What to Watch With KO Stock in 2026

Key Points

Coca-Cola is considered one of the top consumer staples stocks.

The beverage giant has a durable business model and a portfolio of iconic brands.

The stock probably won’t surprise in either direction next year, but it could again be steady.

- 10 stocks we like better than Coca-Cola ›

In any given year, even the worst-performing sectors can be homes to some solid performers. That's been the case this year in the consumer packaged goods space. Previously prized for its low volatility traits, consumer staples is an epicenter of disappointment for investors in 2025.

Thank goodness for Coca-Cola (NYSE: KO). Amid ongoing artificial intelligence (AI) hoopla and talk of restrained consumer spending, shares of the Sprite maker performed admirably in 2025. It heads into 2026 garnering praise as one of the best consumer defensive stocks.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Coca-Cola could again be a consumer staples leader in 2026. Image source: Getty Images.

It remains to be seen if Coca-Cola can live up to that billing, but the company has the ingredients to match or perhaps modestly surpass this year's performance in 2026. Here's how that scenario could come together.

Old reliable can do it again in 2026

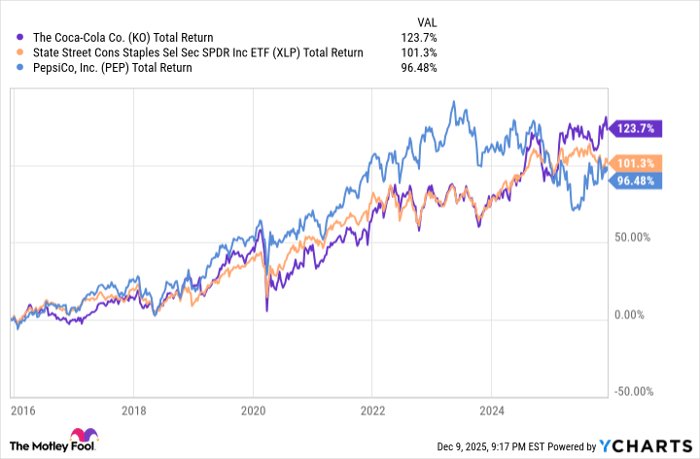

What Coca-Cola lacks in glamour relative to, say, a megacap growth stock, it makes up for in dependability. "Defense travels well" is an oft-used sports saying, but it relates to Coca-Cola because reliable free cash flow generation and robust operating margins travel well, too. So regardless of the macroeconomic environment, Coca-Cola should be able to deliver those traits as it has been. That steadiness has facilitated long-term outperformance of PepsiCo (NASDAQ: PEP) and the stock's home sector. The chart below shows 10-year total returns:

Data by YCharts.

That reliability is important because, speaking of the macroeconomic climate, CEO James Quincey recently said next year could bring incrementally more headwinds than tailwinds on the macro front. Fortunately, he wasn't ringing alarm bells with that commentary, and pertinent to investors considering the stock for 2026, he noted the company is focusing on the things it can control, such as execution, innovation, and pricing.

Another point that could bode for Coca-Cola investors in 2026 is that Quincey appears to be in touch with the consumer, acknowledging that while the company possesses pricing power, it has to be prudent with that instrument because consumers don't have sympathy for any company's higher input costs.

Call that an intangible or a variable, but at a time when so many consumers are rightfully decrying shrinkflation, investors can take heart in knowing that issue is on the radar of Coca-Cola leadership.

Raise a glass to Coke's balance sheet

Coca-Cola sports another trait coveted by long-term investors and one that could support the stock during tricky macroeconomic settings: a strong cash position. As of the end of the third quarter, the company had $14 billion in cash and cash equivalents, and that number may well be higher today following last month's $2.4 billion sale of Coca-Cola Consolidated (NASDAQ: COKE) shares to that company.

Leverage is low and within the company's desired range of 2x to 2.5x net debt/earnings before interest taxes, depreciation and amortization (EBITDA). Factor in an A+ credit rating from S&P Global, and the Dasani maker, if needed, can tap capital markets at favorable rates.

Putting it all together, shares of Coca-Cola are unlikely to set investing ablaze in 2026, but for patient investors seeking durability and reliability, the stock could be a practical, rewarding addition to well-balanced portfolios.

Should you invest $1,000 in Coca-Cola right now?

Before you buy stock in Coca-Cola, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Coca-Cola wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $507,421!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,109,138!*

Now, it’s worth noting Stock Advisor’s total average return is 972% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 8, 2025

Todd Shriber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends S&P Global. The Motley Fool has a disclosure policy.