Exelixis: The Cash‑Generating Biotech That I Think Deserves a Closer Look in 2026

Key Points

Exelixis' main franchise has helped it perform well in recent years.

The biotech company is developing new, promising cancer drugs.

- 10 stocks we like better than Exelixis ›

While not the most popular biotech company on the market, Exelixis (NASDAQ: EXEL) has been quietly making a name for itself over the past five years, while delivering strong financial results and solid returns.

The good news is that the company could still have plenty of room to grow, and that's why it deserves a closer look this year. Let's dig deeper into Exelixis.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

The secret to Exelixis' success

Exelixis markets a cancer drug called Cabometyx, which is approved across a range of indications. Oncology is a tough, highly competitive area to navigate. But the biotech has found success thanks to Cabometyx, which has been the top-prescribed cancer drug of its type in renal cell carcinoma (kidney cancer) for a while. It has also earned enough label expansions, including as a combo treatment with well-established franchises -- including Bristol Myers Squibb's Opdivo -- to keep its sales moving in the right direction.

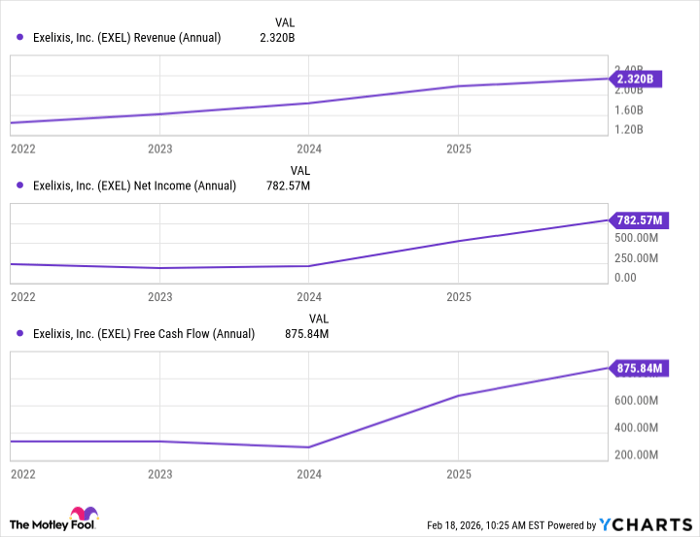

It's thanks to these efforts that Exelixis' financial results have been solid. Revenue, earnings, and free cash flow have all trended up over the past half-decade. The stock has also slightly outperformed the S&P 500 over this period.

EXEL Revenue (Annual) data by YCharts.

What's next for Exelixis?

Some might complain that Exelixis is too reliant on Cabometyx. What happens if competition intensifies, or if it loses patent exclusivity? These are reasonable fears. Generics for Cabometyx could enter the market by early 2030. But the medicine will likely maintain its momentum until then.

Here's an important reason why. In March of 2025, Cabometyx earned approval in patients with previously treated advanced neuroendocrine tumors, thereby opening an entirely new market for the therapy (as opposed to treating different sectors of the liver cancer market, for instance). Of course, the rest of its indications will still matter.

But what happens once Cabometyx starts facing generics? Exelixis is preparing for that eventuality, developing another cancer medicine called zanzalintinib. Last year, this newer drug completed a phase 3 study as a combination treatment for metastatic colorectal cancer (CRC). That's an area with high unmet need, considering that CRC is the second-leading cause of cancer death in the world, and that it's especially deadly once it metastasizes.

The biotech has requested regulatory approval for zanzalintinib in CRC and will eventually seek other indications for the medicine, as it did with Cabometyx. Furthermore, it has several other pipeline candidates that could make clinical progress in the next couple of years, before Cabometyx starts facing cheaper competitors.

Exelixis' prospects over the medium term look bright, as it manages risks to its biggest franchise and leverages its innovative capabilities to overcome them. That's why the biotech stock is worth serious consideration.

Should you buy stock in Exelixis right now?

Before you buy stock in Exelixis, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Exelixis wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,151,865!*

Now, it’s worth noting Stock Advisor’s total average return is 892% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 20, 2026.

Prosper Junior Bakiny has positions in Exelixis. The Motley Fool has positions in and recommends Bristol Myers Squibb and Exelixis. The Motley Fool has a disclosure policy.