Is the U.S. Election the Catalyst for Meta’s Earnings?

Insights - With AI continuously enhancing advertising efficiency and the U.S. election driving a significant increase in ad spending, Meta’s performance is expected to surpass market expectations.

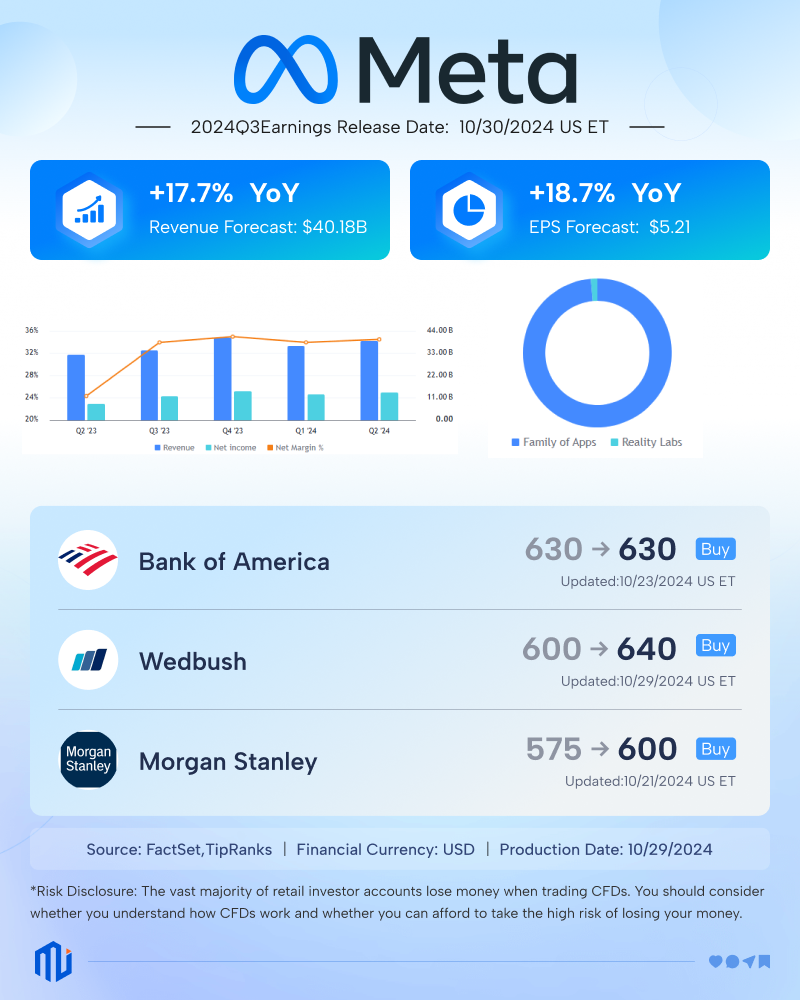

On October 30, after U.S. market hours, social media giant Meta Platforms (META) will release its Q3 2024 earnings report.

The market widely anticipates Meta’s Q3 revenue to reach $40.18 billion, a 17.7% year-over-year increase. Earnings per share (EPS) are expected to rise by 18.7% to $5.21.

Meta’s stock has surged by 65% year-to-date, ranking among the top in the Big Seven. Will this earnings report help the stock continue its upward trajectory?

Source: TradingView, Meta Stock Performance in 2024

AI and the U.S. Election Drive Strong Advertising Growth

Advertising, Meta’s core revenue driver, is undoubtedly in the spotlight. For Q3, the market estimates Meta’s advertising revenue will reach $39.465 billion, representing a 17.30% year-over-year increase and a 2.96% quarter-over-quarter growth.

CEO Mark Zuckerberg stated that AI is empowering Meta’s advertising business, enhancing both the effectiveness and precision targeting of ads.

Additionally, the U.S. election has driven a significant increase in political ad spending.

According to MediaRadar CMAG, advertising expenditures for the 2024 presidential election are nearly three times those of the 2016 election. For digital advertising giants like Meta, this surge in spending represents a substantial opportunity.

Hedge fund manager Dan Niles stated that Meta would benefit from the upcoming highly competitive U.S. presidential election in November due to the significant ad spending it would generate. He also expressed continued optimism about Meta for the next year, citing its reasonable valuation, strong growth, and AI opportunities.

Wall Street Optimistic About New Highs for Meta’s Stock

Bank of America analysts have named Meta their “top AI pick,” emphasizing the robust growth of its core advertising business, increased usage of its core apps among younger users, and the company’s capabilities in large language models. They maintain a “Buy” rating on Meta with a price target of $630.

Bernstein analysts also maintain a “Buy” rating on Meta and have raised their price target from $600 to $675, implying a potential 17% upside. Analysts note that continuous growth in short-form video Reels, new ad offerings on Threads, and Meta’s progress in AI and Advantage+ ad tools will drive revenue growth.

Wedbush has also raised Meta’s price target from $600 to $640. Analysts point out that if Meta’s earnings beat market expectations, the stock is likely to break through $600 and reach new highs.

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.