LetsBONK Commits to 1% Revenue Buyback Plan for BONK Tokens

LetsBONK has drawn strong attention from the community after announcing its commitment to use 1% of total revenue to buy back top tokens in the BONK ecosystem.

Is this a strategic move to redefine the role of meme coins within the Solana ecosystem, or merely a PR-driven statement?

Self-reinvestment strategy: Is LetsBonk on the right track?

The meme coin market in general is known for its short-term speculative waves. Meme coin launchpads like LetsBonk and Pump.fun have been fueling this speculative trend.

However, in a recent statement, LetsBonk appears to be making efforts to build a deeper and more sustainable ecosystem.

LetsBonk has drawn strong attention from the community after announcing its commitment to use 1% of total revenue to buy back top tokens in the BONK ecosystem. By allocating 1% of its revenue to support key tokens in the BONK ecosystem, LetsBONK is positioning itself as a reinvestment hub that sustains liquidity across the system.

“This will happen once a week and any pair that reaches the high levels can be included,” LetsBonk founder Tom stated.

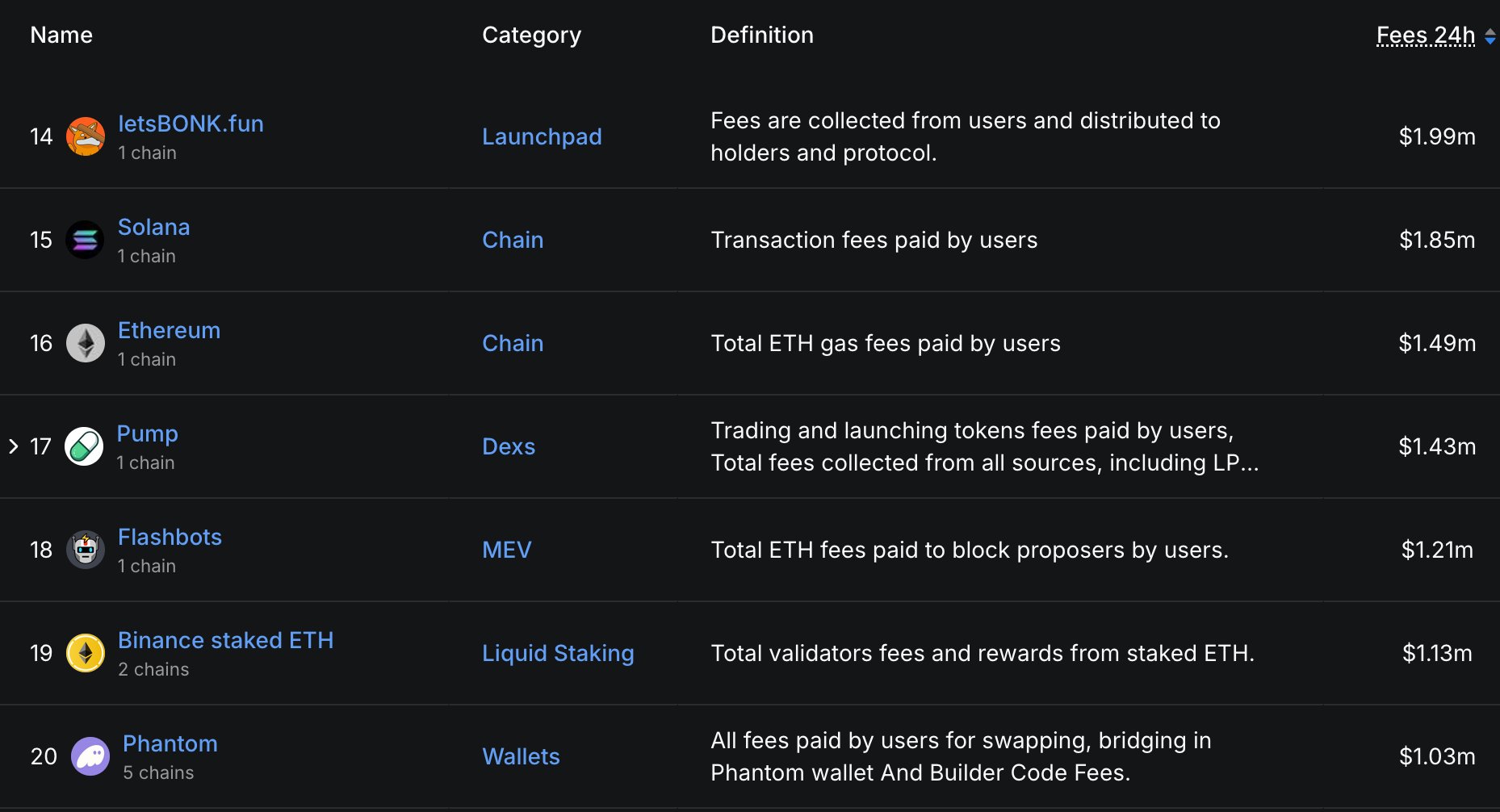

LetsBonk has also recently taken the spotlight from its major competitor, Pump.fun. The latest data shows the platform generated $1.99 million in trading fees within 24 hours.

The significant revenue surge indicates that LetsBonk is becoming one of the true “cash cows” in the meme coin space, delivering clear and sustainable cash flow.

LetsBonk fees. Source: Unipcs

LetsBonk fees. Source: Unipcs

What stands out is that these fees do not originate from traditional DeFi activities but from entertainment-based experiences, where users interact with mini-games, lucky draws, and community events. This shows that building an ecosystem around community, entertainment, and rewards can generate real economic value.

Lessons from SHIB and DOGE

Successful meme coin projects like Dogecoin or Shiba Inu have taught us that community is the backbone, but it’s not sufficient for long-term value.

The BONK ecosystem appears to be adapting and progressing further by adopting a reinvestment model that directs revenue back into key tokens. LetsBonk’s move shows a proactive approach to preserving token value through a buyback mechanism while indirectly yet effectively stimulating market demand.

If this strategy is scaled and maintained with transparency, BONK can move beyond the label of a “pure meme coin” and become a symbol of innovation in the next phase of crypto.

“BONK is the HYPE trade re-run, and Bonk’s journey to $10 billion+ market cap has just started,” X user Unipcs commented.

To transition from speculative hype to long-term value, they must continue to demonstrate transparency, operational efficiency, and above all, sustain the community’s engagement.