Investing in Space Technology & Satellite Stocks

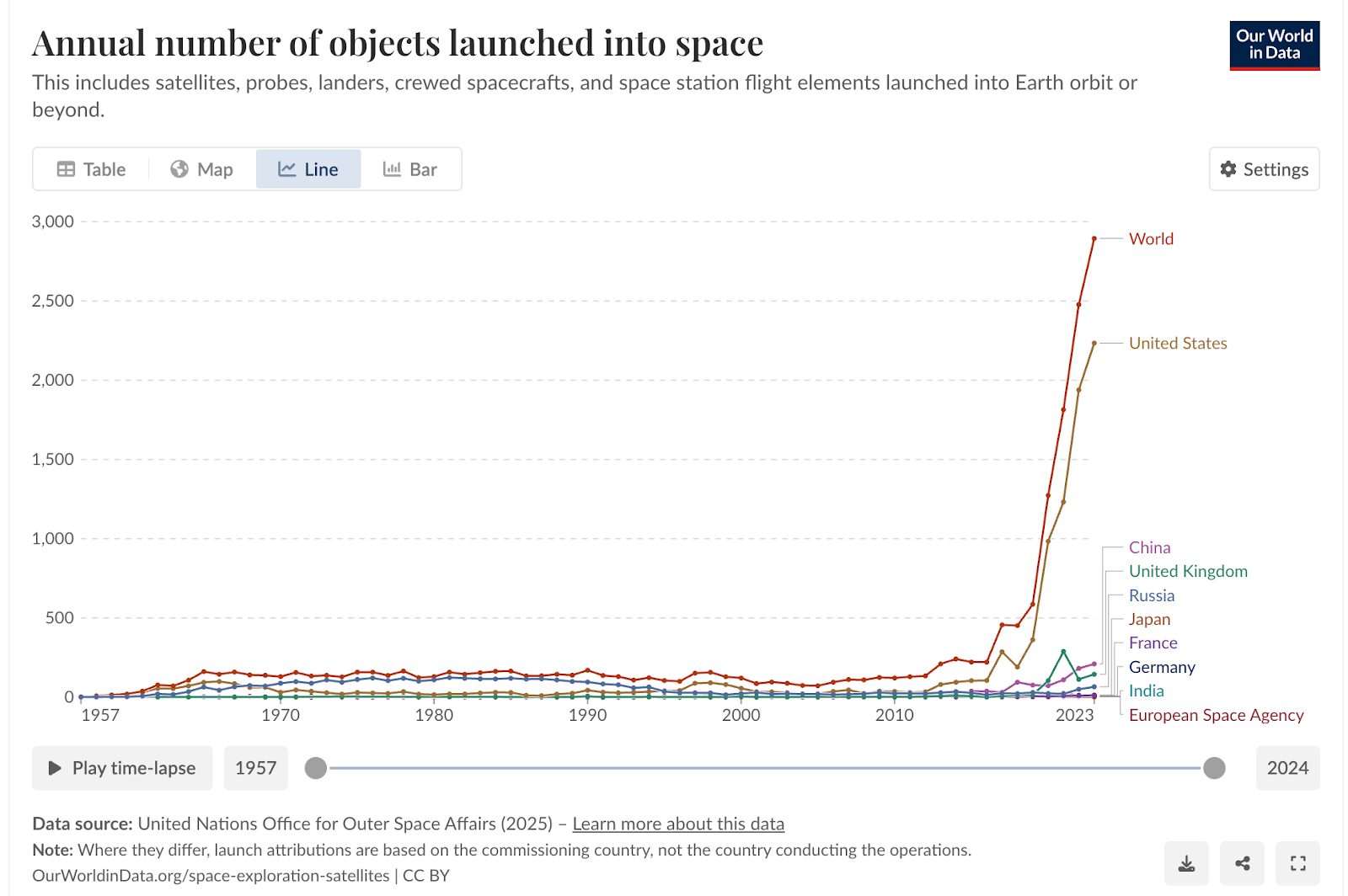

- Space is shifting from state-led missions to a commercial “new space race,” with private launch and satellite players slashing costs and expanding access.

- Satellites are critical infrastructure—powering navigation, weather, defense, and global connectivity—drawing durable government backing alongside private capital.

- Growth stems from reusable rockets, small-sat constellations, and rising data/broadband demand; investors can play incumbents (A&D), pure-plays (launch, imaging, satcom), and diversified ETFs.

