This Artificial Intelligence (AI) Stock Could Soar by 67% in 2025. Here's Why.

Artificial intelligence (AI) isn't a theme that's going to wrap up this year. There are still huge gains to be made in this sector, so investors shouldn't avoid it just because it has had a strong two years. One stock that's been the epitome of AI investing is Nvidia (NASDAQ: NVDA). One key point about Nvidia that sets it apart from other AI investments is that it's making piles of money from all of the AI investments from big tech companies.

Hans Mosesmann from Rosenblatt Securities has a Street-high price target of $220 per share on Nvidia. That means it has a 67% upside over the next year. That's a massive gain for a stock the size of Nvidia, but it's entirely possible if certain things happen.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Nvidia's GPUs are best-in-class

As mentioned above, one key factor about Nvidia that sets it apart from other AI picks is that it's actually making money on AI. While the AI hyperscalers are pouring mountains of money into building out their computing power to train AI models, hoping that these investments will eventually pay off, Nvidia is pocketing some of that money.

Its graphics processing units (GPUs) and software package that powers them are best-in-class and have become the go-to choice for any company looking to train an AI model. GPUs have a key ability to compute in parallel, which means they can process multiple calculations simultaneously. Furthermore, GPUs can be grouped in clusters to multiply this effect. With some of the largest AI companies building servers with thousands of GPUs in them, it's evident how quickly AI models can be trained.

However, that's just with the old-generation models. While Nvidia's legacy Hopper architecture GPUs provided impressive performance, its next-generation Blackwell GPU architecture provides huge performance gains. Blackwell can train AI models at four times the speed of its predecessor, making it a key upgrade for those looking for the best computing performance possible.

Another key factor is that GPUs don't have the longest lifespans in data centers. Because they are used nearly constantly, they burn out quickly. According to an unnamed Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) data center specialist, this can cause the lifespan of a GPU to last from one to three years. As a result, many of the GPUs purchased over the past few years may need to be replaced. Throw in the fact that AI demand is still growing and that these companies are still building out their computing capacity, and it's clear how Nvidia can keep growing.

But Nvidia isn't without its challenges.

Competition is rising for how AI models are created and utilized

A couple of headwinds popping up that could cause Nvidia some trouble in 2025 are a greater push for using CPUs for AI inference and custom AI accelerators. While Nvidia's GPUs are considered some of the best available, they are power-hungry and aren't as efficient as a CPU for simple tasks like AI inference. Inference occurs when a pre-trained model is used, so using a powerful, energy-hungry GPU doesn't make sense when a cheaper, more efficient CPU could be used.

Additionally, most of Nvidia's largest clients are working on developing custom AI training accelerators. These chips would allow them to bypass Nvidia, as they wouldn't need to pay a middleman to have access to the computing power that GPUs provide. However, these custom AI accelerators require workloads to be configured in a certain way for optimum use. If a general AI model is being developed or developers are just testing some training methods, these custom accelerators may not be an efficient way to train AI models.

While these are clear headwinds for Nvidia, I believe they are relatively minor and will only affect a portion of Nvidia's business.

Nvidia's stock is fairly priced for its growth

So, how can Nvidia's stock soar 67% in 2025? Simple. It does what it's expected to and gives a solid outlook for next year.

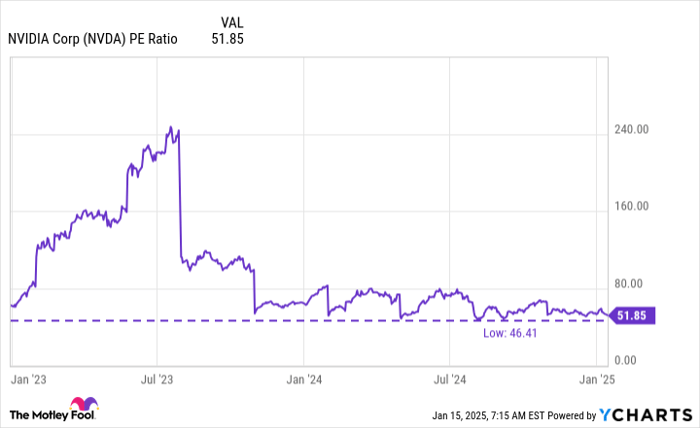

Right now, Nvidia trades for 52 times trailing earnings, which is near the cheapest level it has traded at over the past two years.

NVDA PE Ratio data by YCharts

As a result, I don't think investors can call Nvidia "overvalued," especially when other tech companies like Apple and Amazon trade at 38 and 47 times earnings, respectively, despite growing at a much slower pace.

Nvidia is expected to grow revenue by 52% in fiscal year (FY) 2026 (ending January 2026), so if it maintains its profit margins and its valuation increases just a little bit, Nvidia's stock will rise in that 67% range. As a final kicker, there need to be indications that 2026 (Nvidia's FY 2027) will also be strong; otherwise, the stock may collapse in preparation for a down year.

We're at a point where Nvidia's expectations don't outweigh the current business. Although some are selling Nvidia stock to take profits, there's still plenty of upside available, and I think Nvidia is a great buy after its latest pullback.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $818,587!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of January 13, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Keithen Drury has positions in Alphabet, Amazon, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, and Nvidia. The Motley Fool has a disclosure policy.