Don't Buy XRP Until This Happens

Key Points

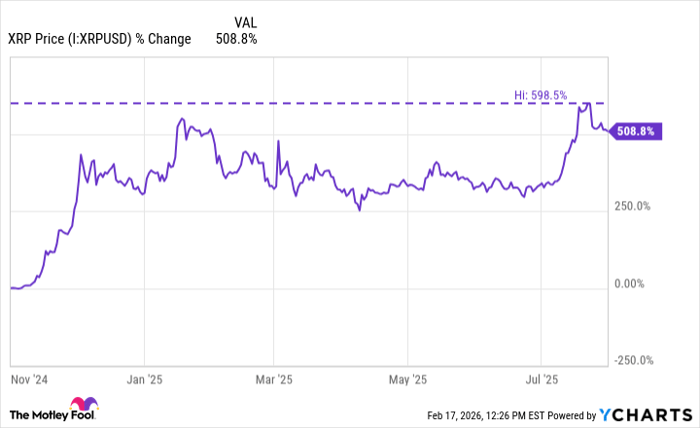

XRP's price has soared as high as 600% since the end of 2024.

At the moment, XRP is experiencing intense selling pressure as investors rotate capital away from cryptocurrency.

While XRP has clear utility, it's not entirely known how large the token's presence is in the fintech landscape.

- 10 stocks we like better than XRP ›

In late 2024, an altcoin called XRP (CRYPTO: XRP) started to experience unprecedented buying activity. When this type of behavior manifests in the cryptocurrency landscape, it's usually because day traders have identified the newest meme coin to manipulate.

That wasn't exactly the case with XRP, though. The cryptocurrency has been around since 2013, which is an eon in this sector. Besides, the token's surge from $0.50 to $2.00 during the final months of 2024 was fueled by legitimate catalysts.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Let's take a look behind XRP's meteoric rise toward the end of 2024 and its subsequent fall over the last six months. From there, I'll outline some key points investors should consider before buying XRP.

Exploring the ups and downs of XRP

Between November 2024 and the end of July 2025, XRP soared as much as 600% -- reaching a price of $3 for the first time in seven years. Two main tailwinds fueled XRP's ascent, both of which involved Washington, D.C.

During his time campaigning, then-candidate Donald Trump frequently spoke about his affinity for cryptocurrency and promised to usher in a new wave of pro-crypto legislation if elected. Following his election victory in early November 2024, money began pouring into XRP specifically. Why is that?

XRP Price data by YCharts

Well, for years, XRP's issuer, Ripple, was entrenched in an intense battle with the Securities and Exchange Commission (SEC). The SEC and Ripple had starkly different opinions about whether the XRP token should be classified as a security like a stock or bond.

Last summer, the SEC dropped its appeal against Ripple -- hence investors poured into XRP (again) and sent its price rocketing even further.

When will XRP be a good buy?

Ripple operates a payments network that offers financial institutions a faster, lower-cost way to send funds across borders. Banks can denominate their transactions in XRP instead of fiat to avoid hefty foreign exchange fees.

Despite its utility, there is a glaring problem with XRP's gains. In both instances -- Trump's election win and the SEC victory -- investors bought XRP on the premise that these things would actually help the token's adoption rate.

But has that actually come to fruition? To be honest, I don't actually know the answer to that. The reason is simple.

Image source: Getty Images.

Ripple is pretty good at promotional disclosures. The company loves to tout how its payments networking is growing by publishing certain milestones around its on-demand liquidity trends. Moreover, the company reveals just enough about XRP's contributions to give the impression that the token is being increasingly adopted.

In reality, however, Ripple's disclosed data is not as granular as sophisticated investors require. Therefore, it's nearly impossible to know XRP's true position in an otherwise crowded fintech landscape. Apart from bearish sentiment around cryptocurrency more broadly right now, some investors are beginning to doubt XRP's potential specifically -- so the token has sold off materially from its prior highs.

While XRP might sound disruptive, I'm suspicious that its adoption or utility is as meaningful as Ripple implies. In my eyes, until a bank like JPMorgan Chase or Goldman Sachs comes out and validates that XRP is helping it move capital globally, I won't give much weight to Ripple's "reporting."

Should XRP win over a major financial institution or Fortune 500 retailer, I'd be more inclined to take a look, as the bull thesis would be strengthened.

Should you buy stock in XRP right now?

Before you buy stock in XRP, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and XRP wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,151,865!*

Now, it’s worth noting Stock Advisor’s total average return is 892% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 20, 2026.

JPMorgan Chase is an advertising partner of Motley Fool Money. Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group, JPMorgan Chase, and XRP. The Motley Fool has a disclosure policy.