Bitcoin At A Crossroads: $97,000 Cost Basis Holds Key To Next Breakout

Bitcoin prices have returned above $105,000 in the past 24 hours following a sharp price decline on Thursday triggered by macroeconomic pressures. Notably, US President Donald Trump and former political ally Elon Musk had engaged in a public spat which spiked the volatility in a crypto market already undergoing a corrective phase.

Amidst some level of renewed stability in the last two days, popular analytics firm Glassnode has now shared an important on-chain analysis highlighting the presently key price levels in the Bitcoin market.

Bitcoin Ready For Breakout As Traders Eye $114K And $83K Levels

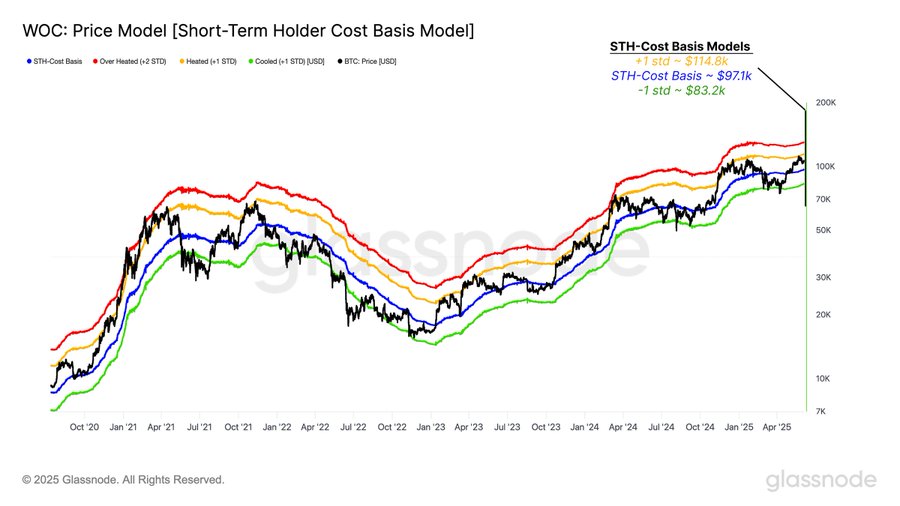

In an X post on June 7, Glassnode provides an insight on potential Bitcoin price action using the Short-Term Holder (STH) cost basis model, derived from the Work of Cost (WOC) price framework. As the name implies, the STH cost basis represents the average purchased price of all coins belonging to short-term holders i.e. investors who acquired their Bitcoin within the last 155 days.

The STH cost basis is an important market metric as it reflects the risk appetite of newer market participants who are typically the most reactive to price change. It is also a strong indicator of market sentiment with an ability to act as resistance or support depending on the price direction.

According to the data by Glassnode, the current Bitcoin STH cost basis is estimated at $97,100. Using standard deviation bands in this WOC model, Glassnode has further identified the $114,800 price level as the +1STD level of this cost basis and a potentially heated market zone.

Considering Bitcoin’s price, this $114,800 price zone represents the next major resistance, a break above which is expected to trigger a massive buying pressure and push the premier cryptocurrency further into uncharted price territory.

Glassnode’s WOC model also identifies the -1STD level at $83,200 to represent a critical support zone in the present bullish structure. A decisive price fall below this level would signal market weakness and is likely to cause a cascade of liquidations and further price corrections.

Bitcoin Price Overview

At the time of writing, Bitcoin trades at $105,745 reflecting a 1.07% gain in the last 24 hours. Meanwhile, the asset’s daily trading volume is down by 34.27% and valued at $38.66 billion. Provided Bitcoin continues to consolidate above the STH cost basis at $97,100, there is a valid chance for a market bullish push towards resistance at $114,800.

However, a loss of the critical support at $97,100 would points to a retest at $83,200 which holds strong potential bearish consequences.