Surprise: McDonald's Has Higher Profit Margins Than Tesla, Apple, or Netflix

Restaurants have notoriously low profit margins. But McDonald's (NYSE: MCD), the world's largest restaurant chain, is surprisingly one of the most profitable businesses. In fact, its profit margins are higher than prestigious businesses such as Tesla (NASDAQ: TSLA), Apple (NASDAQ: AAPL), and Netflix (NASDAQ: NFLX).

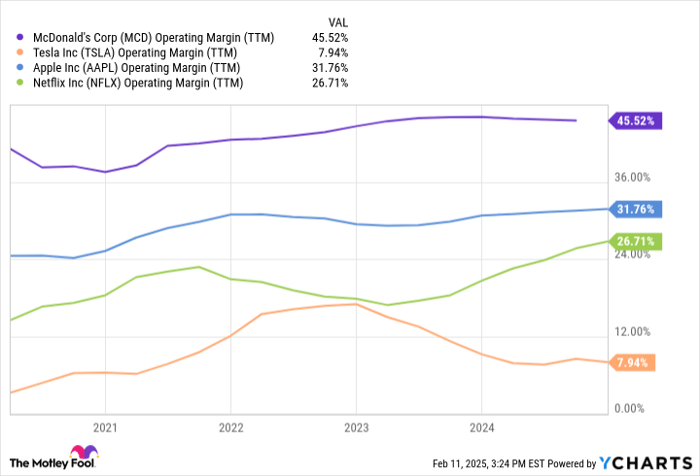

I should clarify that profits can be measured from multiple angles. But one of the best ways to measure profits is with the operating margin. This metric excludes things that aren't related to regular business operations -- such as taxes, which can swing wildly from year to year -- and focuses only on the profits the business produces.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

On Feb. 10, McDonald's reported finalized financial results for 2024. During the year, the company had a stellar operating margin of 45%. That's among the very best in the world. And as the chart below shows, it's far better than the operating margin for companies such as Tesla, Apple, and Netflix.

MCD Operating Margin (TTM) data by YCharts

Assuming that the core business is burgers and fries, it would seem that McDonald's makes $45 in operating profit for every $100 it has in sales. This would suggest that its food is outrageously overpriced. But if you assume that selling food is the core business for McDonald's, you're wrong.

McDonald's has operating margins as good or better than even the most profitable tech companies because it's not in the food business per se. And it's a really interesting thing for investors to note, as I'll explain.

The secret sauce for McDonald's

As of this writing, I'm still waiting on McDonald's to file its annual report, which contains more detailed financials than what it usually reports to investors. So allow me to mention some 2023 numbers for illustrative purposes. In 2023, McDonald's generated total revenue of $25.5 billion. Of this, it generated $15.4 billion (over 60% of its total revenue) from its franchised restaurants -- restaurants operated by independent third parties.

The bulk of franchised revenue for McDonald's comes from a particularly surprising source. As it turns out, the company owns a lot of real estate that it rents out to its franchises. It generated $9.8 billion in rental income in 2023.

McDonald's had over $27 billion in real estate at the end of 2023, when looking at land that it owned and buildings that were on land that it owned. This gives McDonald's the largest real estate portfolio of any restaurant company in the world. And this dynamic goes a long way to explaining why it has operating margins that are so high compared to other restaurant chains.

In other words, McDonald's primarily offers third-party franchisees an opportunity to run a restaurant business. The company provides franchisees with the brand, the system, and even the building. The franchisees sell the classic burgers and fries, which is a much lower-margin business. But the parent company gets royalties and rental income, which is so high-margin that even software companies are jealous.

What does this mean for investors today?

McDonald's expects its operating margin to further improve in 2025. And even a modest improvement could still result in a large increase in operating profits given how massive the business is.

Another interesting thing to consider is that McDonald's has around 43,000 restaurant locations today but expects to surpass 50,000 in 2027. That's a 16% increase in just three years, which is pretty meaningful for a business of this size. And since most of the growth will come from franchisees, expect a respectable increase in its high-margin revenue streams.

Given how big and high-margin this business is, I consider McDonald's stock as one of the safest investments someone could make -- in other words, I believe there's a low chance of losing money over the long term. Given McDonald's size, I'd say it doesn't necessarily have the highest upside potential. But it could still be worth holding, and it's worth watching in case the price ever dips to a particularly attractive valuation.

Should you invest $1,000 in McDonald's right now?

Before you buy stock in McDonald's, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and McDonald's wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $829,128!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

Learn more »

*Stock Advisor returns as of February 7, 2025

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Netflix, and Tesla. The Motley Fool has a disclosure policy.