Buy on the Dip: Double Down on an Ultra-Luxury Stock and Ignore This Pretender

Key Points

Ferrari projections left analysts wanting a little more.

Lucid has lowered its full-year production forecast.

One of these automakers has a much better outlook.

- 10 stocks we like better than Ferrari ›

Buying on the dip is a simple strategy to simply purchase a stock after the price has, in theory, temporarily dropped with the expectation the price will indeed rise again and to potentially higher future returns. Obviously, the problem with that is that timing the market is impossible, and the stock could simply continue to keep falling and shedding value.

Ferrari (NYSE: RACE) and Lucid Group (NASDAQ: LCID) have both shed a chunk of their value over the past three months, but which one warrants your investment for a potentially lucrative future?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Why the declines?

Both Ferrari and Lucid have driving forces behind the decline in valuation, but only one seems to be a classic overreaction, while the other could be raising some red flags. Ferrari is a company that boasts incredible pricing power, exclusivity, and strong margins, and has a plan set forth for its evolution into electric vehicles (EVs). However, the problem with Ferrari could simply be its past success has been so strong that its recent projections for the rest of the decade left many analysts wanting more.

Ferrari shared some key factors at its October Capital Markets Day, including lower-than-expected revenue and earnings before interest, taxes, depreciation, and amotization (EBITDA) forecasts through the end of the decade. The legendary racing company also noted it would scale back its EV targets to 20% of its lineup by 2030, down from a prior 40% estimate.

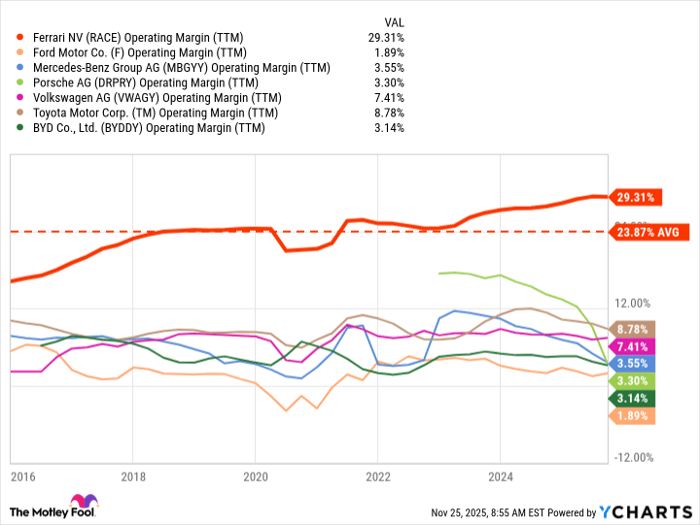

But if there's one graph that should keep investors optimistic, it's a graph of Ferrari's operating margins compared to other industry stalwarts.

RACE Operating Margin (TTM) data by YCharts.

Ferrari famously produces fewer vehicles than the market demands, an instrumental mindset to the company's exclusivity and pricing power. Remember, it's an intense process to be able to purchase a Ferrari. It's racing heritage and technology filter down into its ultra-luxury vehicles, leaving the company with powerful and innovative vehicle launches that move the company's financials.

Analysts might have soured on Ferrari simply because it's a little pessimistic about the end of the decade, but the company's margins show its business is not only strong but still growing, and that isn't likely to change anytime soon.

Dilution concerns grow

You might be surprised to see Lucid's stock spiraling lower considering the EV maker has posted seven consecutive quarters with record vehicle deliveries, helping push its top-line revenue higher. However, despite setting quarterly records, the company has still lowered its full-year production forecast, checked in below Wall Street estimates, and accelerated the delivery of its recently launched Gravity more slowly than hoped.

Lucid Gravity image source: Lucid Motors.

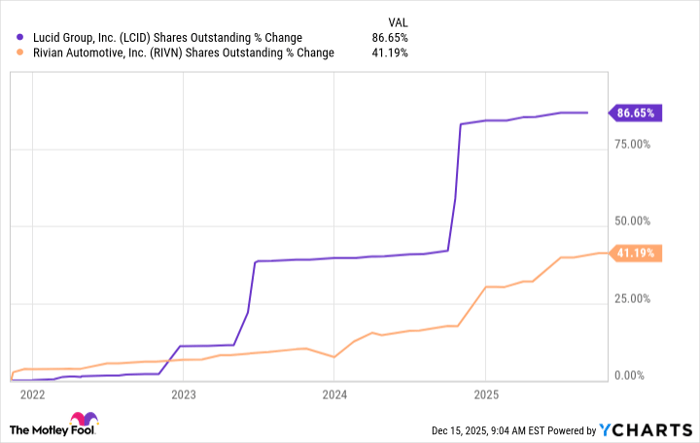

Making matters worse is the fact that Lucid is navigating choppy waters when it comes to tariffs on automotive parts, the end of the $7,500 federal tax credit, and a seemingly unending cash burn. That's where things get a little uneasy for investors because Lucid is very likely going to need more cash in the near term, and that could leave the door open for shareholder dilution. Lucid has already done so at a more rapid rate than rival Rivian as a comparable example.

LCID Shares Outstanding data by YCharts.

Subsequent to the end of the third quarter, Lucid made a couple of moves to help shore up liquidity. First, the company extended the capability of its credit facility from $750 million to roughly $2 billion, giving the company more capital for general business purposes. The company also priced a $875 million offering of convertible senior notes due 2031, with most of the proceeds going to repurchase existing 2026 convertible notes, essentially kicking the can down the road.

Buy the dip

Ferrari and Lucid may share more similarities than differences as far as businesses go, but these two automakers are far from being the same. Ferrari possesses an economic moat with competitive advantages to support and expand its margins, while Lucid is merely trying to survive long enough to reach scale and support its own business model.

If you're buying the dip, Ferrari's roughly 20% drop over the past three months is a rare opportunity to buy shares of arguably the best automotive stock on the market.

Should you buy stock in Ferrari right now?

Before you buy stock in Ferrari, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ferrari wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,955!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,089,460!*

Now, it’s worth noting Stock Advisor’s total average return is 968% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of December 17, 2025.

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool recommends Ferrari. The Motley Fool has a disclosure policy.