Crypto AI investors dump $2.5B as China retaliates to Trump trade war with NVIDIA, Google probe

- The Crypto AI sector plunged 8.5%, shedding over $2.5 billion on Tuesday in reaction to the aftershocks of the U.S.-China trade war.

- China has revived antitrust investigations into U.S. tech giants Google and NVIDIA following a 10% ]\tariff imposed by the Trump administration.

- NEAR, Ai16z, and Bittensor were among the biggest losers on the day.

AI Crypto Sector Crashes as China Revives U.S. Tech Antitrust Probe

The artificial intelligence (AI) cryptocurrency sector nosedived on Tuesday, posting an 8.5% decline that wiped out more than $2.5 billion in market capitalization.

The sell-off came in response to escalating tensions between the United States and China, triggered by the Trump administration's aggressive tariff policies.

Technical indicators suggest that major AI crypto assets like NEAR, Ai16z, and Bittensor could experience heightened volatility in the coming days.

China’s renewed antitrust scrutiny on major U.S. technology firms, including Google and NVIDIA, has sparked investor anxiety.

According to local reports, Chinese regulators have reopened investigations into Google and NVIDIA and are reportedly considering a broader probe into Intel.

This move appears to be a calculated response to the Trump administration’s tariff escalation.

“The tech investigations may be part of the retaliatory measures made by China in response to Trump’s new tariffs against the country”

- Liu Xu, Researcher, National Strategy Institute of Tsinghua University, China.

Trump’s Trade War Spells Trouble for AI Crypto Markets

The Trump administration has doubled down on its hardline trade policies, imposing a 10% tariffs on Chinese imports while briefly threatening similar measures against Canada and Mexico.

Initially, the administration’s stance on cryptocurrency appeared promising, with Trump-linked entities such as WLFI making strategic crypto investments and his official campaign embracing the $TRUMP token.

However, recent trade policy shifts have sent shockwaves through global financial markets, with AI-focused blockchain projects taking a direct hit.

The latest U.S. tariffs include a 10% import tax on Chinese semiconductor components, a move that has disrupted the supply chains of major AI firms reliant on NVIDIA’s GPU hardware.

Beijing’s counterstrike—a retaliatory 15% tariff on select U.S. imports—escalated concerns over prolonged trade hostilities. The situation deteriorated further after reports surfaced of China leveraging legal action against U.S. tech giants to gain an upper hand in negotiations.

Crypto AI sector sheds $2.5 bllion as China probes NVIDIA

China’s decision to relaunch its antitrust investigation into NVIDIA sent ripples through AI-related cryptocurrencies, with the sector losing approximately $2.5 billion in daily trading volume.

According to Coingecko, AI crypto projects integrating blockchain with machine learning tools suffered significant losses, with NEAR, Bittensor, and Ai16z among the worst performers.

