Ethereum-Focused Stocks Are Surging — Is This Wall Street’s Next Big Opportunity?

TradingKey - Ethereum (ETH) has jumped an impressive 54% over the past month, now trading around $3,700. While some of that momentum can be attributed to the broader crypto market, a more targeted catalyst may be in play: companies like SharpLink Gaming and Bitmine Immersion Technologies are aggressively accumulating ETH, and their stock prices are skyrocketing.

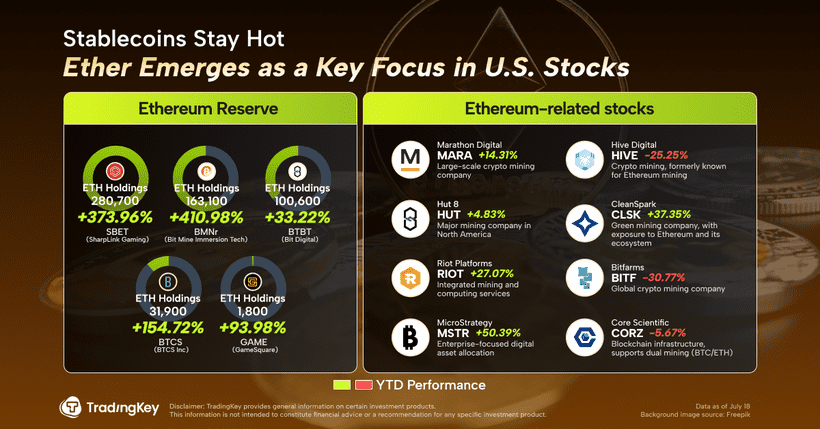

At the same time, SharpLink and Bitmine shares have surged about 230% and 390%, respectively. That kind of jump is turning heads—not just in crypto circles, but across Wall Street.

SharpLink, a Minneapolis-based fan engagement and iGaming performance tech firm, has quietly become one of the world’s largest institutional holders of ETH. The company now holds 280,706 ETH—worth over1 billion at current prices.To fuel its buyingspree,SharpLink raised more than 400 million in an at-the-market (ATM) equity offering.

Bitmine—the other major player—has an even bigger pile of ETH: 300,657 coins worth around $1.13 billion. The company is chaired by Fundstrat’s Tom Lee, a well-known Wall Street strategist. Bitmine isn’t stopping there—it’s aiming to eventually control up to 5% of Ethereum’s total circulating supply.

Lee’s move into ETH came at a time when interest in stablecoins is also climbing. Circle, the issuer of USD Coin (USDC), just completed a successful IPO, and momentum is building in Congress toward U.S. stablecoin legislation.

Why Are Companies Pivoting Toward Ethereum?

Bitcoin was built to be digital gold—a place to store value. Ethereum is more like financial infrastructure. Often called “digital oil,” ETH powers everything from smart contracts to NFTs and decentralized finance (DeFi) applications. And for institutions, that utility opens real revenue opportunities.

Ethereum’s usefulness lies in its versatility. It acts as the underlying fuel—or “gas”—that drives transactions and operations across the Ethereum blockchain. It also serves as collateral within lending protocols and supports the stability of decentralized stablecoin systems. Perhaps most compelling, ETH can be staked to generate consistent yields, making it a yield-bearing asset that appeals to investors and now corporations alike.

Because of all this, ETH is becoming increasingly attractive to corporate finance teams that are looking for more than just capital appreciation. They’re seeking ways to unlock productivity and cash flow from digital assets. As Ryan Chow, CEO of Solv Protocol, puts it: “Ethereum’s utility makes it a unique asset for enterprises who want yield and exposure to real blockchain use cases.”

Strategy 2.0 — But For Ethereum?

SharpLink’s playbook might feel familiar—and for good reason. In early July, the company raised over 400 million to build out its ETH reserve, and quickly followed up with another round of purchases. As of now, SharpLink still has more than 250 million in capital earmarked for future acquisitions.

That’s because it closely mirrors the strategy pioneered by Strategy with Bitcoin. The core idea is straightforward: rather than using existing cash flows, raise funds through the public equity markets and reinvest that capital directly into a targeted crypto asset. It’s a model that proved highly effective with Bitcoin—and now companies like SharpLink and others are applying it to Ethereum.

Tom Lee, Chairman of Bitmine, has openly acknowledged that his firm is modeling its ETH strategy on Strategy’s Bitcoin-focused approach. That means funding Ethereum acquisitions through capital markets, transforming ETH into a yield-generating asset through staking, and adopting a new kind of performance metric—specifically tracking the company’s ETH holdings on a per-share basis, much like Strategy’s Bitcoin-per-share disclosures.

Lee has stated that Bitmine aims to grow its ETH-per-share value through a mix of corporate cash flow reinvestment, capital market transactions, and appreciation in Ethereum's price. So far, market participants appear to be validating that strategy—the sharp rise in these stocks suggests growing confidence in Ethereum as a corporate treasury asset and long-term growth lever.

ETH Staking: A Yield Engine Companies Can’t Ignore

SharpLink and Bitmine aren’t just buying ETH—they’re staking it. This turns ETH into a productive, yield-generating asset, which also differentiates their approach from pure Bitcoin-holding strategies.

Major players are taking notice. BlackRock’s iShares Ethereum Trust recently filed to add ETH staking capabilities to its institutional fund. Nasdaq has submitted a rule-change proposal to enable those functions.

While the SEC hasn’t signed off yet, many analysts believe approval could land in late 2025. The market is already pricing it in.

Call options data suggests strong bullish sentiment: Open interest for 4,000 ETH calls has climbed to 650 million, signaling investor expectations for greater liquidity and potential upside from staking-enabled ETFs.

Stocks to Watch in the Ethereum Ecosystem

If Ethereum exposure via equity appeals to you, here are some public companies aligned—either directly through ETH holdings, or indirectly via mining or infrastructure roles:

- Ethereum-Focused Asset Holders

- SharpLink Gaming (SBET): focused on ETH reserves

- Bit Mine Immersion Tech (BMNr): Tom Lee’s company, focused on ETH purchasing and staking

- Bit Digital (BTBT): Holds BTC and ETH, combines mining with treasury management

- BTCS Inc. (BTCS): Builds and operates Ethereum validator nodes and staking infrastructure

- GameSquare (GAME): A Web3 and esports platform participating in ETH ecosystem development

- Large-Scale Crypto Miners

- Marathon Digital (MARA): Primarily focused on Bitcoin, but has previously engaged in ETH-related mining equipment

- Diverse or Green-Energy Miners

- Hive Digital (HIVE): Former Ethereum miner, now a multi-chain green energy-powered mining operation

- Hut 8 (HUT): Major Canadian miner with GPU capabilities to support ETH-compatible chains

- CleanSpark (CLSK): U.S.-based, renewables-focused Bitcoin miner evaluating broader crypto exposure

- Riot Platforms (RIOT): Provides enterprise-grade mining and infrastructure services

- Bitfarms (BITF): Global operator of mining farms with potential ETH exposure

- Crypto-Treasury Allocation Leaders

- MicroStrategy (MSTR): A proven playbook for digital asset-driven valuation via Bitcoin

- Blockchain Infrastructure Providers

- Core Scientific (CORZ): Offers BTC and ETH mining, co-hosting, and crypto compute infrastructure