Pi Network Price Forecast: Social chatter grows surrounding Pi as bulls struggle below $0.50

- Pi Network edges lower on Friday as it struggles to reclaim the $0.50 psychological mark.

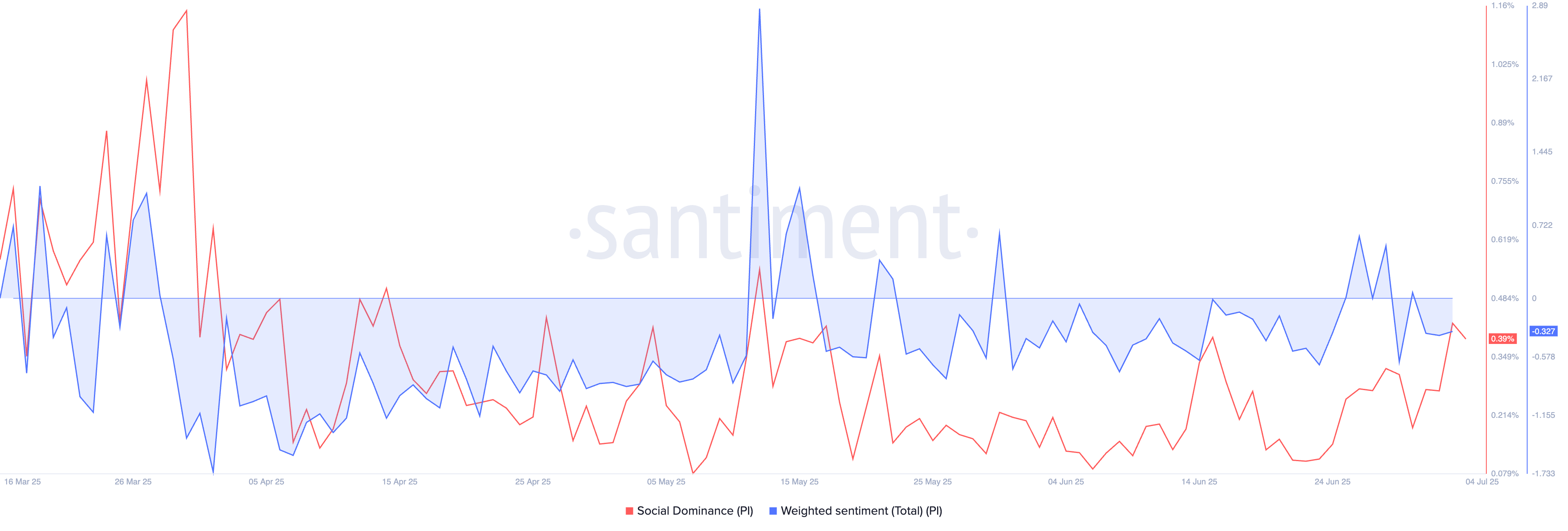

- A surge in social dominance reflects increased chatter surrounding the Pi network.

- Investors are on a buying spree as CEX balances decline while PI Foundation offloads 5.81 million PI tokens.

Pi Network (PI) ticks lower by nearly 2% at press time on Friday following a Doji candle formed the previous day. As Pi Network bids in a sideways range under $0.50, social chatter grows concurrently with increased interest from investors. However, a net outflow from Pi Foundation wallets suggests that confidence is declining.

