Dogecoin price forecast: Miners offload $240M as DOGE approaches risk zone

Dogecoin market update

- After reaching a three-year peak of $0.43 on November 12, Dogecoin price wobbled 13% to find support at the $0.38 level on Wednesday.

- Miners capitalized on Trump’s recent D.O.G.E confirmation statement to offload 620 million DOGE in the last three days.

- Widening Bollinger Bands, and an overbought RSI reading, suggest potential downside risks ahead.

Dogecoin has dominated the top gainers chart since the start of November, market signals suggest the sentiment could shift in the days ahead.

Dogecoin price rally cools after Trump confirmed D.O.G.E department

Since Donald Trump’s victory on November 5, Dogecoin has emerged as the best performing asset among the top 10 ranked cryptocurrencies. On November 12, DOGE reached a new milestone price propelled by Trump’s statement confirming Elon Musk’s involvement in the incoming administration.

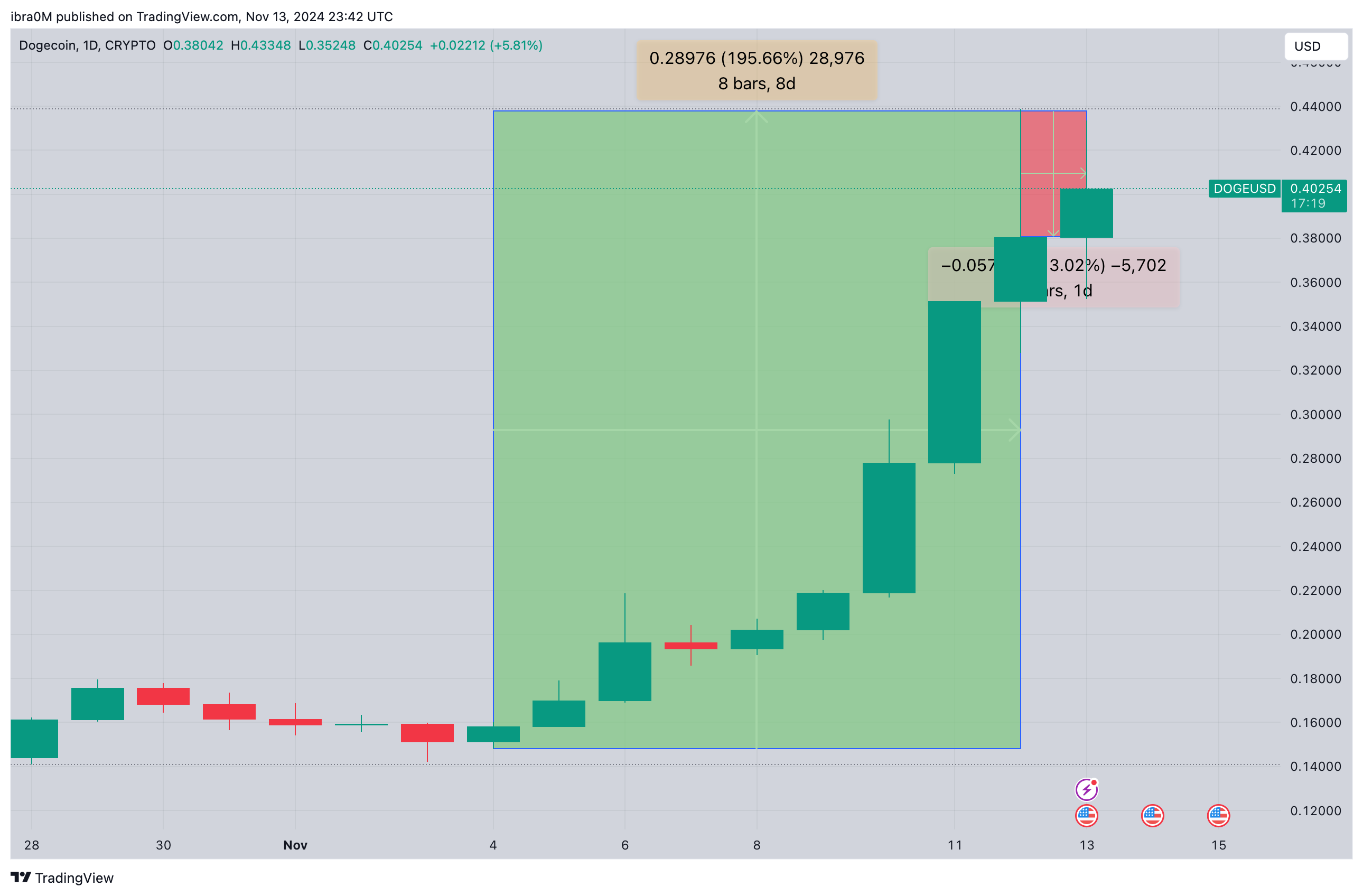

Dogecoin (DOGE) price action November 2024 | TradingView

The DOGEUSD daily chart DOGE price recorded a blistering 195% gains in a frenetic nine-day winning streak. As depicted above, Dogecoin had opened trading at $0.16 on November 5, before making its way to a three-year peak of $0.43 on Wednesday.

According to Trump’s official statement released, on November 13, billionaire entrepreneur Elon Musk is due to head the Department of Government Efficiency, along with Republican party member Vivek Ramaswamy.

With all bullish Dogecoin speculations around Trump’s election win now fully priced in, DOGE has begun to flash early signals of buyer fatigue.

At the time of publication on Wednesday November 13, DOGE price entered a 13% correction, finding support at the $0.38 level.

Miners offloaded 620 million DOGE as market euphoria peaks

Looking beyond the price charts, bullish trading activity among miners is another key factor that has supported the Dogecoin breakout in recent months. But curiously, the Dogecoin miners have now made a major u-turn as market euphoria peaked in the aftermath of Trump’s official statement on Wednesday.

