Ripple Price Forecast: XRP uptrend suppressed despite steady open interest, fund inflows

- XRP pulls back after encountering resistance at $2.22, reflecting lethargic sentiment in the broader cryptocurrency market on Monday.

- Inflows into XRP-related investment products amounted to $10.6 million last week, pushing year-to-date flows to $219 million.

- XRP futures Open Interest maintains above the $4 billion mark, representing a 15.5% increase from $3.54 billion recorded on June 23.

Ripple (XRP) bulls face increasing overhead pressure, which continues to cap their recovery below the resistance level at $2.22. The cross-border money transfer token is trading at $2.17, down over 1% on the Monday.

The slight pullback reflects subdued sentiment in the broader cryptocurrency market ahead of United States (US) Federal Reserve Chair Jerome Powell's discussion at the European Central Bank Forum on Central Banking 2025 in Sintra, Portugal, on Tuesday.

XRP shrugs off institutional interest as technical risks persist

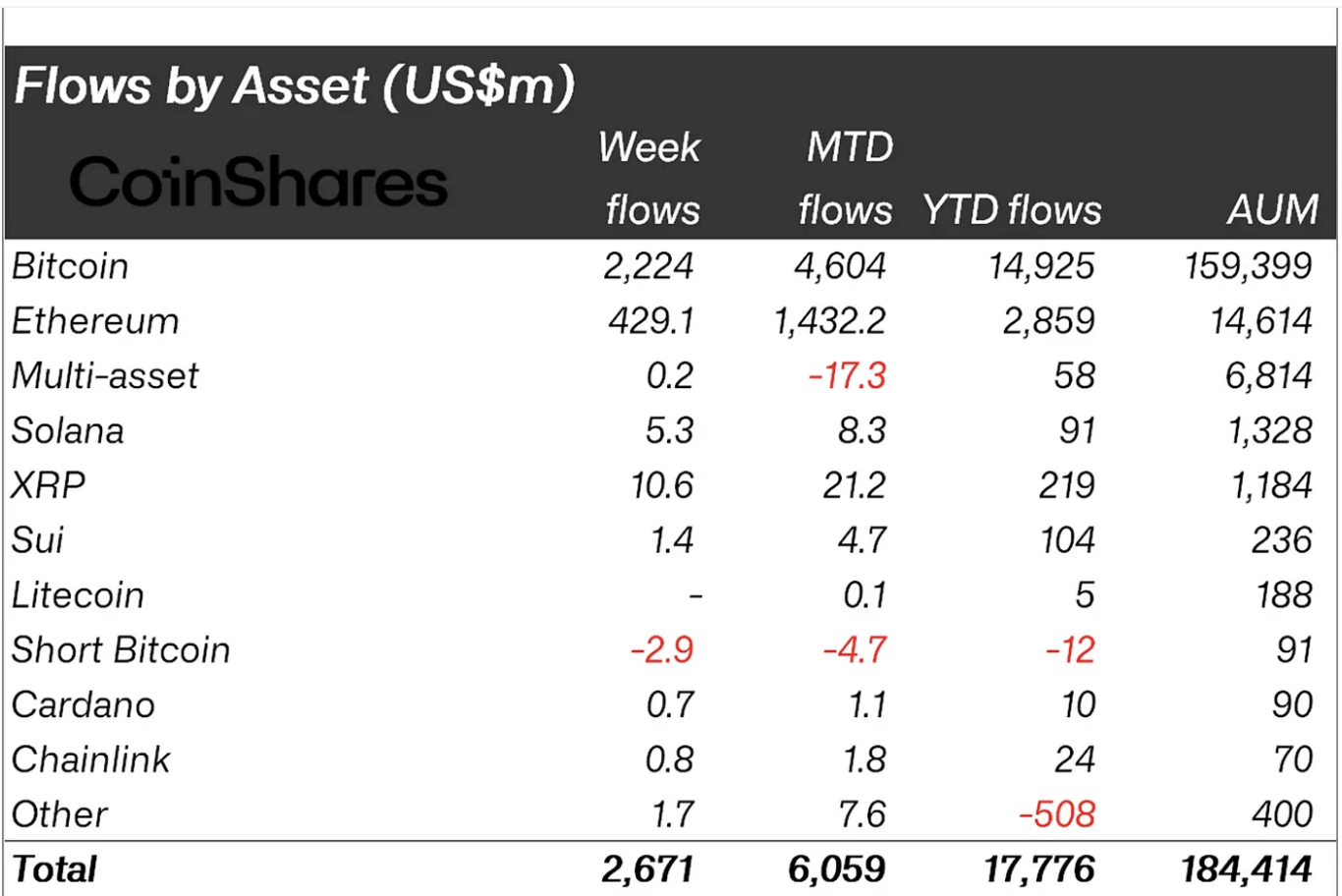

XRP experienced a surge in inflows, reaching $10.6 million last week, according to CoinShares' Digital Asset Funds Flows Weekly Report. The chart below highlights month-to-date flows at $21.2 million, bringing the year-to-date inflow to $219 million and total assets under management (AUM) at $1.18 billion.

"We believe this resilient investor demand has been driven by a combination of factors, primarily heightened geopolitical volatility and uncertainty surrounding the direction of monetary policy," the CoinShares weekly report states.

Digital asset funds flow weekly report | Source: CoinShares

Meanwhile, the microenvironment, especially in the derivatives market, has continued to improve following heightened volatility due to geopolitical uncertainty and the Fed's monetary policy.

The XRP futures Open Interest (OI) holds steady above the $4 billion mark, reflecting growing interest in the token, particularly after staging a recovery from the drop to $3.54 billion on June 23 to $4.19 billion on Monday.

XRP futures Open Interest | CoinGlas

Open Interest refers to the number of futures and options contracts that have not yet been settled or closed. An increase in OI while volume rises in tandem indicates high trader conviction in the digital asset, reflecting a spike in trading activity.

The derivatives market's trading volume currently stands at nearly $3 billion, up 17% over the past 24 hours. Liquidations totaled approximately $3 million, with longs accounting for roughly $1.52 million and shorts at $1.53 billion.

XRP derivatives market data | Source: CoinGlass

Technical outlook: XRP downtrend targets the 200-day EMA support

XRP hovers at around $2.18 after the week's recovery from support at $1.90, snapped under resistance provided by the 100-day Exponential Moving Average (EMA), currently at $2.22.

