Bitcoin Weekly Forecast: BTC looks set to head back to $100K after logging fourth straight week of gains

- Bitcoin price hovers around $97,000 on Friday following a decisive breakout the previous day as markets cheer easing trade tensions.

- Arizona passes a bill that allows the state treasurer and retirement system to invest up to 10% of available funds in digital assets, specifically Bitcoin.

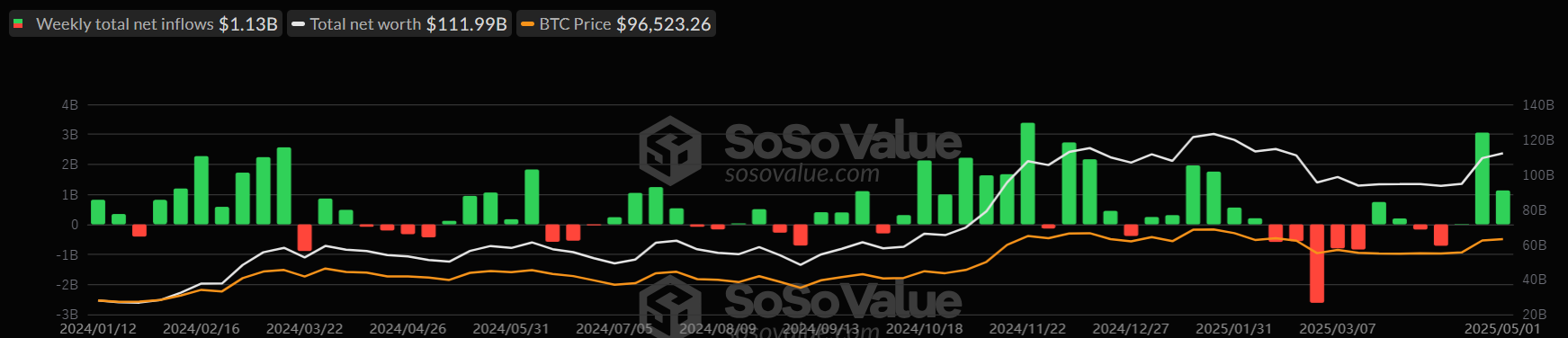

- US Bitcoin spot ETFs recorded a total inflow of $1.13 billion until Thursday, continuing their three-week inflow streak.

- Corporate demand for BTC strengthens as Metaplanet issues $24.7 million interest bonds and Microstrategy raises another $21 billion to buy BTC.

Bitcoin (BTC) price is hovering around $97,000 at the time of writing on Friday, following a decisive breakout above its key resistance level the previous day, and looks set to post a fourth consecutive week of gains.

Bitcoin price remained strong this week as markets remained on edge about any possible breakthrough in trade talks between the US administration and the country’s main trading partners, particularly China. News on Friday that China is evaluating the possibility of trade talks with the US supported risky markets such as crypto.

In other news, the US state of Arizona passed a bill that allows the state treasurer and retirement system to invest up to 10% of available funds in digital assets, specifically BTC. Following this news, the institutional demand for Bitcoin strengthened, as US spot Exchange Traded Funds (ETFs) recorded an inflow of $1.13 billion until Thursday, continuing its three-week inflow streak since mid-April.

Corporate demand for BTC also strengthens as the week proceeds. Metaplanet issues $24.7 million interest bonds, and Microstrategy raises another $21 billion to buy more BTC.

Arizona could be the first state to hold BTC as reserve

Bitcoin started this week on a positive note. According to the Bloomberg Government report, Arizona’s Bitcoin Reserve Bill SB1025 was passed on Monday, which allows the state treasurer and retirement system to invest up to 10% of available funds in digital assets, specifically Bitcoin.

The bill is now sent to Democratic Governor Katie Hobbs’s desk, and if signed, the state would be the first to require public funds to invest in Bitcoin. Arizona will become the first US state to hold Bitcoin as a reserve asset, which could set a precedent for other states, such as New Hampshire and Texas, also listed in the State Reserve Race.

Public companies’ demand for Bitcoin remains strong

Pubic companies' demand for the largest cryptocurrency by market capitalization strengthened this week. MicroStrategy’s Q1 earnings presentation on Thursday reported a loss of $4.2 billion, as the BTC declined from its all-time high of $109,588 in January and closed around $82,550 in March.

Despite the loss in Q1, the firm shows no signs of slowing its pace of Bitcoin acquisitions. Having used up its $21 billion at-the-market (ATM) shelf offering, as explained in the previous report, the company, alongside earnings, announced a fresh $21 billion at-the-market offering.

The injection of this fresh capital could boost BTC’s price and trigger new firms to set their reserves in BTC.

Following the announcement, Japanese company Metaplanet issued $24.7 million in 0% interest bonds on Friday to buy more Bitcoin. It followed a strategy to diversify its treasury with cryptocurrency amid Japan’s economic challenges, like a weakening Japanese Yen (JPY). The firm holds a total of 5,000 BTC in its reserve.

Looking at Bitcoin’s institutional demand, it supported its rally this week. According to SoSoValue data, the US spot Bitcoin ETF has recorded a total inflow of $1.13 billion as of Thursday, continuing its three-week inflow streak since mid-April. If these inflows continue and intensify, Bitcoin prices could rally further.

Total Bitcoin Spot ETFs weekly chart. Source: SoSoValue

Bitcoin rallies despite weak economic conditions

Bitcoin price remains strong despite the weak economic conditions in the US. The Kobessi Letter report explains that the unexpected GDP contraction (the first since early 2022) came alongside inflation data exceeding forecasts, as shown by the PCE Price Index, also at 3.7% versus the expected 3.1%. Other data seem to point to a deteriorating economic outlook, such as Oil prices dropping below $60 and US consumer confidence falling sharply to 86, the lowest level since May 2020.

