Ethereum Price Forecast: ETH tackles $1,688 resistance as Vitalik Buterin proposes swapping the EVM for RISC-V

- Ethereum co-founder Vitalik Buterin suggested replacing the EVM with RISC-V to provide potential efficiency gains of 100%.

- Adam Cochran argued that swapping the EVM for RISC-V could affect Ethereum's L2-centric roadmap.

- ETH could tackle the upper boundary of a key descending channel if it smashes the $1,688 resistance.

Ethereum (ETH) is down 1% on Monday following a proposal by co-founder Vitalik Buterin to replace its current Ethereum Virtual Machine (EVM) smart contract language environment with a more "efficient" RISC-V.

Vitalik Buterin proposes changing the EVM to RISC-V

In a Sunday post on the Ethereum Magicians forum, Vitalik Buterin proposed an ambitious change to Ethereum's execution layer (EL) that could provide efficiency gains of 100%. He suggested replacing the current EVM smart contract language environment with the open-source RISC-V (Reduced Instruction Set Computing version 5) architecture.

"It [RISC-V] aims to greatly improve the efficiency of the Ethereum execution layer, resolving one of the primary scaling bottlenecks, and can also greatly improve the execution layer's simplicity - in fact, it is perhaps the only way to do so," wrote Buterin.

He highlighted several ways to implement such changes without affecting the developer experience, including enabling support for both the EVM and RISC-V, "using an EVM interpreter contract written in RISC-V that runs their existing EVM code" or "enshrine the concept of a 'virtual machine interpreter' and require its logic to be written in RISC-V."

While several developers are debating the proposal's viability, Adam Cochran, partner at Cinneamhain Venture, argued that swapping EVM for RISC-V could affect Ethereum's L2-centric roadmap.

"This would be great for L1 execution, but that lowers the value add of L2s, competing against ourselves, and doesn't add much value to that roadmap in exchange for a huge technical lift," noted Cochran.

Meanwhile, Tomasz Stańczak, co-executive director at the Ethereum Foundation (EF), shared that the organization's recent leadership restructuring has freed up time for Buterin to carry out research and exploration that "accelerates major long‑term breakthroughs" for Ethereum. However, he cautioned that Buterin's proposals are mainly aimed at sparking conversations and pushing progress in key research areas.

"Community review may refine them significantly or even reject them," wrote Stańczak. "Ethereum researchers often ask that readers recognize the exploratory nature of their posts and proposals," he added.

Stańczak stated that the EF would focus on L1 and L2 scaling and UX improvement in the upcoming Pectra, Fusaka and Glamsterdam upgrades.

Ethereum core developers scheduled the Pectra upgrade for May 7, aiming to introduce several features to mainnet, including wallet recovery, transaction batching, blobspace expansion and improving the maximum validator staking limit to 2,048 ETH.

The upcoming changes and proposals come at a time when L2s and Solana are taking volume from the Ethereum L1, causing a plunge in its revenue over the past year.

Ethereum Price Forecast: ETH tests $1,688 resistance after rising above key descending trendline

Ethereum saw $53.44 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of long and short liquidations is $27.33 million and $26.11 million, respectively.

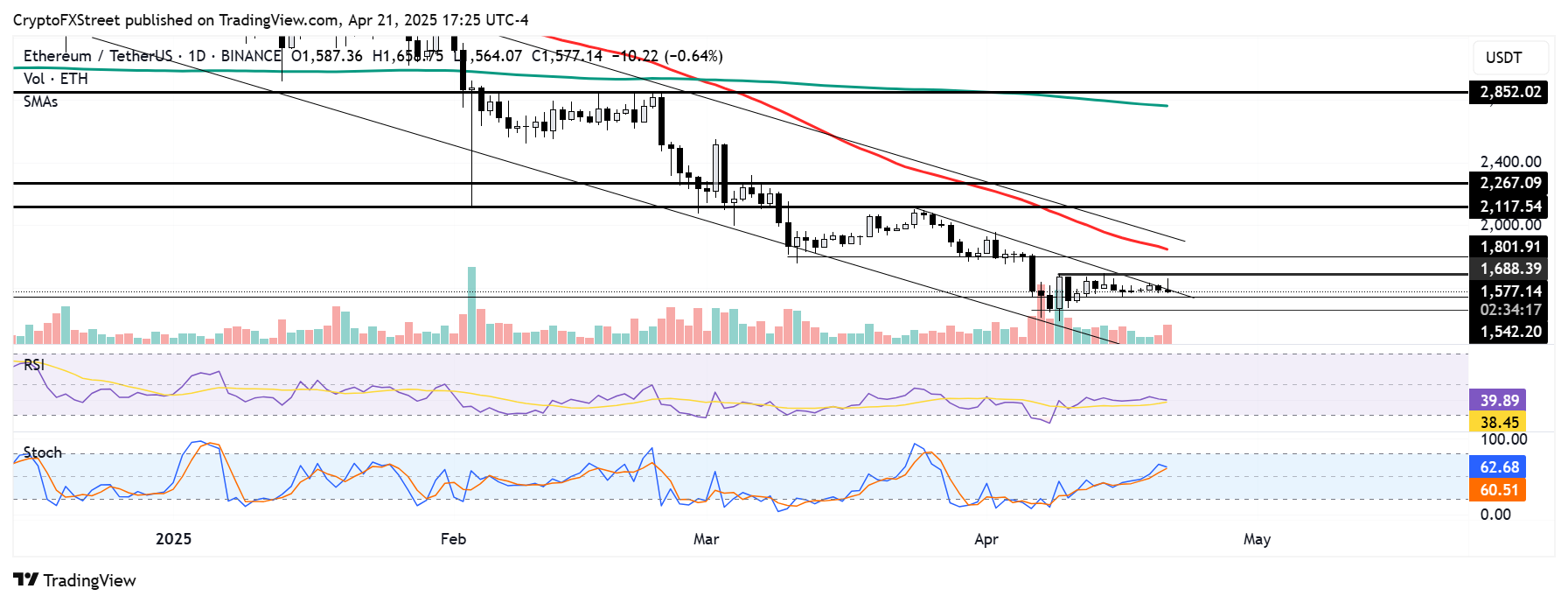

ETH broke above a descending trendline extending from March 24 after a week-long consolidation around $1,600. However, the top altcoin faced resistance at $1,688 — a level that bears have mounted selling pressure on since April 9.

ETH/USDT daily chart

If ETH holds the descending trendline as a support level and smashes the $1,688 resistance, it could tackle the upper boundary of a key descending channel extending from December 16. The channel's upper boundary is strengthened by the 50-day Simple Moving Average (SMA).

On the downside, a sustained move below the descending trendline could see ETH finding support near $1,450. A breakdown below $1,450 may send ETH plunging 30% toward the lower boundary of the descending channel at $1,150.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are trending downwards after initial upward movement, indicating a gradual increase in bearish momentum.