The path of least resistance appears downward as the Relative Strength Index (RSI) drops slightly below the midline. A prolonged drop toward oversold territory would indicate bearish momentum, with sellers having the upper hand.

The 200-day EMA highlights potential support at $2.10, which could be tested in upcoming sessions if the decline persists.

A sell signal was triggered by the SuperTrend indicator on May 31, which could help validate the downtrend. This is a trend-following tool that utilizes data from the Average True Range (ATR) to gauge market volatility.

Traders use the SuperTrend as a dynamic support and resistance. A sell signal is confirmed when the price of XRP slides below the tool, changing its color from red to green.

XRP/USDT daily chart

If the down leg extends below the 200-day EMA support at $2.10, key levels likely to gain importance include $1.90, which was tested on June 22, $1.80, and $1.61, the latter of which were both tested in April.

On the other hand, due to the steady investor interest in XRP, the decline could be limited, allowing for consolidation ahead of another breakout attempt. A 7.44% upswing from the current price level could bring XRP to the hurdle at $2.33, probed on June 16, the highest peak of June at $2.65, implying a 22% move.

Cryptocurrency metrics FAQs

The developer or creator of each cryptocurrency decides on the total number of tokens that can be minted or issued. Only a certain number of these assets can be minted by mining, staking or other mechanisms. This is defined by the algorithm of the underlying blockchain technology. On the other hand, circulating supply can also be decreased via actions such as burning tokens, or mistakenly sending assets to addresses of other incompatible blockchains.

Market capitalization is the result of multiplying the circulating supply of a certain asset by the asset’s current market value.

Trading volume refers to the total number of tokens for a specific asset that has been transacted or exchanged between buyers and sellers within set trading hours, for example, 24 hours. It is used to gauge market sentiment, this metric combines all volumes on centralized exchanges and decentralized exchanges. Increasing trading volume often denotes the demand for a certain asset as more people are buying and selling the cryptocurrency.

Funding rates are a concept designed to encourage traders to take positions and ensure perpetual contract prices match spot markets. It defines a mechanism by exchanges to ensure that future prices and index prices periodic payments regularly converge. When the funding rate is positive, the price of the perpetual contract is higher than the mark price. This means traders who are bullish and have opened long positions pay traders who are in short positions. On the other hand, a negative funding rate means perpetual prices are below the mark price, and hence traders with short positions pay traders who have opened long positions.