Pi Foundation outflow outpaces investors’ interest

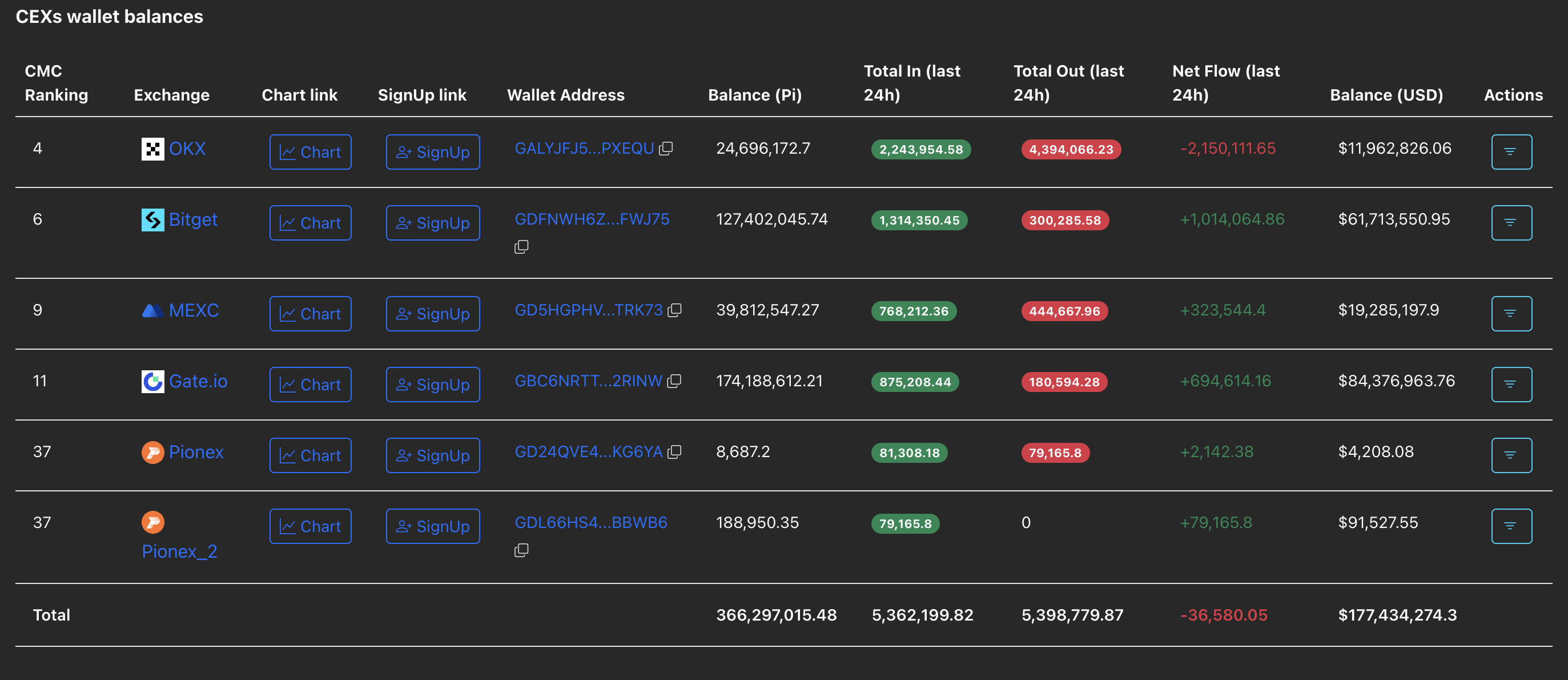

PiScan data shows a sharp net outflow of 2.15 million PI tokens from the OKX exchange in the last 24 hours. The OKX net outflow outpaces the net inflows from all other exchanges, resulting in a total net outflow from Centralized Exchanges (CEX) of 36,580 PI tokens.

CEXs wallet balances. Source: PiScan

Typically, a drop in CEX wallet balances indicates increased demand from investors as the broader market recovers.

