US President Joe Biden stands down from reelection, endorses Kamala Harris

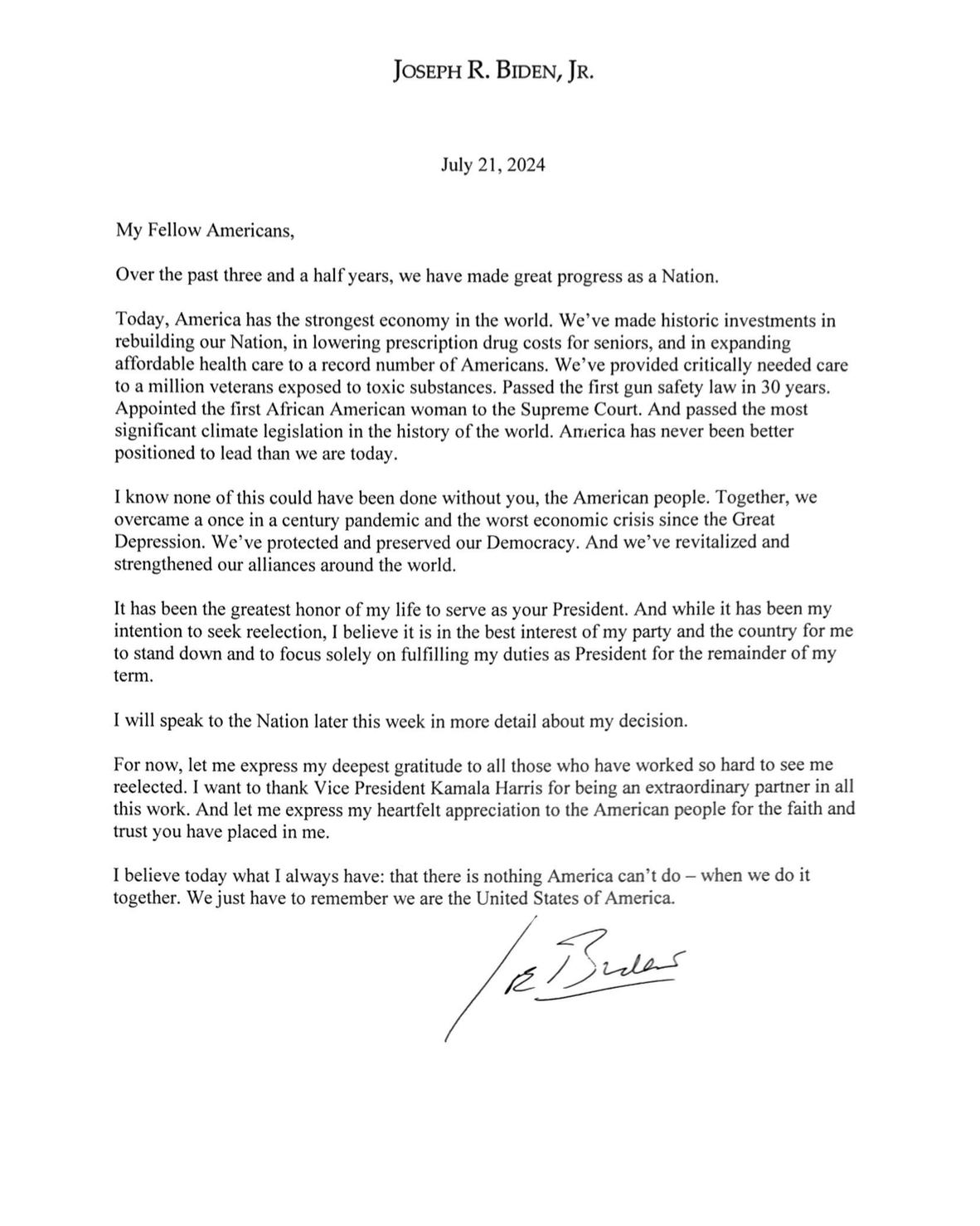

Following a long week of political turmoil, United States (US) President Joe Biden announced on Sunday that he will end his reelection bid and will speak to the nation later this week in more detail about his decision.

Throughout the last couple of weeks, different members of the Democratic party, including senior lawmakers, have called on President Joe Biden to step aside as the party’s nominee. Additionally, former US President Barack Obama said that Biden’s path to victory had greatly diminished and that he should rethink whether he can win, while former House Speaker Nancy Pelosi has told Biden that she is pessimistic about his chances.

President Biden posted a letter in his official X account that stated: “ I believe it is in the best interest of my party and the country for me to stand down and to focus solely on fulfilling my duties as President for the remainder of my term.”

After the letter, Biden posted: “My fellow Democrats, I have decided not to accept the nomination and to focus all my energies on my duties as President for the remainder of my term. My very first decision as the party nominee in 2020 was to pick Kamala Harris as my Vice President. And it’s been the best decision I’ve made. Today I want to offer my full support and endorsement for Kamala to be the nominee of our party this year. Democrats — it’s time to come together and beat Trump. Let’s do this.”

The odds of Donald Trump’s victory seem to have increased with turmoil in the rival party. Financial markets may welcome the news and seek high-yielding assets at the beginning of the week.