Ethereum Price Prediction: Will ETH Rise Again This Year? Future Trends?

TradingKey – Ethereum Surges Past $3,800 on Its 10th Anniversary, Sparking a New Altcoin Season

In July 2025, Ethereum (ETH) marked its 10-year milestone with a powerful rally, breaking past $3,800 and igniting a broad altcoin surge — lifting tokens like XLM, ADA, and XRP.

This bullish momentum has drawn global investor attention, but also raised key questions:

- Can Ethereum’s rally continue?

- What’s driving ETH’s price?

- What does the future hold for Ethereum?

Let’s dive into Ethereum’s historical cycles, technical resistance levels, and institutional forecasts to assess its trajectory.

Ethereum Price History: Three Bull-Bear Cycles

Cycle 1: 2015–2020

- ETH launched in 2015 at ~$0.31 via ICO.

- By 2017, the ICO boom pushed ETH to $1,400, with market cap peaking at $123 billion.

- In 2018, the crypto crash sent ETH down 90% to ~$80.

- From 2019–2020, DeFi began to emerge, stabilizing ETH between $100–$300.

Ethereum price trend chart (2015-2025), source: CoinMarketCap

Cycle 2: 2021–2023

- In 2021, DeFi and NFTs drove ETH to a new high of $4,300 in May.

- A sharp correction followed, but liquidity stimulus in November pushed ETH to $4,800.

- In 2022, Fed rate hikes and the LUNA/UST collapse triggered another bear market, with ETH falling to $900.

- By 2023, ETH recovered above $2,000.

Cycle 3: 2024–Present

- In 2024, ETH broke $4,000 on multiple catalysts:

- SEC approval of spot ETH ETFs

- Trump’s re-election

- U.S. declaring ETH as a crypto reserve asset

- RWA (Real World Asset) tokenization boom

While Bitcoin has already surpassed its previous bull market high, ETH has yet to do so — fueling expectations of a catch-up rally.

What’s Driving Ethereum’s Price?

Ethereum’s price is influenced by:

- Macroeconomic factors (e.g. Fed rate decisions)

- Regulatory developments (e.g. ETF approvals)

- Technical upgrades (e.g. Layer 2 scaling, Cancun upgrade)

ETH’s bull cycles often mirror Bitcoin’s, but its narrative is application-driven:

- 2017: ICO boom

- 2021: DeFi & NFT explosion

- 2024–2025: RWA tokenization

While Ethereum remains dominant, competition from Solana (SOL), Sei (SEI), and Stellar (XLM) is eroding its monopoly.

Technical Analysis: Key Resistance Levels

Since April 2025, ETH has rebounded 170% from $1,400 to $3,800, approaching the critical $4,000 resistance.

- ETH has tested this level three times (March, May, December 2024) but failed to break through.

- The next major resistance is $4,800, ETH’s all-time high from 2021.

- While long-term holders may have exited, profit-taking pressure remains.

Weekly ETH Price Chart – Source: TradingView

Institutional Forecasts: ETH Price Predictions

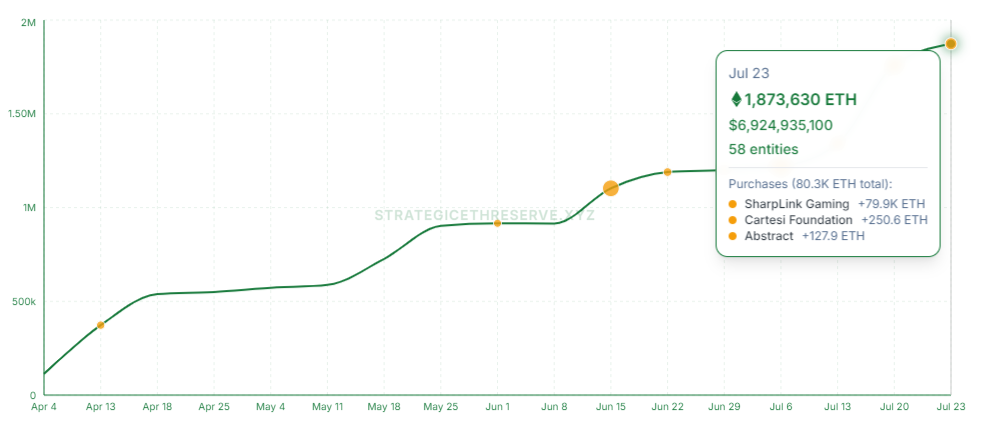

As the U.S. accelerates crypto adoption — including spot ETF approvals, stablecoin legislation, and the establishment of crypto reserves — Ethereum (ETH) is emerging as a top institutional target. According to Strategic Eth Reserve, 58 entities now hold a combined 1.87 million ETH, valued at approximately $7 billion.

Strategic ETH Reserve Holdings – Source: Strategic Eth Reserve

With favorable policy and liquidity conditions, Wall Street analysts are increasingly bullish:

- Bank of America projects ETH could reach $5,000–$6,000 this year.

- Goldman Sachs sees ETH climbing to $8,000, citing its rising role in institutional portfolios.

- Arthur Hayes (BitMEX co-founder) predicts ETH will hit $10,000 by year-end, driven by Trump’s wartime economic policies and stablecoin monetization as a new government financing model.

Major financial institutions expect Ethereum to play a central role in future financial infrastructure:

- Standard Chartered forecasts ETH at $8,000–$12,000 by 2030, positioning it as a mainstream settlement layer.

- Bernstein estimates ETH could reach $15,000+, citing DeFi’s disruption of traditional finance and Ethereum’s value capture.

- ARK Invest (Cathie Wood) offers the most aggressive target: $20,000–$30,000, envisioning Ethereum as a “decentralized global computer.”

Conclusion

Ethereum's impressive 2025 rally has been largely fueled by inflows from spot ETFs and a surge in institutional holdings, signaling growing confidence in its role as a core asset in the crypto market. However, to officially confirm the start of a new bull cycle, ETH must break above the critical $4,000 resistance level in the near term.

If it successfully holds above that threshold, Arthur Hayes’ $10,000 target could become a realistic milestone — driven by accelerating adoption, favorable policy, and expanding use cases across DeFi, NFTs, and tokenized assets.