Such a slowdown in economic conditions indicates stronger chances of entering a stage of stagflation – when the economy is characterized by stagnant growth and high inflation.

Traders should be cautious as stagflation fears will likely drive a risk-off sentiment in the market, which does not bode well for risky assets such as Bitcoin. Moreover, high inflation reduces retail investor participation, and the US Federal Reserve’s (Fed) reluctance to cut rates immediately adds to the headwinds.

What is there for Bitcoin in May?

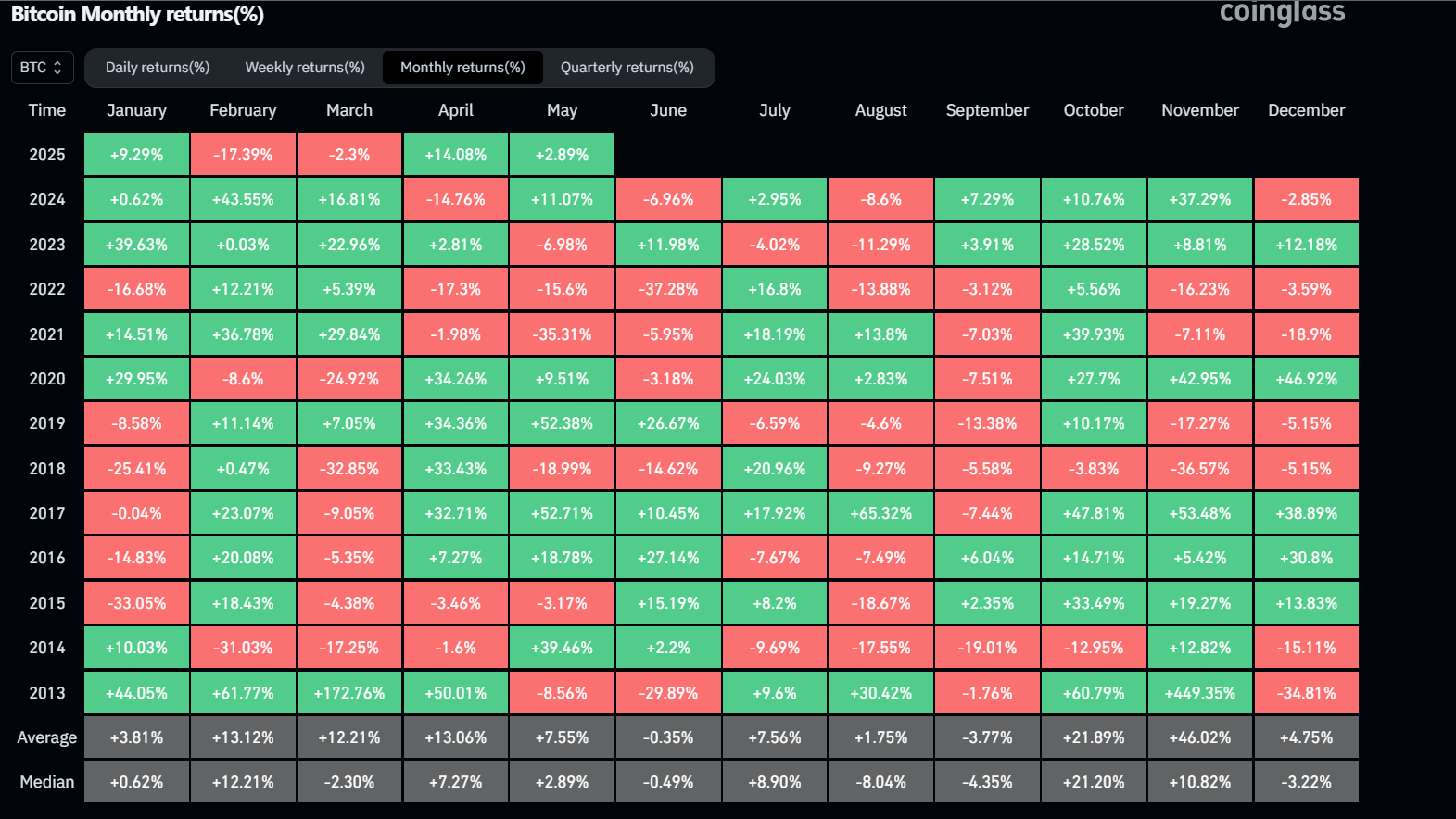

Bitcoin's monthly returns for April came higher than its average returns, ending with an increase of over 14% in the month. According to Bitcoin’s historical data, BTC generally has a positive yield in May, averaging 7.5%.

Bitcoin monthly returns chart. Source: Coinglass

Will BTC reach the $100,000 mark?

Bitcoin price broke above its key resistance level of $95,000 on Thursday after consolidating around it for the past five days and reaching a high of $97,400. At the time of writing on Friday, it trades at around $97,000.

If BTC continues its upward momentum and closes above its daily resistance at $97,700, it could extend the gains to retest its psychological resistance at $100,000.

The Relative Strength Index (RSI) on the daily chart reads 70, hovering around overbought levels. Traders should be cautious as the chances of a pullback are high once the RSI reaches such an area. Another possibility is that the RSI will remain above the overbought levels and continue its price rally.

BTC/USDT daily chart

However, if BTC fails to close above $97,700, it could face a correction toward its next daily support at $95,000.