Hashflow (HFT) Leads DEX Tokens With Over 100% Surge — What’s Fueling the Rally?

Hashflow (HFT), a decentralized exchange (DEX) that uses a Request for Quote (RFQ) mechanism, has just posted a sharp spike in trading volume and impressive price performance at the start of July.

While the broader altcoin market still struggles to recover, what helped HFT move against the trend?

Hashflow (HFT) Leads DEX Tokens With a Gain of Over 100%

According to data from BeInCrypto, HFT’s price soared more than 100% in just the past two days. Currently, HFT is trading around $0.135 — its highest price since February 2025.

On June 30, HFT recorded a daily increase of over 80%. That day marked its strongest single-day performance since the peak back in 2023.

Hashflow (HFT) Price Performance. Source: BeInCrypto

Hashflow (HFT) Price Performance. Source: BeInCrypto

Additionally, CoinMarketCap data shows HFT’s 24-hour spot trading volume has surpassed half a billion USD. This is the highest daily volume of the year and is 25 times higher than its recent daily average.

This price surge has made HFT the best performer among DEX tokens, making the DEX sector the best-performing crypto segment over the past week.

Data suggests investors are buying back into HFT heavily after the token lost up to 95% of its value over nearly three years.

What’s Driving HFT’s Price Rally?

In June, Binance announced support for HFT deposits on the Solana network, alongside other integrations with platforms like Jupiter and Titan.

“Hashflow is growing fast in the Solana ecosystem. Binance now supports HFT on Solana and so do we. We’ve already integrated with Jupiter, Kamino, and Titan. More integrations are coming,” Hashflow stated.

These developments may have sparked positive investor sentiment and fueled HFT’s price rally.

However, this rally could face some challenges. First, the project’s token unlock schedule continues daily and will last until the end of 2028. Currently, only 36.5% of HFT’s total supply is in circulation, while each month, an additional 15.8 million HFT—equal to 1.58% of the total supply—is unlocked.

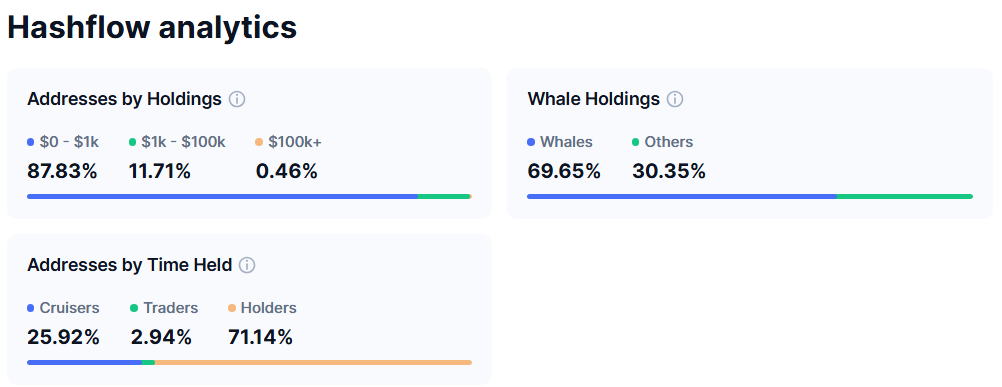

Moreover, CoinMarketCap data shows that nearly 70% of HFT’s supply is held by whales.

HFT Token Distribution Structure. Source: CoinMarketCap

HFT Token Distribution Structure. Source: CoinMarketCap

Although holders who have kept tokens for over a year account for more than 71%, many have endured a price drop of over 90% in nearly three years. These long-term holders might sell if the price recovers.

Although HFT’s price surged, Hashflow’s TVL showed no significant breakout. It remains modest at just $618,000, while its daily DEX trading volume stands around $7.6 million.

Together, these data points highlight that the real challenge for Hashflow lies in sustaining this price momentum, rather than it being just a short-term breakout.