Why Upstart Stock Lost 29% in 2025

Key Points

Upstart reported strong growth and improved profitability in 2025.

Rising credit risk, including in the auto loan market, hammered the stock.

The labor market is weakening heading into 2026, which could be a threat for Upstart.

- 10 stocks we like better than Upstart ›

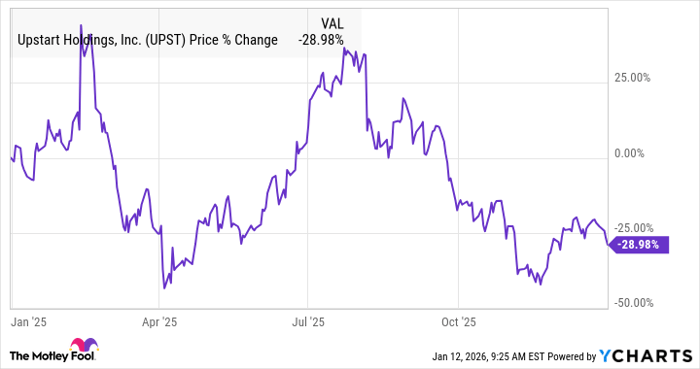

Shares of Upstart Holdings (NASDAQ: UPST), the volatile fintech stock, finished lower last year after a series of up-and-down movements. Despite strong growth in the underlying business due to the rollout of a new AI model and falling interest rates, fears about rising credit risk seemed to overcome the positive signs in the business. As a result, the stock finished the year down 29%, according to S&P Global Market Intelligence.

As you can see from the chart below, the stock was up more than 25% on two separate occasions last year, though it lost those gains both times.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

UPST data by YCharts

What happened with Upstart last year

Upstart has long been a volatile stock. The company, which operates as an AI-based online loan originator, jumped out of the gate after its IPO in December 2020, soaring in 2021 as profits soared and loan demand was strong due to low interest rates, rising asset prices, and ample stimulus during the pandemic.

However, in 2022, the stock plunged in the tech bear market, and management has been trying to rebuild the business since then. It made significant progress last year toward that, with the help of a new AI model.

Through the first three quarters of the year, Upstart's revenue jumped 79% to $747.8 million, and it reported a generally accepted accounting principles (GAAP) net income of $35 million, compared to a loss of $125.8 million in the same period a year ago. Upstart also gave strong guidance for the fourth quarter, calling for continued growth and improved profitability.

Despite those strong results, the stock still slumped toward the end of the year on broader concerns about rising credit risk. Though Upstart management said its own credit models didn't show any cracks, the labor market soured in the second half of the year, and discretionary spending has struggled. Additionally, rising auto delinquencies have spooked the credit market, and there have also been some delinquencies among auto lenders.

Image source: Getty Images.

What to expect for Upstart in 2026

Heading into 2026, Upstart stock looks set to face the same kind of themes in the economy that it did at the end of 2025. The labor market remains weak, and that could lead to increased delinquencies in the credit market.

However, Upstart's business is in a much stronger position than it was when it plunged in 2022, and its models have thus far held up.

The fintech stock still looks well-priced based on its current growth. While Upstart is still risky, the upside potential makes the stock a buy, especially as the company has soared past analyst expectations in recent quarters.

Should you buy stock in Upstart right now?

Before you buy stock in Upstart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Upstart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $482,451!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,229!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 12, 2026.

Jeremy Bowman has positions in Upstart. The Motley Fool has positions in and recommends Upstart. The Motley Fool has a disclosure policy.