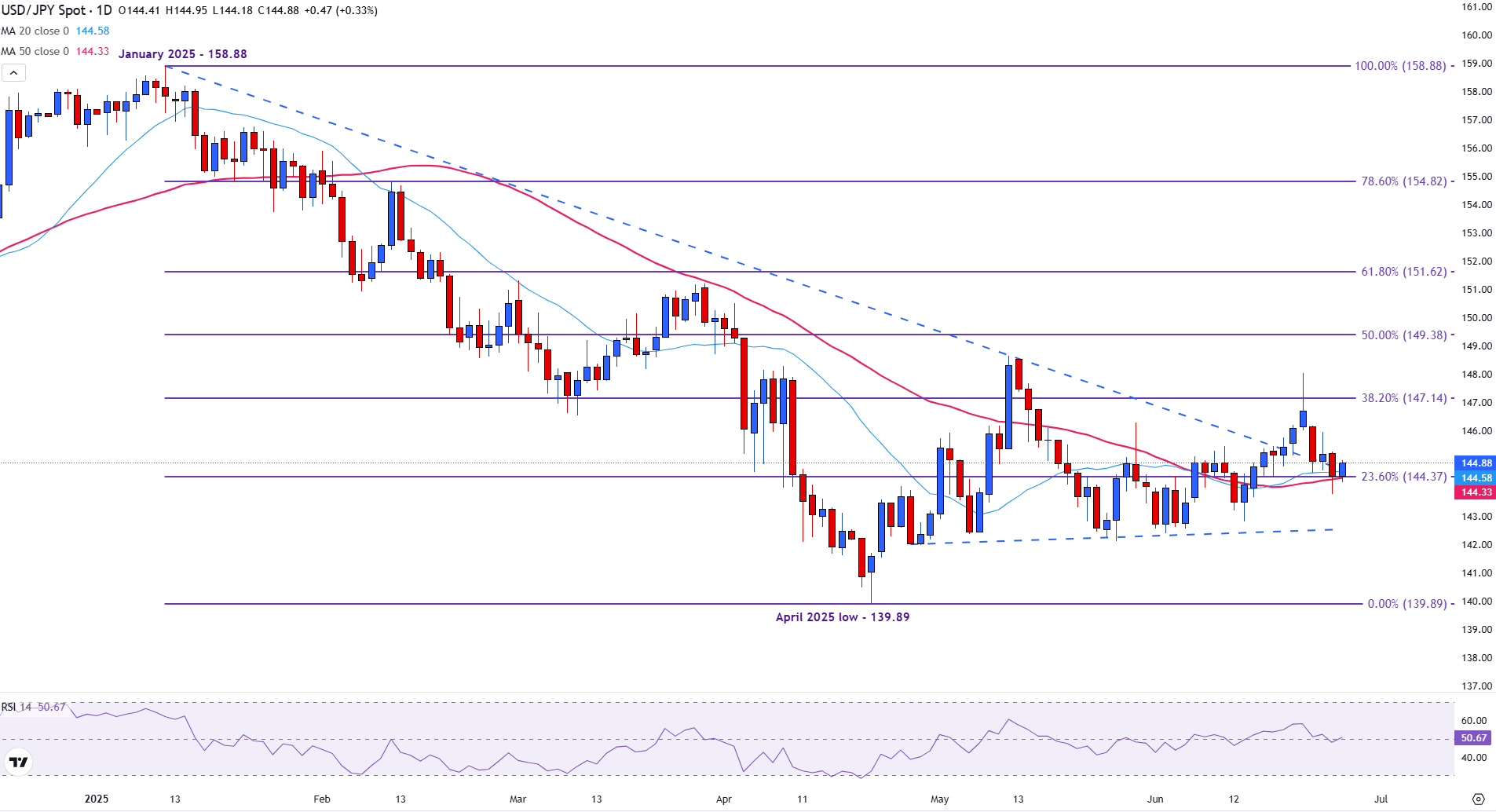

At the time of writing, USD/JPY is trading above 144.00, reclaiming the 20-day Simple Moving Average (SMA) at 144.57.

Inflation in Japan cools while US core PCE shows signs of elevated price pressure

In Japan, Consumer Price Index (CPI) data on Thursday showed inflation easing a touch in May. This has increased expectations that the Bank of Japan won’t move on rates in July.

Although inflation is still above the BoJ’s 2% target, the slower pace seems to be giving policymakers some breathing room.

Over in the US, Friday’s core Personal Consumption Expenditure (PCE) numbers came in hotter than expected. The May data showed core inflation rising 0.2% for the month with the annual rate at 2.7%. Both figures printed above consensus..

This has signaled that inflation hasn’t cooled as much as the Fed might like. But at the same time, Personal Income and Personal Spending came in weak, the the latest University of Michigan data showed Consumer Inflation Expectations ticking down.

That combination adds to growing signs the US economy may be losing steam. With President Trump continuing to pressure the Fed for rate cuts, traders are left trying to read between the lines.

Additionally, the US and China finalized the trade deal agreed upon in June, which added to the increase in investors' appetite for risk. Throughout the week, easing geopolitical tensions in the Middle East have reduced demand for the Yen as a safe-haven asset.

USD/JPY remains supported by the 144.00 psychological level

The USD/JPY is hovering near 144.88 at the time of writing, with the pair supported by the 23.6% Fibonacci retracement level of the January-April decline at 144.37.

Prices are currently trading near a cluster of support. The 20-day (144.57) and 50-day (144.33) Simple Moving Averages (SMA) are converging at this zone.

The 145.00 psychological level provides near-term resistance at 145.00, a break of which could see prices retest Tuesday’s high of 146.19. Above that is 147.14, which marks the 38.2% Fibonacci retracement. This level also aligns with a descending trendline that has capped price action since February.

USD/JPY daily chart

A break above this region is needed to open the path toward 149.38 (50% retracement). The Relative Strength Index (RSI) sits near 50, reflecting neutral momentum and a lack of strong directional conviction. A daily close below the 144.30–144.40 area would likely expose the downside toward 143.00, with stronger support seen near 141.60–142.00.

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.