Bitcoin, Ethereum To Back Loans? JPMorgan Explores Bold New Option

JPMorgan is reportedly considering loans backed directly by clients’ Bitcoin and Ethereum holdings, a move that would pull TradFi further into crypto.

JPMorgan Could Launch Crypto-Backed Loans As Soon As Next Year

According to a Financial Times report, JPMorgan Chase is exploring plans to offer its clients the option to use their cryptocurrency holdings as collateral for loans. JPMorgan Chase is the largest bank in the US and ranks amongst the biggest in the world. It manages over $4 trillion in assets and serves customers in more than 100 markets around the globe.

The Financial Stability Board (FSB) considers the bank to be a Global Systematically Important Bank (G-SIB), which means that it’s so relevant to economic stability on Earth that its collapse could potentially mean widespread financial distress.

Led by CEO Jamie Dimon, who has openly expressed his dislike for Bitcoin, the bank has historically been cautious around digital assets, but its stance has been shifting.

JPMorgan Chase plans to allow clients to take loans against holdings in cryptocurrency exchange-traded funds (ETFs), according to reports from last month. Just last week, Dimon announced that the bank is set to explore stablecoins.

Now, this idea of offering direct cryptocurrency collateral could take the bank a step further into digital assets. As per FT, JPMorgan could begin Bitcoin and Ethereum-backed loans next year. That said, the report cautions that the plans are subject to change.

The bank’s earlier rigid stance may have cost it business, as revealed by one source cited by the newspaper.

According to one person familiar with the matter, Dimon’s early comments about bitcoin — in which he also said he would fire any trader who traded it — had alienated some prospective clients who either had made their money through crypto assets or were long-term believers in their potential.

Earlier this month, another G-SIB, Standard Chartered, made headlines of its own in the digital asset space. The bank announced the launch of a spot trading desk for Bitcoin and Ethereum, becoming the first bank of its scale to offer the service.

Because of their importance, G-SIBs face heightened regulatory scrutiny. So for these institutions to be willing to dip into cryptocurrencies shows how far the sector has come in gaining acceptance within traditional finance circles.

Bitcoin Has Taken To Sideways Movement Recently

While cryptocurrency institutional adoption has been making strides, Bitcoin itself has gone cold recently as its price has hit a phase of consolidation. The asset is currently trading around $119,000, which is more or less unchanged from last week.

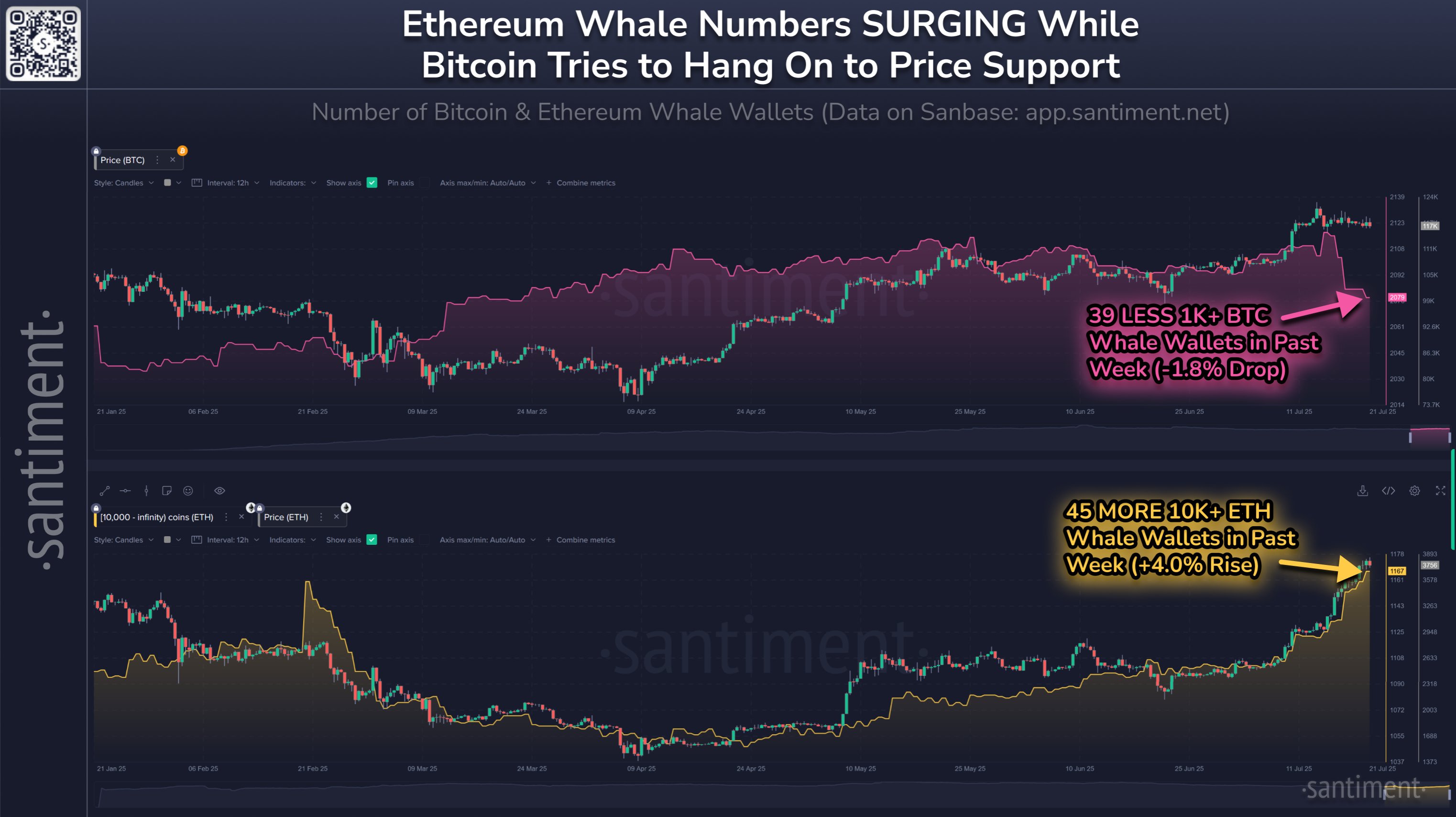

The same isn’t true for the wider market, however, as the altcoins have been flying. Ethereum, in particular, has taken the spotlight with its 25% surge. Data from on-chain analytics firm Santiment shows this rally has come as whale-sized entities have been rising on the network, while Bitcoin has been witnessing an exodus.