Kamala Harris vs Donald Trump: betting odds put Trump ahead

United States citizens are deciding who will rule the destiny of the world’s largest economy today. Either Vice President Kamala Harris or former President Donald Trump will become the 47th President of the United States.

Over the weekend, one of the major betting platforms, PredictIt, showed that Harris became the slight favorite to win the US presidential election, surpassing Trump for the first time since early October. This lead, however, remained short-lived as Trump moved to the top again on the platform, albeit with a small margin.

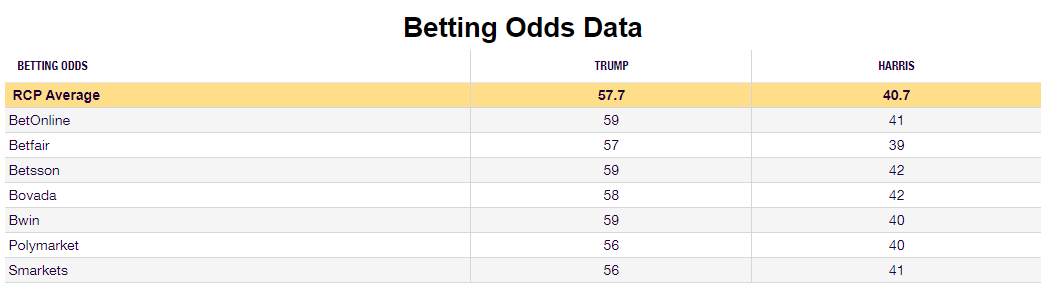

Although US presidential election betting odds should not be taken as a representative view of US voters, they might still trigger a reaction in financial markets. Unlike PredictIt, RealCelarPolling's average for betting odds currently has Trump with at a comfortable lead against Harris, 57.7 vs 40.7.

According to Reuters, betting site PredictIT showed Harris at 54 to Trump on 53, compared to 42 to 61 just a week ago.

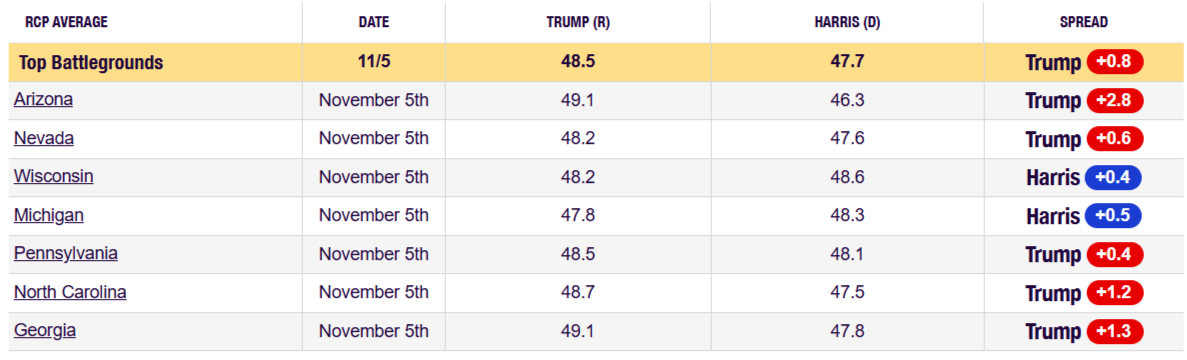

Nevertheless, polls show the race remains tight. Neither Harris nor Trump has a clear lead, with polls showing a modest 1 to 2-point lead favoring one or other candidate. The election will likely be defined by the so-called seven swing states, that is, states without a clear winner at sight, as opposed to most US states, which clearly lean towards either Republicans or Democrats

“Polls will start closing at 19:00 EST or 00:00 GMT, and the excitement on exit polls will likely move markets, although the final result could take a couple of days. The focus will be on the key seven swing states, with Georgia, North Carolina and Pennsylvania among the first to report,” notes Valeria Bednarik, FXStreet.com Chief Analyst.

Follow our live coverage of the market reaction to the US presidential election as counting results start hitting the wires.

Top Battlegrounds: Trump vs. Harris

According to www.realclearpolling.com