- Risks are high—technical failures, financing needs, regulation/geopolitics, and frothy valuations—so use diversified, long-horizon positioning anchored in core aerospace with selective space exposure.

A New Space Race

TradingKey - For years, space was the preserve of governments and a few defense contractors. Now it is a growing business expecting billions in private investment. The intersection of the reusable rocket, the miniaturized satellite, and commercial use has taken space from a faraway dream and made it an investment reality. Players now vie to launch satellites, deliver connectivity, and explore the new frontier. Investors see this as one of the most exhilarating and challenging opportunities of the next few decades.

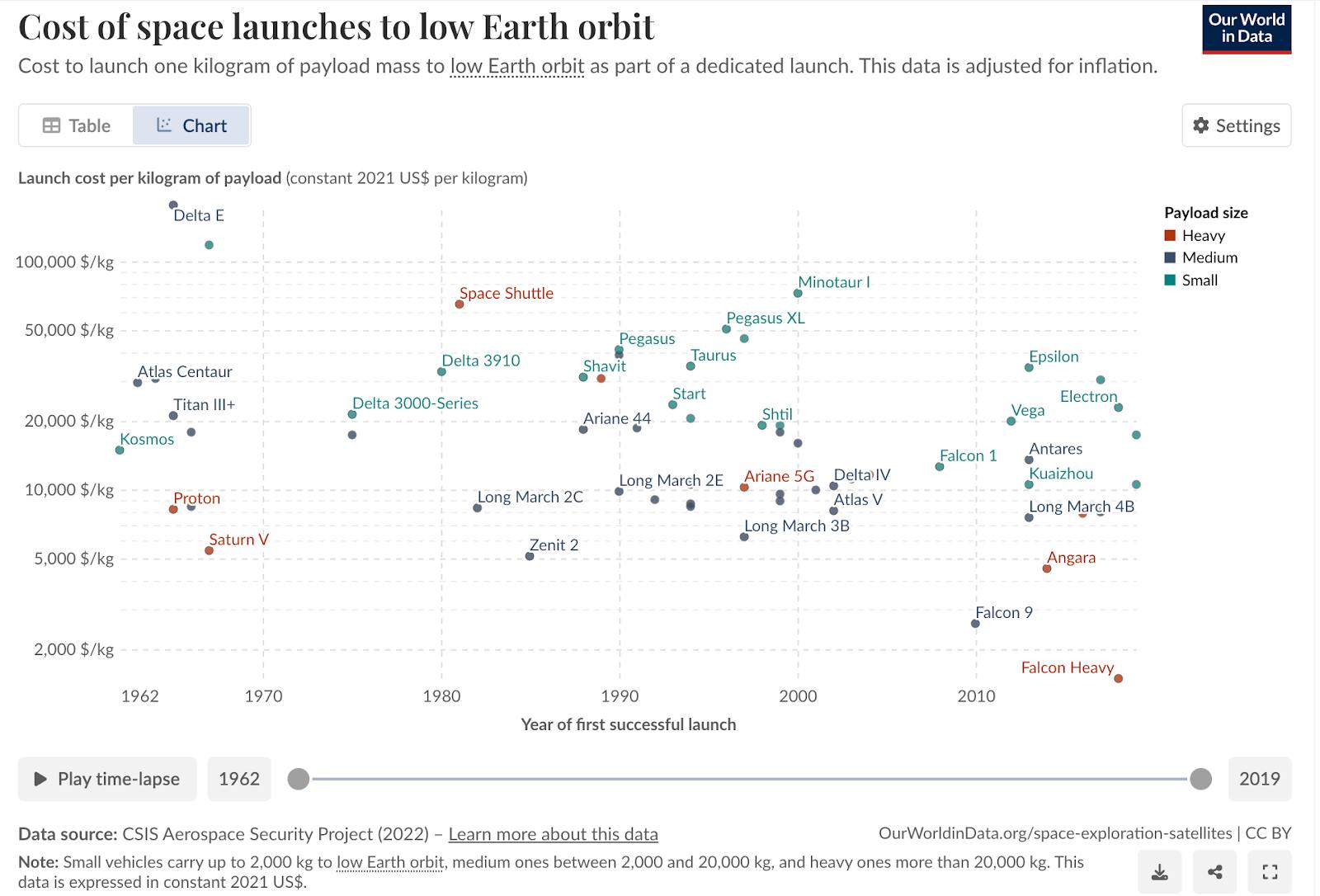

While government initiatives defined earlier space races, the current space age is determined by commercialization. SpaceX and Blue Origin are the leaders of a new series of private companies cutting launch costs and broadening access. At the same time, the current aerospace giants prepare for a world in which satellites, space infrastructure, and even tourism are part of business plans. The convergence of technology, capital mobility, and policy has set the stage for a rapidly expanding sector.

