Litecoin Price Hits 4-Month High, But Whale Selling Could Bring Risks

Litecoin is making headlines again with a 14% price jump, trading at $116 after days of consistent upward momentum. This recent surge aligns with the broader crypto market’s rally and growing signs of an incoming altcoin season.

However, despite the optimism, significant whale activity threatens to undermine this bullish trend. Large holders are securing profits, and this move may challenge Litecoin’s ability to sustain its gains.

Litecoin Support Could Be Fading

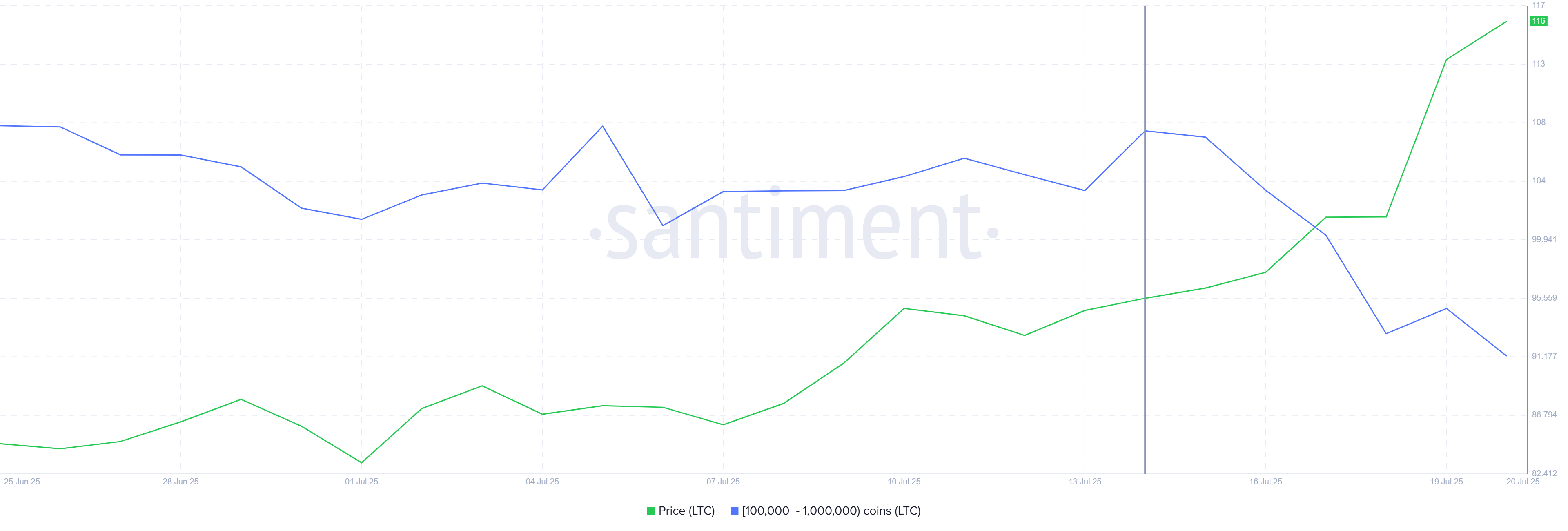

In the past five days, whale wallets holding between 100,000 and 1 million LTC offloaded more than 500,000 coins. This massive selloff is equivalent to roughly $58 million and suggests a cautious sentiment among major investors. Their actions imply they may doubt the longevity of the current rally.

The sudden spike in selling pressure signals potential instability ahead. These large-volume trades often influence market direction due to their impact on liquidity.

If selling continues at this rate, retail sentiment could turn bearish, compounding the pressure on Litecoin’s short-term performance.

Litecoin Whale Holding. Source: Santiment

Litecoin Whale Holding. Source: Santiment

Despite the whale selloff, on-chain data from the Mean Coin Age (MCA) indicator suggests a different story. Long-term holders (LTHs) are showing resilience, opting not to follow suit in selling their holdings. These wallets, known for their conviction, continue to hold, which is a positive sign for price stability.

LTHs typically dictate mid- to long-term trends, and their minimal participation in the recent selloff indicates confidence in Litecoin’s outlook. This counterforce could offer the support Litecoin needs to resist further downside pressure and potentially stabilize its price at current levels.

Litecoin Mean Coin Age. Source: Santiment

Litecoin Mean Coin Age. Source: Santiment

LTC Price Needs To Breach Key Resistance

At the time of writing, Litecoin trades at $116, just shy of the $117 resistance level. While the price has climbed 14% in the last 24 hours, the looming whale selloff could create friction.

A strong bullish push is needed to overcome the overhead barrier and maintain upward momentum.

If bearish sentiment driven by whale activity intensifies, Litecoin could retrace its steps to $105. This level serves as the next significant support and may become the base for sideways consolidation if selling persists.

Litecoin Price Analysis. Source: TradingView

Litecoin Price Analysis. Source: TradingView

Alternatively, continued support from retail buyers and LTHs could help Litecoin break past $117. Breaching this resistance would signal strength and open the door for a move toward $124, marking a new four-month high and validating the bullish trend.