US Election 2024: Exit polls awaited as voting begins

American voters have started casting their ballots to decide whether Vice President Kamala Harris or former President Donald Trump will become the 47th President of the United States.

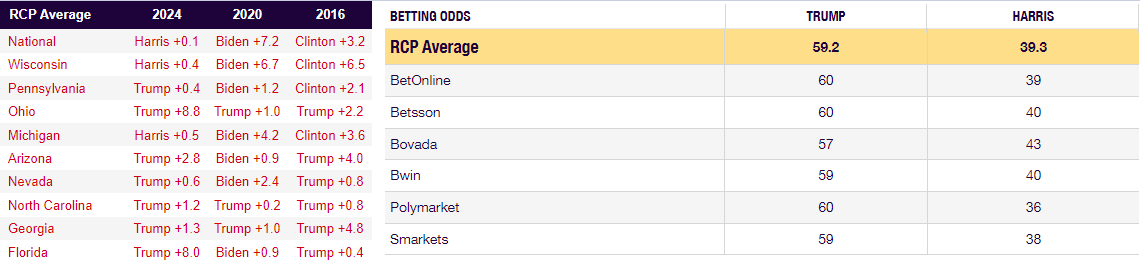

Latest election polls point to a tight race. The TIPP poll has Donald Trump and Kamala Harris tied at 48, the Ipsos poll has Harris leading by two points, 50 vs 48, and the Atlas Intel poll has Trump leading by one point, 50 vs 49, as per RealClearPolling.

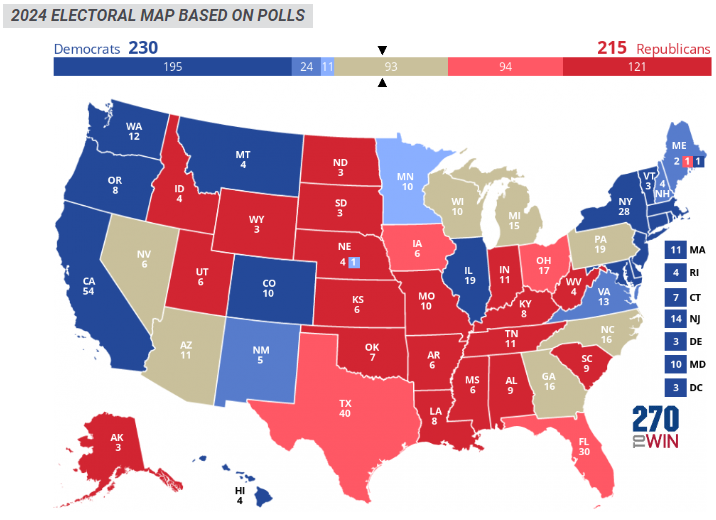

While Trump stays on top in some swing states, such as Arizona and North Carolina, Harris seems to have taken a small lead in Wisconsin and Michigan. Four swing states – Arizona, Nevada, Pennsylvania and Wisconsin – have absentee ballot procedures and that could delay the calling of a winner.

Source: RealClearPollig.com

"Early vote returns in US battleground states may not be a good indicator of whether Democratic candidate Kamala Harris or Republican rival Donald Trump will win, experts say, thanks to vote counting rules and quirks in several key states," explains Reuters.

Polls will close at 00:00 GMT and ensuing exit polls should provide some information on which candidate is likely to capture swing states.

In the meantime, US presidential election betting odds point to a Donald Trump victory. RealClearPolling's average for betting odds currently has Trump at 59.2 and Harris at 39.3.

Follow our live coverage of the market reaction to the US presidential election as counting results start hitting the wires.