Launch & Rockets

- SpaceX (private) leads with reusable rockets but remains private.

- Rocket Lab (RKLB) provides small-satellite launch services.

- Boeing (BA) remains a player in heavy-lift rockets through NASA contracts.

Source: https://www.ourworldindata.org

Why Space Technology Matters

Space tech isn't about prestige nowadays. It forms the basis for contemporary economies in a manner too frequently undervalued. Satellites enable world positioning, weather monitoring, and monitoring of the Earth. They underpin military intelligence and secure communications. They are the basis for telecommunications and increasingly a component of broadband internet through constellations such as Starlink.

While the world becomes increasingly dependent on digital infrastructure, the space infrastructure grows in importance. Satellite data is used by farmers in precision farming. Trucking companies monitor vehicles across continents. Governments track the weather and natural disasters, plus geopolitical risks from space. In a nutshell, satellites are not a luxury but a necessity.

The fact that the industry is essential ensures commercial viability and government support. Governments view space as a strategic asset and continue to invest. Investors value this government and private investment combination, offering support even in uncertain markets.

Source: https://www.ourworldindata.org

Growth Drivers

Various stimuli push the development of space technology. SpaceX-led reusable rockets reduced the price of launch by several folds and now make the deployment of satellites affordable for the global business and governments. Miniaturization advancements make small satellites capable of accomplishing missions that previously needed bulky systems and make it possible to cluster hundreds or thousands of units.

The requirement for connectivity is also a motivator. Billions lack access to reliable internet, and satellite broadband offers solutions where terrestrial infrastructure is not possible. Starlink, OneWeb, and Amazon’s Kuiper project are vying for this marketplace.

The space infrastructure is also increasing. It provides the data for industries ranging from insurance to energy to ag. High-def imagery and AI analysis create new commercial use cases. The defense use cases add support, as space becomes increasingly integral for national security.

Satellite Communications

- Iridium (IRDM) operates a global satellite phone network.

- Globalstar (GSAT) provides low-bandwidth satellite connectivity.

- AST SpaceMobile (ASTS) is building space-based cellular broadband.

- Amazon (AMZN) backs Project Kuiper to rival Starlink.

Investment Opportunities

One can access space technology through different avenues. The publicly traded space and defense companies provide security and space contract exposures. The likes of Lockheed Martin, Boeing, and Northrop Grumman continue to have prime spots in government operations while commercial service businesses expand.

Pure-play space companies possess more growth potential but more volatility. Rocket Lab provides launch services for small satellites. Maxar is in the earth imaging business. Iridium and Globalstar are in the business of satellite communications. These companies are smaller and more volatile but give you straight access to the business’s core engines of growth.

Investors can also consider developers of satellite broadband. Starlink is a privately owned business under SpaceX, but publicly traded competitors like AST SpaceMobile are available. These businesses cater to massive underserved markets but face implementation and capital challenges.

These space exploration exchange-traded funds provide you with diversified exposure matching risk in a variety of companies. They suit investors who won't make individual judgments.

