Chainlink looks at $14 resistance as outflows from exchanges signal continued demand

- Chainlink exchange outflows exceed $120 million in the last 30 days, hinting at increasing accumulation.

- The breakout from a falling wedge technical pattern and an uptrending RSI indicator signal stronger bullish momentum.

- LINK price struggles to sustain the uptrend amid stubborn resistance at the 50-day EMA.

Chainlink (LINK) price increases almost 3% on Tuesday to exchange hands at $13.47 at the time of writing. The oracle token, which has recovered 31% from $10.13 – the lowest year-to-date price seen on April 7 –, looks set to uphold its recent uptrend amid rising exchange outflows and a favourable technical setup. Still, the path beyond the $14 level looks more complicated due to the presence of strong resistance clusters.

Chainlink price uptrend buoyed by consistent exchange outflows

According to IntoTheBlock, Chainlink net exchange outflows have surpassed $120 million in the last 30 days. Net exchange outflows are the total amount of tokens withdrawn from exchanges minus the total amount deposited over a specified period.

Chainlink net flows | Source: IntoTheBlock

A spike in net exchange outflows could be interpreted as bullish. It suggests that investors are moving funds from ‘hot exchange wallets’ to hold them long-term in self-custody wallets, reducing the available exchange balance and potentially propelling Chainlink’s price higher as sell-side pressure dwindles.

Net exchange outflows may also reflect accumulation trends, especially among large investors known as whales. Generally, token accumulation indicates growing optimism about future price increases.

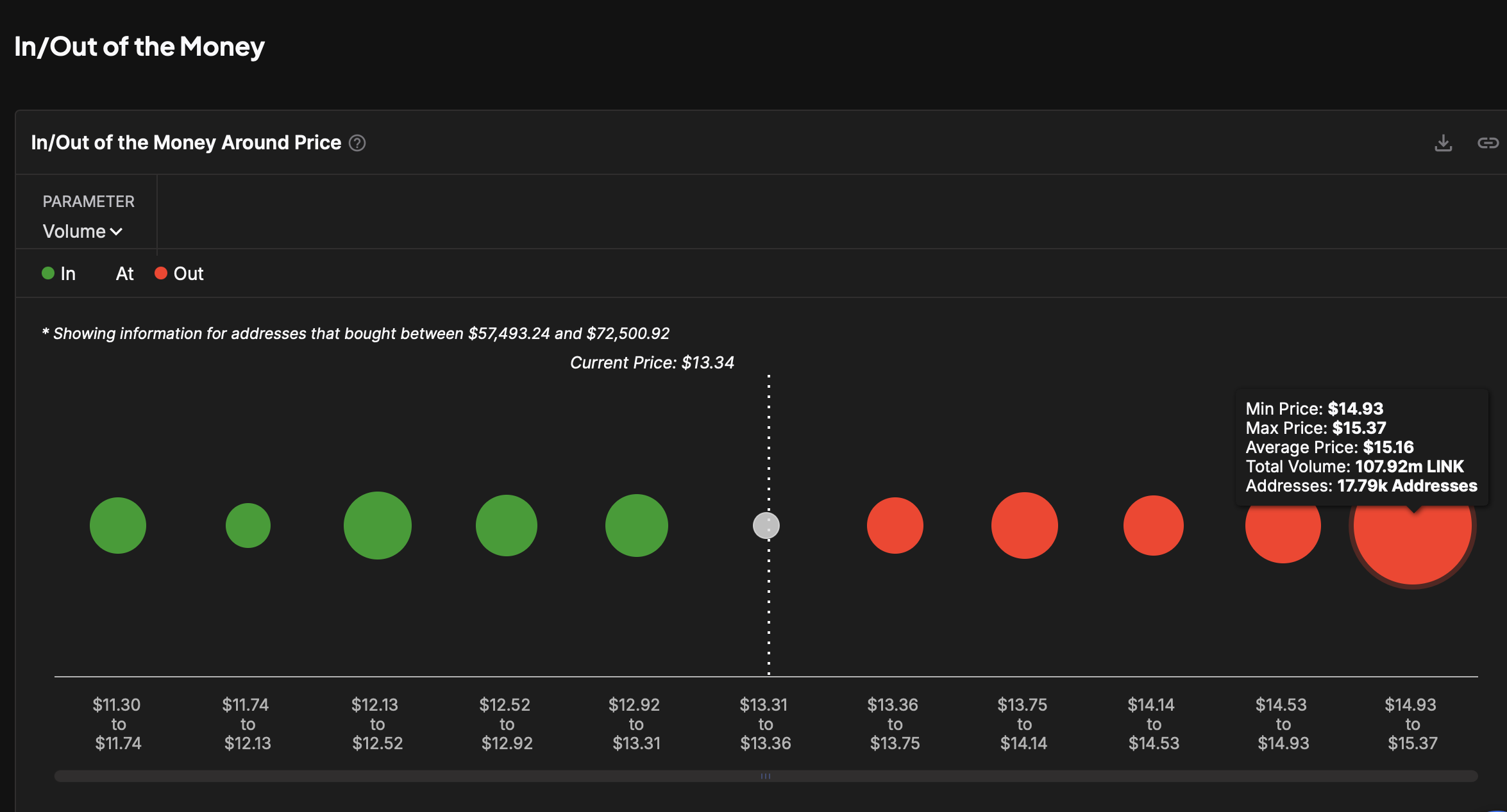

However, other on-chain metrics suggest that the upward path for LINK could encounter some bumps. The In/Out of the Money (IOMAP) (highlighted in the chart below) shows that Chainlink sits above smaller support areas than larger resistance clusters.

As Chainlink’s price moves higher, investors who previously purchased approximately 108,000 LINK between $14.93 and $15.37 could sell at breakeven, dampening sentiment and preventing further price increases. Looking down, due to weaker support clusters, declines could erase the gains accrued in the last two weeks after the tariff-triggered crash.

Chainlink’s IOMAP metric | Source: IntoTheBlock

LINK price runs into crucial resistance clusters

Chainlink’s technical setup shows some signs that it could extend the uptrend to $15.28. This is because LINK price broke out from a falling wedge pattern on Friday, a bullish sign, targeting a 25% increase to $15.28. This target is arrived at by measuring the distance between the pattern’s widest points, as shown in the daily chart extrapolated above the breakout point.

The Relative Strength Index (RSI) at 52.66 and trending upward indicates Chainlink remains in a neutral zone, yet bullish momentum could be building up. If traders maintain interest in LINK and delay profit-taking, this momentum could drive the token toward the wedge pattern’s target of $15.28, potentially even extending gains to the $20.00 resistance level last tested in February.

LINK/USDT daily chart

Beyond the resistance levels shown by the IOMAP, Chainlink price holds below the 50, 100, and 200-day Exponential Moving Averages (EMA) indicators, hinting at possible challenges to the uptrend. Therefore, it is essential to prepare for different outcomes, including profit-taking at the 50-day EMA ($13.97), the 100-day EMA ($15.54), and the 200 EMA ($16.20).

If the immediate resistance at $13.97 is rejected, traders may look toward the previously tested $12.20 area for support before extending the fall to the April 7 low of $10.13.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.