Can Shiba Inu Reach $1 in 2026? The Answer Might Blow Your Mind.

Key Points

Shiba Inu's price could benefit from lower interest rates, changes in crypto regulation, and rising utility.

While these catalysts may help Shiba Inu, a $1 price target would imply a market cap of $589 trillion -- beyond unrealistic.

For Shiba Inu to reach $1, a coordinated coin burning effort of global proportions is required.

- 10 stocks we like better than Shiba Inu ›

When investors think about mainstream cryptocurrencies, names like Bitcoin, Ethereum, or XRP often surface first. In the same vein that newcomers try to disrupt established blue chip companies on Wall Street, the cryptocurrency universe goes far beyond the usual suspects.

One cryptocurrency that has amassed a loyal following -- albeit a polarizing reputation -- is Shiba Inu (CRYPTO: SHIB). Created by an anonymous developed called Ryoshi nearly five years ago, Shiba Inu has now become one of the most valuable cryptocurrencies in the world as measured by market capitalization.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Right now, Shiba Inu trades for just fractions of a penny. However, several catalysts are on the horizon that could send its price higher.

Image source: Getty Images.

Could the milestone price of $1 be right around the corner for Shiba Inu? Read on to find out.

What catalysts could drive Shiba Inu higher?

There are a few meaningful catalysts that could have a positive influence on the cryptocurrency industry in the near term.

Lower interest rates

After long-standing pressure from Washington, the Federal Reserve may finally be ready to introduce a series of rate cuts. Looser monetary policy can lead to more willingness to take on risk -- potentially unlocking capital inflows from retail investors into more speculative assets.

Pro-crypto regulatory environment

During his time on the presidential campaign trail, Donald Trump frequently voiced his support for the cryptocurrency industry. Following his inauguration, his administration has advised the U.S. Treasury to establish a strategic Bitcoin reserve as well as consider stockpiling other digital assets.

Rising utility

The reason Bitcoin, Ethereum, and XRP have witnessed meaningful price appreciation during the past several years is because they offer legitimate utility across investing and payments infrastructure. Conversely, altcoins such as Shiba Inu lack real-world application. Nevertheless, its developer community remains ambitious -- introducing a host of new features through its Layer-2 network, Shibarium.

While the ideas explored above might create some hype, it's crucial for prudent investors to remember that lower interest rates or new regulatory frameworks may not directly benefit Shiba Inu, per se. Instead, these dynamics could represent catalysts for the broader crypto realm.

Is a $1 price target for Shiba Inu realistic?

Like any asset, Shiba Inu's price is determined through the dynamics of supply and demand. When Shiba Inu was first introduced, there were 1 quadrillion tokens in the supply outstanding. Today, there are 589 trillion tokens remaining in circulation.

For the sake of this analysis, I'll assume that Shiba Inu trades at a price of $1. Given the details above, that would imply a market value of $589 trillion. So what?

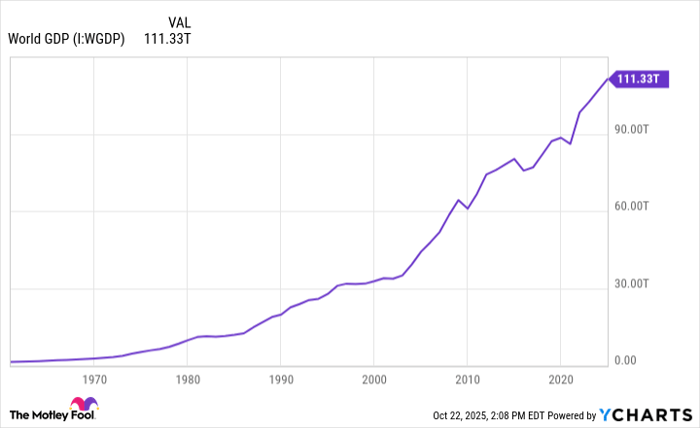

World GDP data by YCharts

Well, to add context here by way of the above chart, this translates to more than five times the entire value of global gross domestic product (GDP).

Common sense tells us that the only way for Shiba Inu to experience a meaningful price surge would be if its supply continued to decline. The way that would happen is through enormous burning initiatives -- removing more tokens from circulation by sending them to inactive wallet addresses.

This is where logistics enters the picture. In theory, it's possible for a significant chunk of Shiba Inu's supply to be burned and removed from circulation. But is this realistic? The answer is almost unequivocally, "no."

To reach $1 (Shiba Inu now trades at about $0.00001), a global, coordinated burning effort led by a consortium of institutional and high-net worth investors -- sustained for a prolonged period of time -- would be required.

Should you buy Shiba Inu right now?

What investors need to remember above all else is that the cryptocurrency landscape is far more volatile than traditional asset classes like stocks or bonds.

Even established cryptocurrencies such as Bitcoin and Ethereum are still vying for mainstream adoption. It could be years before these digital assets are considered a normal cornerstone of diversified investing.

While Shiba Inu provides entertainment, its price generally moves based on narratives drummed up in online forums like Reddit or social media platforms like X. In my eyes, Shiba Inu is best left as a playground for meme traders and should be avoided for long-term investors seeking to build durable wealth.

Should you invest $1,000 in Shiba Inu right now?

Before you buy stock in Shiba Inu, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Shiba Inu wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $602,049!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,105,092!*

Now, it’s worth noting Stock Advisor’s total average return is 1,028% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of October 20, 2025

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin, Ethereum, and XRP. The Motley Fool has a disclosure policy.