Down 50% From Its All-Time High, Should You Buy CoreWeave Before 2025 Is Over?

Key Points

CoreWeave has a massive revenue backlog, which should encourage investors.

However, the cloud computing company is a long way from breaking even.

Plus, it has to regularly replace its costly hardware every several years.

- 10 stocks we like better than CoreWeave ›

CoreWeave (NASDAQ: CRWV) has taken investors on quite the roller-coaster ride in 2025. The stock is up over 125% since its March initial public offering (IPO) but rose as much as 360% in June. That places it at around 50% down from its all-time high at today's prices.

However, the question arises: Is today's stock price the fair value for CoreWeave, or was its June high the correct price? The answer lies in how bullish you are on CoreWeave's prospects heading into 2026, as it could become a monster company if everything pans out.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

CoreWeave's platform is popular among the AI hyperscalers

CoreWeave operates a cloud computing service that is artificial intelligence (AI)-focused. It essentially buys the most advanced graphics processing units (GPUs) from Nvidia (NASDAQ: NVDA), and then rents out the computing capacity to big-name clients. Some of its clients include OpenAI, Microsoft (NASDAQ: MSFT), and Meta Platforms (NASDAQ: META).

Those are some of the biggest names in the generative AI realm, and being a customer of CoreWeave shows that they're doing something right. The problem is, CoreWeave is doing it in an incredibly unprofitable way.

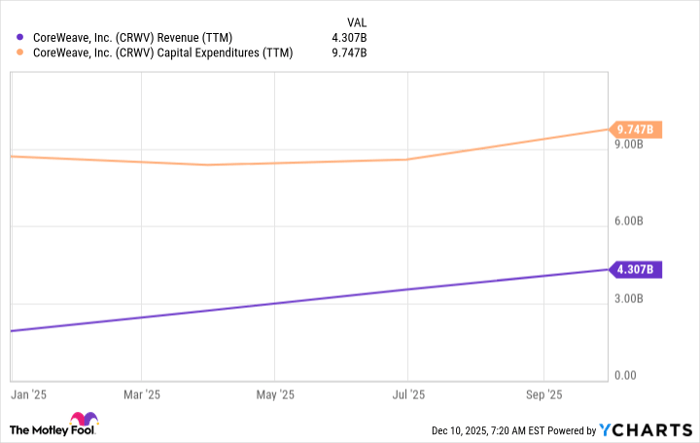

During the third quarter, CoreWeave spent $1.9 billion on capital expenditures. That comes after $2.9 billion in Q2 and $1.9 billion in Q1. That's not a huge problem, as there is massive demand for AI computing power out there. The issue is CoreWeave's revenue. In Q3, it totaled only $1.4 billion.

CRWV Revenue (TTM) data by YCharts. TTM = trailing 12 months.

The old saying is that you have to spend money to make money, but CoreWeave is taking that phrase to the extreme. Over the past 12 months, it has spent double the amount on capital expenditures than it has brought revenue in the door.

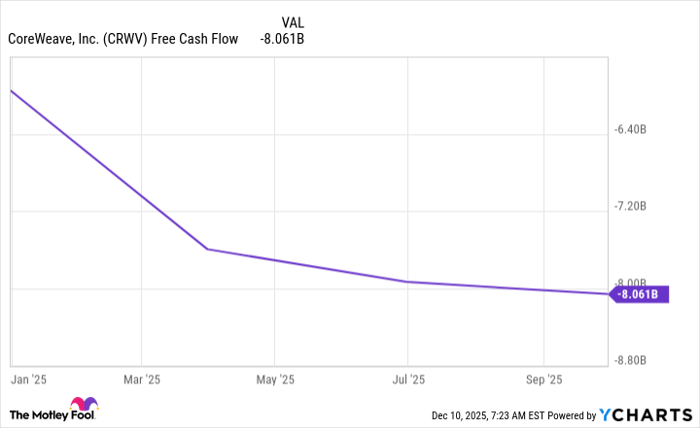

That doesn't even include the cost to operate these data centers, making CoreWeave's losses far greater. The best way to assess CoreWeave's business is to use a metric called free cash flow. Free cash flow is operating cash flow minus capital expenditures, giving investors a great idea of how much cash a company is generating (or burning). For CoreWeave, it has burned over $8 billion over the past 12 months, and those losses are widening.

CRWV Free Cash Flow data by YCharts.

However, all hope isn't lost for CoreWeave. Once its capital expenditures are complete, it will be free to run these computing units without needing to fund additional capacity builds.

Still, there's another key problem: GPUs don't last forever. GPUs tasked with AI workloads are run incredibly hard and often have a lifespan of three years, but they can burn out in as little as one. That means the hardware CoreWeave is spending billions on has a relatively short lifespan, limiting its long-term usability.

Furthermore, Nvidia is always launching new products that make the old computing hardware obsolete in about a year's time. With CoreWeave priding itself on always offering best-in-class hardware, this means its capital expenditures will likely never cease.

As a result, CoreWeave really needs to be operating profitably right now for its business model to pan out in the long term. Clearly, that's not the case right now, but it may flip the switch in 2026.

CoreWeave's backlog is keeping investors interested

CoreWeave already has a massive revenue backlog, as its services are quite popular. Its revenue backlog has reached $55.6 billion, with 40% of that revenue coming due over the next 24 months. This indicates that CoreWeave will generate a ton of money from the infrastructure being built today.

This is a strong metric and may convince many investors to stick around through the hefty losses, but they will tolerate only so many losses for so long. At some point, CoreWeave needs to become profitable. If that's in 2026, then I think now is a genius time to buy. If it's beyond 2026, I think investors are better-suited waiting until CoreWeave shows substantial progress toward profitability.

I doubt CoreWeave will turn profitable in 2026, so I think investors should wait on the sidelines for this stock.

Should you invest $1,000 in CoreWeave right now?

Before you buy stock in CoreWeave, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CoreWeave wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $513,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,072,908!*

Now, it’s worth noting Stock Advisor’s total average return is 965% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Keithen Drury has positions in Meta Platforms and Nvidia. The Motley Fool has positions in and recommends Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.