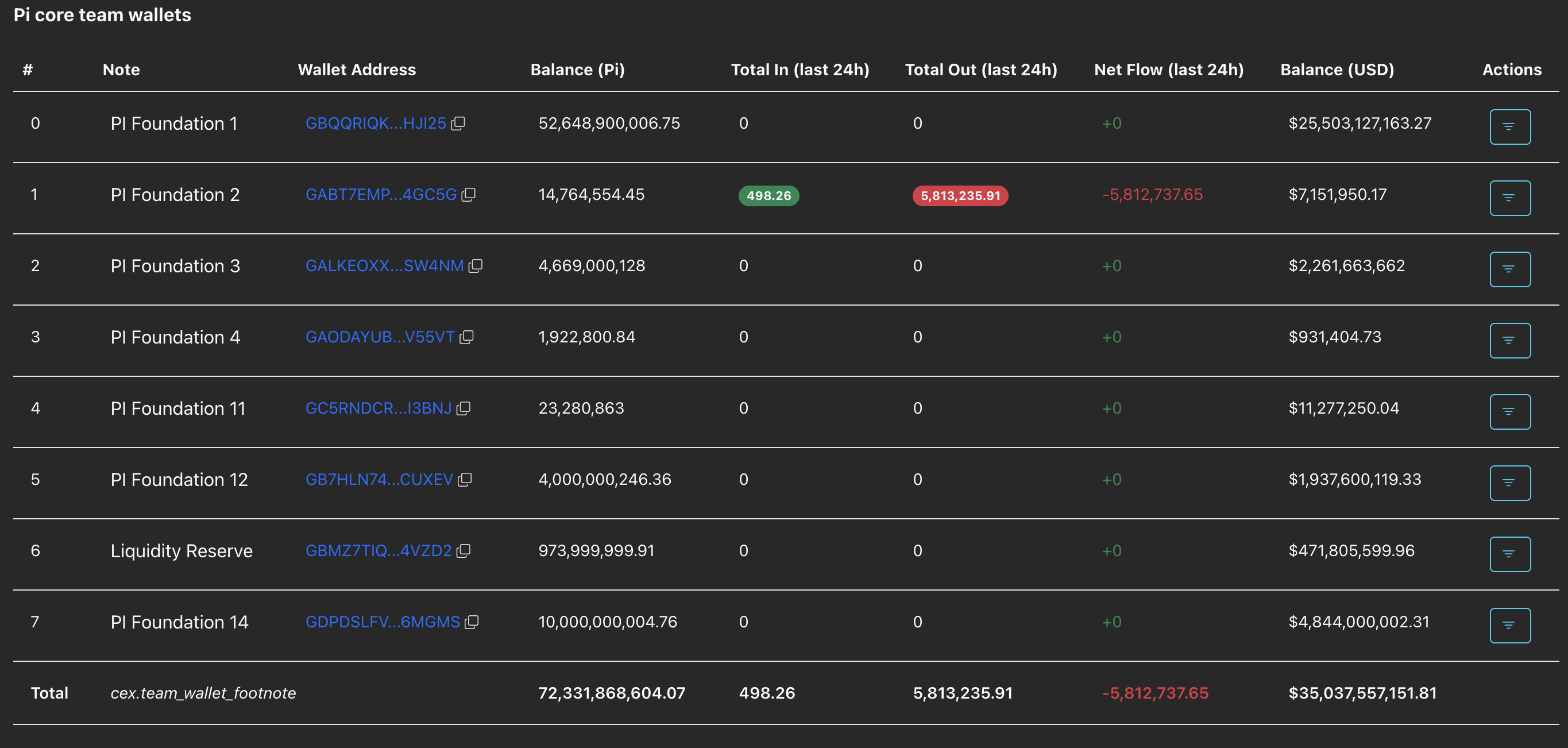

However, the Pi Foundation 2 wallet records a net flow of -5.81 million Pi Tokens, outpacing the total net outflow from CEX wallet balances. Investors must remain cautious to avoid becoming exit liquidity to the outflows of the Pi Foundation team.

Pi core team wallets. Source: PiScan

Pi Network social dominance is on an uphill

The social dominance score measures the frequency of mentions of an asset in social conversations. Santiment’s data shows Pi Network’s social dominance at 0.39% so far this Friday, up from 0.18% on Monday. Amid the increasing social chatter this week, the total weighted sentiment at -0.327 reflects a bearish tilt.

Social dominance score. Source: Santiment

Pi Network risks a crucial support level fallout

Pi Network edges lower around 2% at press time on Friday, trading between the $0.5000 psychological mark and the low of June 22 at $0.4711. A potential daily close below the latter could extend its downfall towards $0.4000, last tested on June 13.

The technical indicators suggest a bearish influence on trend momentum as the Moving Average Convergence/Divergence (MACD) indicator triggers a sell signal (MACD line crossing below its signal line) on the daily chart.

The Relative Strength Index (RSI) at 36 hovers close to the oversold boundary zone, indicating bearish momentum still persists.

To reinforce an uptrend, Pi Network must close above the $0.5031 level, aligning with the June 22 close. If so, the uptrend could target the $0.6600 level last tested on June 25.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.