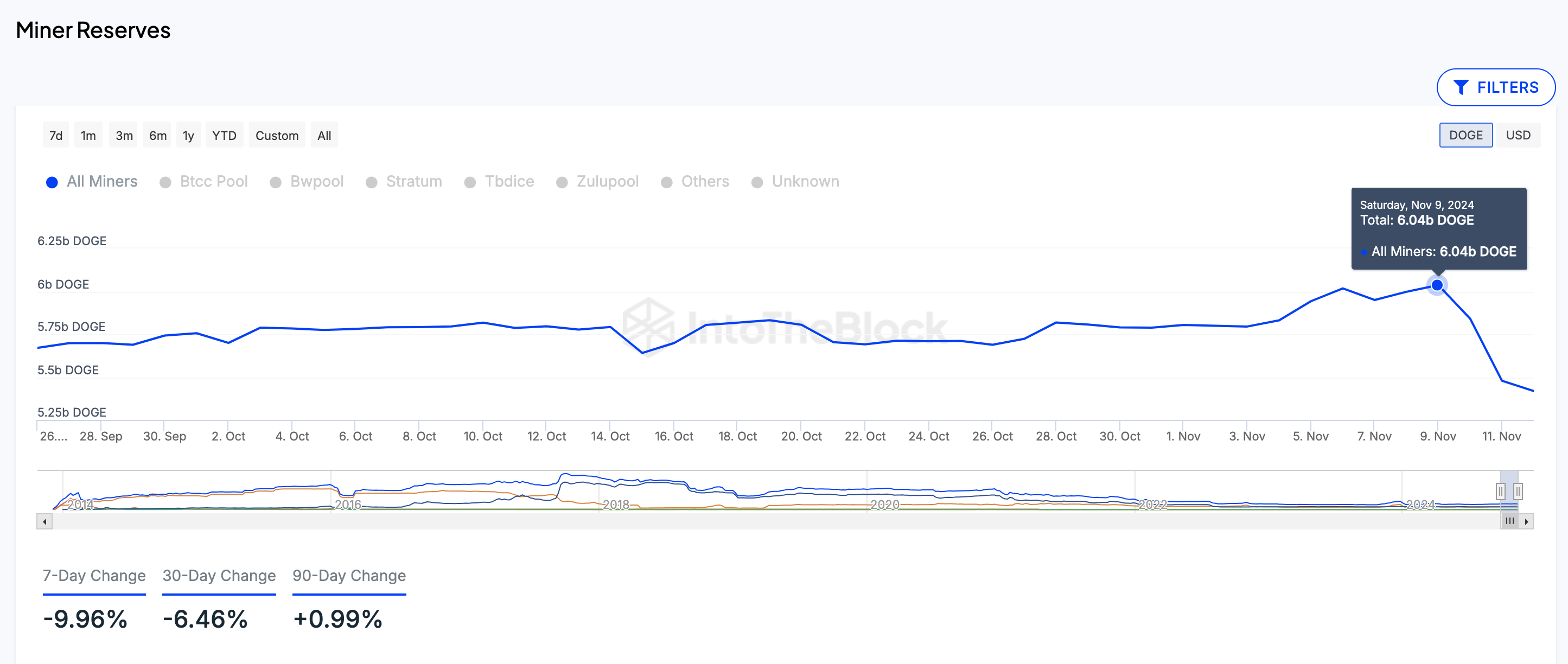

IntoTheBlock’s miners reserves chart below tracks balances held in wallets controlled by recognized miners and mining pools.

Notably, in the 25 trading days between Oct 25 and November 9, Dogecoin miners increased their balances by 400 million DOGE, bringing their reserve balances to a 7-month peak of 6.04 billion DOGE.

Dogecoin miners reserves | IntoTheBlock

But as the market euphoria peaked this week, miners have entered a major selling spree. The latest data shows that Dogecoin miners now hold just 5.42 billion DOGE at close on November 12.

This reflects that they sold a staggering 620 million DOGE, worth approximately $240 million, in the last three days.

When miners sell-off surge a large volume of coins after a prolonged accumulation period as observed in the DOGE markets this week, it is interpreted as a bearish signal for two key reasons.

Firstly, it signals overwhelming expectation among Dogecoin key stakeholders, that the market rally may be approaching a saturation point.

If other traders mirror this sentiment, it could set-off a widespread profit-taking in the days ahead.

Secondly, miners effectively dilute the existing market supply, when they offload such large volumes newly-mined coins within a short period.

Hence, the $240 million increase in Dogecoin’s short-term market supply over the last 3 days could potentially intensify downward pressure if traders begin to book profits.

DOGE technical analysis: Failure to hold $0.30 could trigger downward volatility

Dogecoin price has now dipped 12% since market euphoria peaked when Trump confirmed Elon Musk’s involvement in the D.O.G.E department.

With miners selling off $240 million worth of DOGE in a 3-day selling spree, bears may capitalize to force a major downswing in the near term.

Technical indicators on the DOGEUSD daily chart below also affirm this cautious Dogecoin forecast.

Dogecoin Price Forecast | DOGEUSD

First, the widening of the Bollinger Bands, signals heightened market volatility, which could trigger major price fluctuations in the near term.

A close below the $0.30 level could potentially trigger a negative swing in market sentiment, putting DOGE at risk of a major correction phase.

Furthermore, the RSI is firmly in the overbought zone at 92.79, suggesting that the recent rally may have reached a saturation point.

Looking ahead, $0.30 remains a critical support level. But if bears manage to breach that key support buy-wall, DOGE could dip further toward the mid-Bollinger Band around $0.20506.

Conversely, if the bulls regain control, the price could attempt to retest the $0.45 resistance.