Prediction: These 2 AI Darlings Will Be Worth $5 Trillion or More in 2026

Key Points

Nvidia's growth is expected to be rapid in 2026.

Alphabet could see its valuation increase and strong growth continue to cross the $5 trillion mark.

- 10 stocks we like better than Nvidia ›

Currently, there are no stocks with a $5 trillion market cap or greater. Nvidia (NASDAQ: NVDA) is valued at $4.3 trillion, and was recently valued at over $5 trillion before pulling back. Following up Nvidia are Apple at $4 trillion, Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) at $3.7 trillion, and Microsoft at $3.5 trillion. These are the only real candidates that can be worth $5 trillion or more, as Amazon is the fifth-largest company in the world at $2.6 trillion, which means its stock would have to more than double to breach the $5 trillion threshold.

So, of these four, which ones could be worth $5 trillion or more in 2026? I think there are only two real answers, and one may surprise you.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Reaching the $5 trillion valuation threshold won't be easy for one of these stocks

It should come as no surprise that I think Nvidia will cross the $5 trillion valuation threshold in 2026. It's still growing at a rapid pace thanks to its best-in-class graphics processing units (GPU) technology stack. Demand for artificial intelligence computing power in data centers isn't slowing down, and it is shouldn't for some time. Nvidia believes global data center capital expenditures will reach $3 trillion to $4 trillion by 2030, up from $600 billion in 2025. Should that come to fruition, Nvidia would be a monster performer over the next five years, and 2026 is shaping up to be another phenomenal year.

CEO Jensen Huang noted that the company is "sold out" of cloud GPUs, although he didn't elaborate on how far in the future they are sold out. Regardless, demand outpaces supply for its GPUs, which allows it to maintain high prices and lofty profit margins. This will fuel Nvidia's growth in 2026, and Wall Street analysts are expecting 48% growth again in fiscal year 2027 (ending January 2027) after rising a projected 63% in fiscal year 2026 (ending January 2026).

With growth like that, it won't take a whole lot for Nvidia to reach the $5 trillion threshold in 2026.

However, it will take a bit more effort from Alphabet.

Alphabet was a bit of a laggard in the AI arms race because competitors launched generative AI tools before it did. Furthermore, the initial release of its model was bad and caused several PR nightmares. However, Alphabet has addressed those issues and is now one of the leading providers of generative AI. In addition, Alphabet's core Google search business was spared from being broken up due to monopoly concerns earlier this year, and its future is now much clearer than it was just six months ago.

Since July 1, Alphabet's stock has been on fire, rising about 80%. However, for Alphabet's stock to be worth $5 trillion, it must rise at least 35% from today's levels.

Can it do that?

Alphabet's earnings growth has been impressive in recent quarters

There are a few ways for a stock to rise: growing revenue and earnings, or an increase in valuation. Both of these are reasonable actions for a share price to rise, and Alphabet will likely need a boost from both to cross the $5 trillion threshold. In Q3, revenue rose 16% year over year, and diluted earnings per share (EPS) increased 35%. If Alphabet can keep up its EPS growth, then it could cross the $5 trillion threshold with growth alone. However, I think it could also use some help in the valuation department.

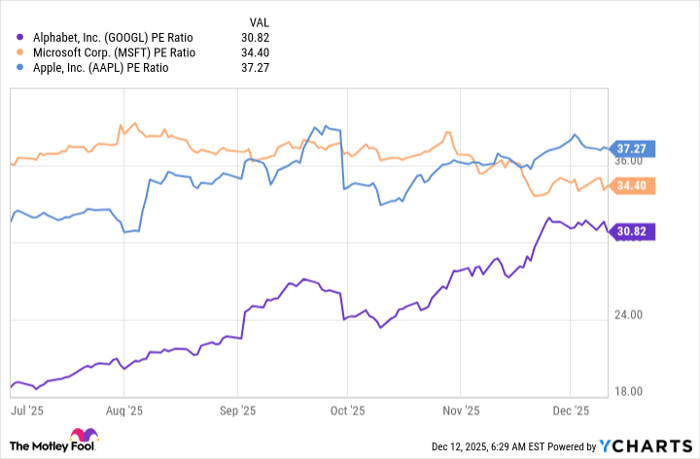

Despite growing at the same pace or faster than Apple or Microsoft, Alphabet trades at a discount from a price-to-earnings perspective.

GOOGL PE Ratio data by YCharts

Should Alphabet's stock receive a 35 times trailing earnings valuation, that would result in 14% growth alone.

Alphabet will need all the help it can get to reach a $5 trillion valuation by the end of 2026, but I think it can do it. Even if it doesn't, I think it could easily reach that level by 2027.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,955!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,089,460!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 17, 2025.

Keithen Drury has positions in Alphabet, Amazon, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.