Should You Buy Apple Stock? Analysts and Billionaires Are Sending Investors Mixed Signals.

Apple (NASDAQ: AAPL) stock has climbed by 73% since the end of 2022 -- outperforming the S&P 500's return of 48% over the same period. Investors are pricing in growing sales over the next year as Apple Intelligence rolls out, given that users will have to upgrade to one of the newest iPhone models to use those artificial intelligence (AI) features.

However, early signs are pointing to relatively weaker demand for the new iPhones compared to last year. Several analysts who are closely tracking lead times for the new iPhone 16 are not seeing signs of a demand increase.

Investors are also getting mixed signals on the stock from billionaire investors. Warren Buffett's Berkshire Hathaway sold half its massive position in Apple in the second quarter, but two other billionaires -- Daniel Loeb of Third Point and Andreas Halvorsen of Viking Global -- were buying Apple stock recently.

Given all that, it's natural to wonder: What returns can an investor reasonably expect from Apple over the long term?

AI could push the iPhone to the top of the smartphone market

One factor that is causing slower sales for iPhone 16 out of the gate is that Apple Intelligence isn't available yet. It is scheduled to release as a free software update to U.S. customers in this month, but it won't be available in other languages until next year. And Apple Intelligence's initial features will be limited compared to where the company will take it over the next several years.

Apple has spent years investing in AI, and management is optimistic about its potential to transform the user experience. Some of the new AI features are slick, including AI-generated images, audio transcriptions, and text summaries. These features could save people a lot of time, and that will almost certainly drive healthy iPhone demand once Apple Intelligence is widely available.

Importantly, AI could help the iPhone stretch its lead against its competitors. iPhone snagged the top spot in the smartphone market for the first time ever in 2023, taking the throne away from Samsung, according to IDC. However, it still has tremendous opportunities for more gains, considering Apple controlled just 20% of all smartphone shipments last year. New AI services and features that Apple might launch could significantly boost the appeal of the iPhone and allow the brand to dominate the smartphone market.

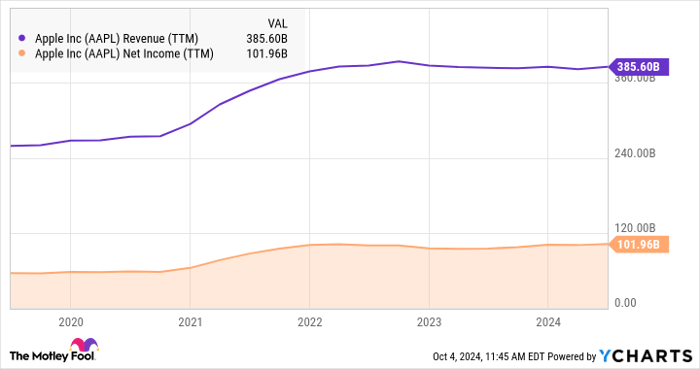

Apple's spending on research and development nearly doubled over the last five years to more than $30 billion, and given its vast resources and cash hoard, it will likely keep growing those outlays in the years to come. The company is highly profitable, generating $101 billion in profit on $385 billion of revenue over the last year.

AAPL data by YCharts. TTM = Trailing 12 months.

Apple is a solid investment

Apple has a great opportunity to increase the value of its brand with AI-optimized devices. Before deciding whether its stock is right for your portfolio, consider what sort of long-term returns it is realistic to expect from it.

The smartphone market isn't high growth anymore. It's expected to expand at an annualized rate of just 3.5% through 2029. Consistent with that projection, iPhone sales have barely increased annually over the last three years. Apple Intelligence may give a boost to sales, but the iPhone may still produce single-digit percentage annualized sales growth over the next decade.

Analysts expect Apple to grow its earnings at an annualized rate of 11% in the coming years. Wall Street estimates can shift depending on business trends, but something in the range of 10% to 15% annual earnings growth is a reasonable expectation. The reason is that AI-optimized devices will open the door for Apple to introduce new services that will boost profit margins. Over the last five years, Apple's earnings grew at a compound rate of 17%, and much of that was driven by its services segment.

The stock trades at a fair forward P/E of 27 on next year's earnings estimate, so investors shouldn't expect returns higher than the company's underlying earnings growth. Think of Apple as a blue chip stock that can deliver returns on par with the S&P 500, and with the potential to marginally outperform the index over the long term.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 781% — a market-crushing outperformance compared to 168% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Apple made the list -- but there are 9 other stocks you may be overlooking.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2024

John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.