Here's Why Aehr Test Systems Stock Slumped in November

Key Points

Market sentiment turned negative for AI-related stocks in November.

Aehr keeps signing orders with leading AI players.

Aehr's end markets appear to be strengthening and the company is building momentum in its orders.

- 10 stocks we like better than Aehr Test Systems ›

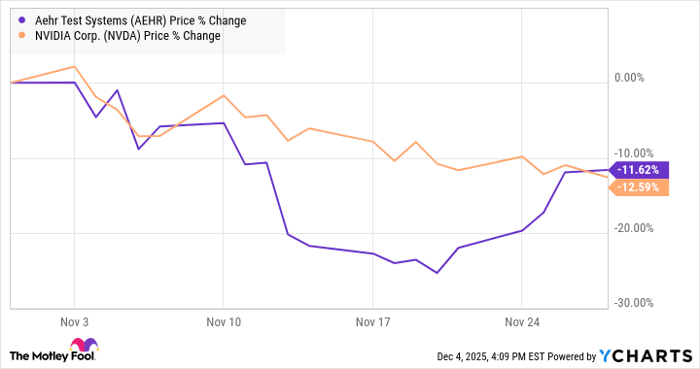

Aehr Test Systems' (NASDAQ: AEHR) stock price performance in November was almost a microcosm of a broader debate around whether an artificial intelligence (AI) capital spending bubble is forming or not right now. According to data provided by S&P Global Market Intelligence, the stock declined 11.6% in November as the market decided to take what you might call an "AI breather", but is it a buying opportunity or the start of a deeper decline?

Aehr Test Systems and artificial intelligence

The company's sales have been under pressure in recent years as its previous core end market, wafer-level burn-in (WLBI) test systems for silicon carbide (SiC) chips primarily used in electric vehicles (EVs), has slowed. While EVs remain in the growth area of the auto market, their sales haven't met industry expectations, and many automakers have cut back on new-model releases.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

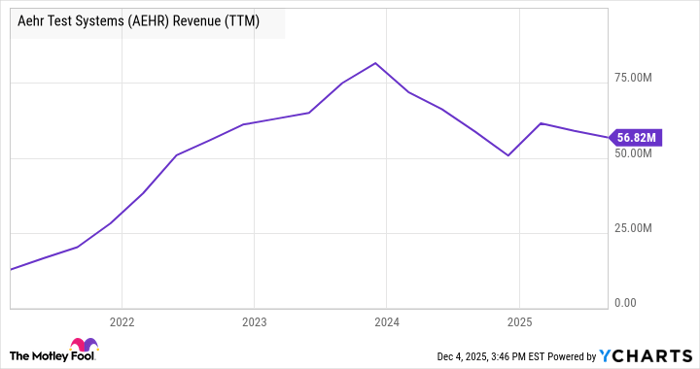

Simply put, the new normal is targeted development of new EV models rather than the aggressive expansion-at-all-costs approach aimed at winning market share. That change took its toll on Aehr's revenue growth over the past few years.

AEHR Revenue (TTM) data by YCharts

That said, there's more than one string to Aehr's bow, and the company has been successful in building orders for its WLBI test systems for AI processors, including multiple orders from a leading hyperscaler. Naturally, these developments have excited the market about Aehr as an AI-related stock, and despite the November decline, the stock is up 52% year-to-date at the time of writing.

As for the decline in November, it largely stems from negative sentiment toward AI, specifically the debate over whether it's in a bubble. Given that the Aehr is now viewed as an AI stock, it's understandable that a decline would coincide with a sell-off in companies like Nvidia in the same month.

AEHR data by YCharts

Is the market wrong?

But here's the thing. The negative sentiment, partly inspired by "Big Short" investor Michael Burry, isn't backed up by near-term fundamentals or anecdotal evidence. For example, Teradyne, a company that makes semiconductor test equipment, tends to be in an earlier cycle than Aehr, and recently reported stellar results driven by AI spending.

Image source: Getty Images.

Moreover, in mid-November, Aehr's CEO Gayn Erickson stated that "multiple leading companies" were "requesting benchmark evaluations for their AI processors since just our last earnings call."

Given that the last earnings presentation was in early October, this implies Aehr's AI end markets are strengthening, not weakening. Something to consider before turning negative on the investment theme.

Should you invest $1,000 in Aehr Test Systems right now?

Before you buy stock in Aehr Test Systems, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Aehr Test Systems wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $560,649!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,100,862!*

Now, it’s worth noting Stock Advisor’s total average return is 998% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool recommends Teradyne. The Motley Fool has a disclosure policy.