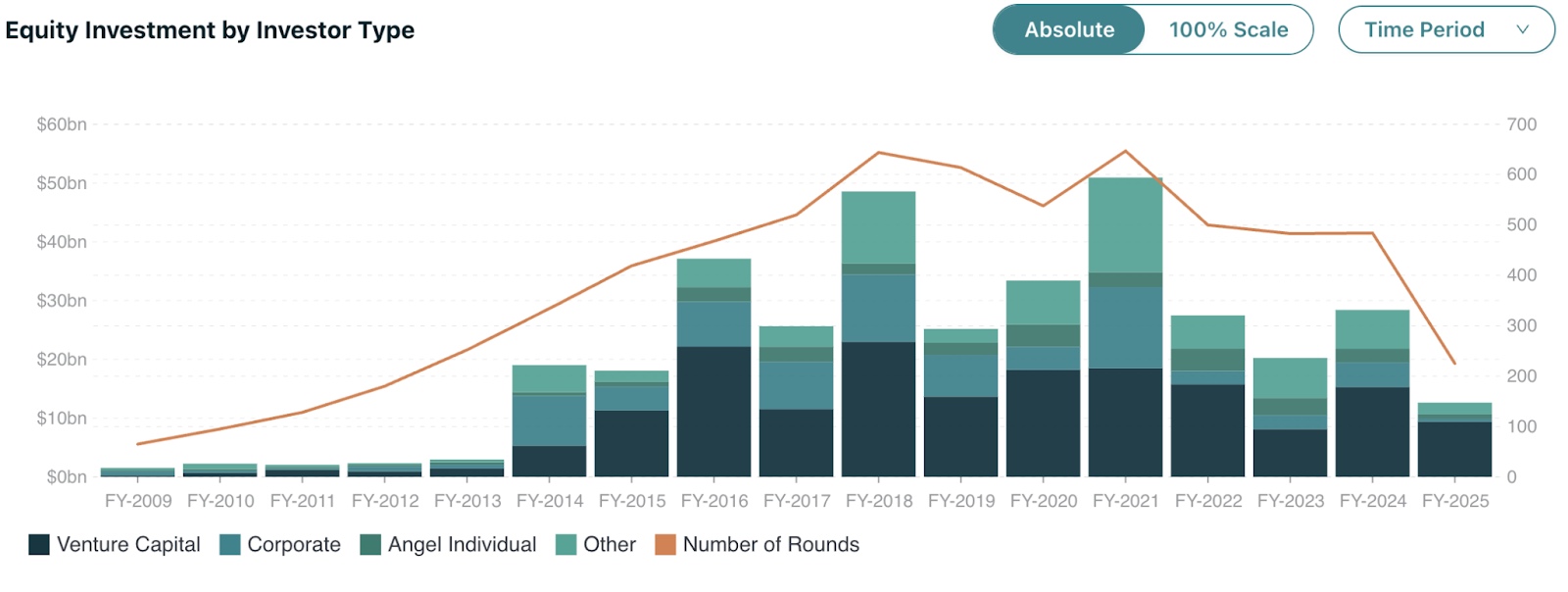

Source: https://www.spacecapital.com

Risks and Challenges

It is one of the toughest sectors for business. Technical risk is very high. Failed launches, satellites gone wrong, or delays can scuttle projects. Businesses typically burn a significant amount of capital before generating revenue, thereby creating financing risks.

Geopolitics and regulatory risk also linger. It is a contested space wherein states compete for preeminence. Export control, controversies about the allocation of the electromagnetic spectrum, and global tensions can affect operations.

Valuations also create difficulty. Investor excitement has driven the multiples of some space businesses high and often away from near-term cash flows. Distinguishing the sustainable business models from speculative bets is necessary.

Lastly, the market is consolidating. Not all the companies will make it. Just like in previous cycles of technology, numerous early entrants WILL FAIL while a few grow dominant.

Portfolio Positioning

For most investors, space is a satellite position of a broader technology or industrial portfolio. The space business is a high-risk and high-growth space and is best entered in a diversified manner. Diversification is achieved by anchoring with core aerospace and defence companies and selective participation in pure space plays to capture upside.

The time horizon does make a difference. The investments in space entail a wait of several years for projects to gain commercial significance. The quarterly earnings report-focused investors may get impatient, but longer-term investors benefit once the business matures.

Thematic funds represent a balanced solution that is best suited for novice investors in the field. They spread the risk by application, launch service, operator, imaging, and communications, with decreased reliance upon a single business model.

Conclusion

The Final Frontier Becomes Investable Once the preserve of science fiction and government monopolies, space has become a maturing industry in transition and part of the world infrastructure. Satellites and space-based rockets, and orbital data are also revolutionizing economies, militaries, and societies. The potential for investors is profound but not without discernment. The risks are very real: technical disappointments, political tensions, and speculative valuations can deflate earnings.

But the long-term trajectory is unmistakable. As the price falls and applications expand, space technology is going to creep more and more into the routine of daily living. The shrewd investors in this frontier are not investing in spacecraft or satellites at all, they are investing in the creation of the next infrastructure layer of human activity. It requires courage, patience, and discipline to invest in space. But just as the arrival of the rails connected the continents and the web brought the world together, space offers the possibility of aligning portfolios with one of the 21st century's defining frontiers.

-433cb51b3db74cbebb6f39fdfb42e636.jpg)

Get Started