USD/JPY tests 155.00 as hawkish FOMC meets rising BoJ hike bets

- Hawkish Fed minutes lift the US Dollar as Japan's headline CPI drops to 1.5%, easing pressure on the BoJ.

- Wednesday's FOMC minutes struck a hawkish tone, with several members flagging that rate hikes could not be ruled out if inflation reaccelerates, pushing USD/JPY back toward the 155.00 level.

- Japan's January National Consumer Price Index (CPI) dropped to 1.5% from 2.1%, with core CPI excluding fresh food easing to 2.0%; US core Personal Consumption Expenditures (PCE) on Friday is the next key test for rate expectations.

Wednesday's Federal Open Market Committee (FOMC) minutes from the January meeting revealed a deeply divided committee, with the 10-2 vote to hold at 3.50% to 3.75% accompanied by language describing disinflation as potentially "slower and more uneven" than expected. Several participants favored "two-sided" guidance that would explicitly leave open the option of raising rates, a hawkish shift that boosted the US Dollar and pushed the Yen to its sharpest one-day decline this month. Thursday's Japan National CPI for January dropped sharply to 1.5% year on year from 2.1%, falling below the Bank of Japan's (BoJ) 2% target for the first time in months, while core CPI excluding fresh food eased to 2.0% from 2.4% and core CPI excluding food and energy slipped to 2.6% from 2.9%. The softer inflation print could temper expectations for an April BoJ hike from the current 0.75%, though markets still assign roughly 80% probability to that move.

On the US side, Thursday's data was firm, with initial jobless claims at 206K (below the 225K consensus) and the Philadelphia Fed Manufacturing Survey jumping to 16.3 against 8.5 expected. Friday's US Q4 Gross Domestic Product (GDP) (consensus 3%, prior 4.4%), core PCE (consensus 2.9%, prior 2.8%), and preliminary S&P Global Purchasing Managers Index (PMI) data round out the week.

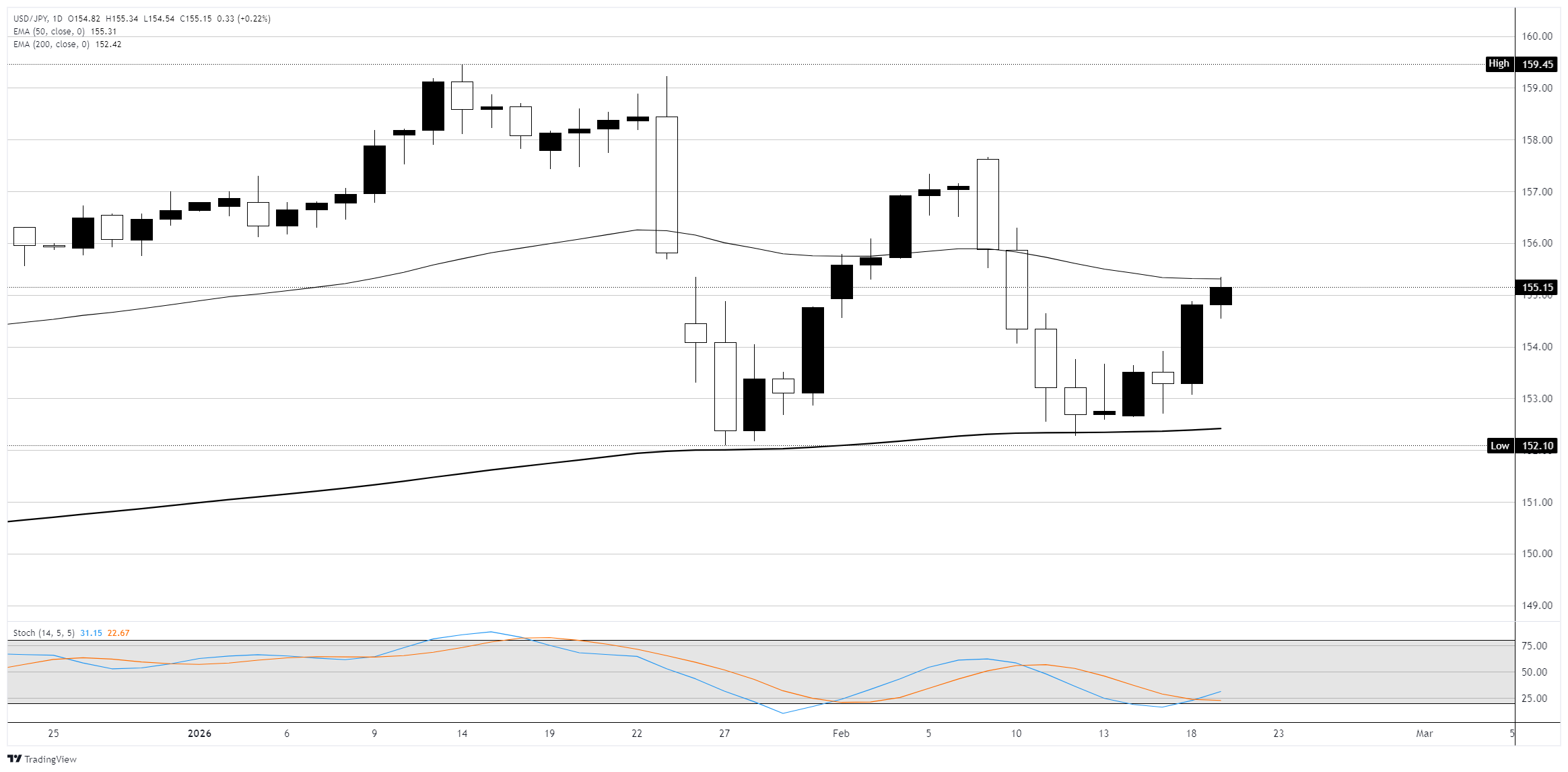

Battle at the 50-day EMA near 155.00

On the daily chart, USD/JPY stuck close 155.00 on Thursday, sitting just below the flattening 50-day Exponential Moving Average (EMA) at 155.30 after rebounding from the 152.10 year-to-date low printed earlier this month. The 200-day EMA at 152.42 continues to trend well below, so the longer-term bullish structure from the late 2025 lows is still valid, but the pair has been trading in a choppy 152.00 to 158.00 range since mid-January. The sharp sell-off from the 159.45 high to the 152.10 low retraced most of the January rally, and the pair is now contesting the 50-day EMA as a pivot level. The Stochastic Oscillator is approaching the oversold zone after crossing bearish, suggesting near-term downside pressure, though a bounce from this area would be consistent with the broader range-trading pattern. Recent sessions show alternating bullish and bearish candles with expanding bodies, pointing to two-way volatility around the 155.00 level. Resistance sits at 156.00 and the 158.00 area; a sustained break above the 50-day EMA would target the upper end of the range. Support rests at 153.00 and the 200-day EMA near 152.42, with the 152.10 low below.

USD/JPY daily chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The BoJ ultra-loose monetary policy between 2013 and 2024 caused the Yen to depreciate against its main currency peers due to an increasing policy divergence between the Bank of Japan and other main central banks. More recently, the gradually unwinding of this ultra-loose policy has given some support to the Yen.

Over the last decade, the BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supported a widening of the differential between the 10-year US and Japanese bonds, which favored the US Dollar against the Japanese Yen. The BoJ decision in 2024 to gradually abandon the ultra-loose policy, coupled with interest-rate cuts in other major central banks, is narrowing this differential.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.