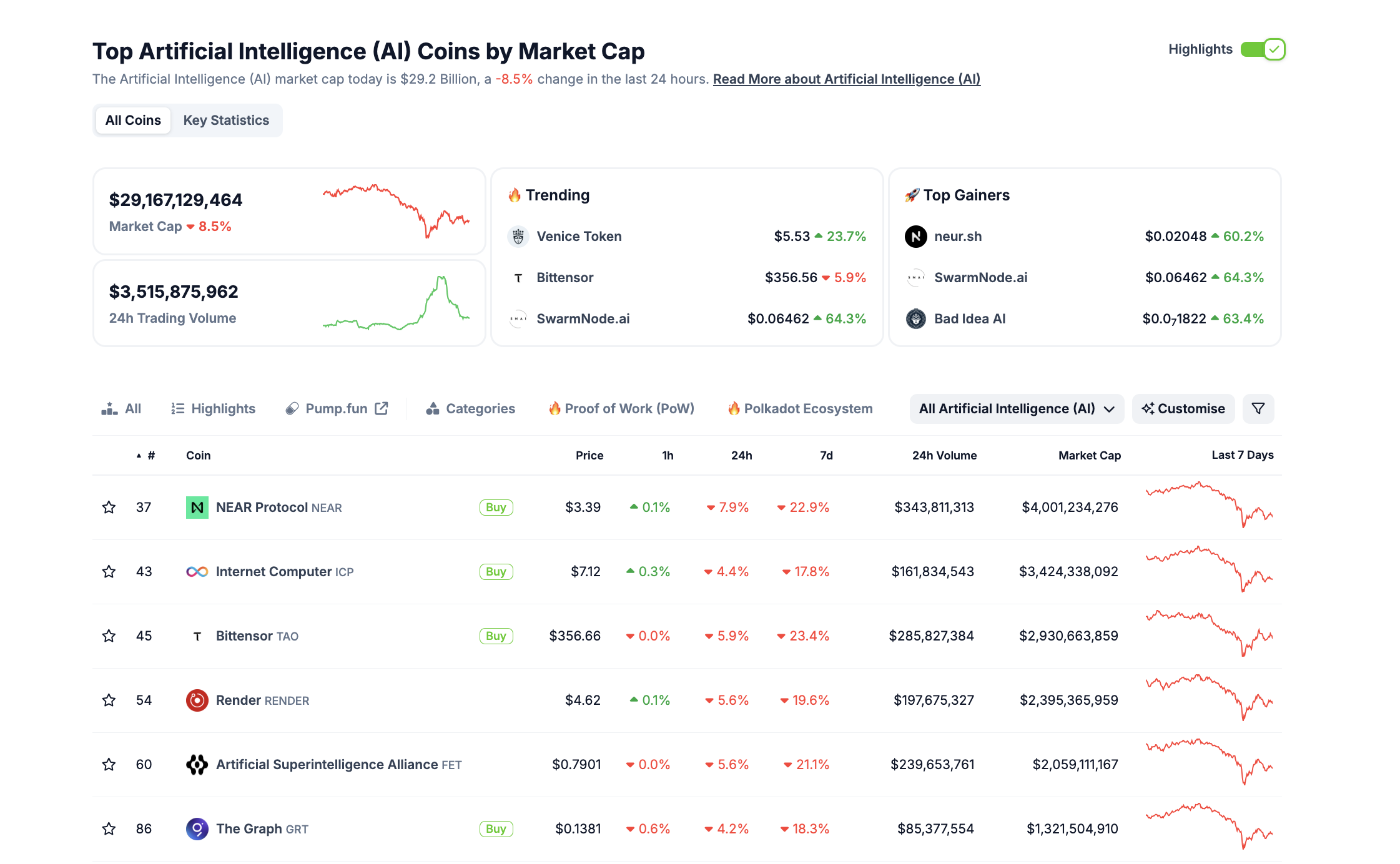

The sector’s total market cap tumbled to $29.2 billion, marking one of the sharpest daily contractions in recent months.

Crypto AI Sector Performance | Source: Coingecko

Crypto AI Sector Performance | Source: Coingecko

NEAR, the largest project in the AI crypto space by market capitalization, dropped 7.9% on the day, aligning with the broader sector downturn.

Meanwhile, Bittensor’s TAO token, which had seen a strong rally last week on growing optimism around decentralized AI solutions, declined by 5.9%.

Analysts attribute this drop to fears that an extended regulatory battle involving NVIDIA could slow AI hardware production, impacting blockchain projects dependent on high-performance computing.

Ai16z, one of the leading AI agent tokens, emerged as the biggest loser of the day, plummeting 13%—far exceeding the sector’s average decline of 8.5%. The sell-off reflects growing investor unease over China’s crackdown on foreign AI firms and its potential repercussions for blockchain-based AI projects.

Outlook: More volatility ahead if China vs. US Trade war escalates

The AI crypto sector remains on shaky ground as global trade tensions mount. Investors fear that if China’s investigation into NVIDIA results in severe penalties, it could set off a chain reaction affecting AI infrastructure development.

Beyond that, a prolonged legal battle could also deter institutional capital from flowing into AI-driven blockchain projects.

If China expands its crackdown to other U.S. chipmakers such as Intel or Qualcomm, the sector could face even steeper losses. In contrast, if diplomatic negotiations ease trade tensions, AI crypto assets could recover swiftly.

For now, traders are bracing for heightened volatility as the sector navigates the uncertain geopolitical landscape. AI crypto remains one of the most promising sectors in blockchain, but the latest developments highlight the risks associated with global regulatory uncertainty.

Investors will be watching closely for any policy shifts from Washington or Beijing that could determine the sector’s next move.