Bitcoin Rebound From $100,000 – Healthy Pullback Or Start Of Deeper Correction?

On Thursday, Bitcoin (BTC) prices dipped to below $101,000 as fallout between US President Donald Trump and world’s wealthiest man Elon Musk rocked the US financial markets. However, in the past 48 hours, the maiden cryptocurrency has registered a rebound climbing to above $105,000 before slipping into a sideways movement. Amidst these developments, a popular crypto analyst with X pseudonym KillaXBT has outlined multiple scenarios for Bitcoin’s next price action.

Behind Bitcoin’s Rebound From $100,000

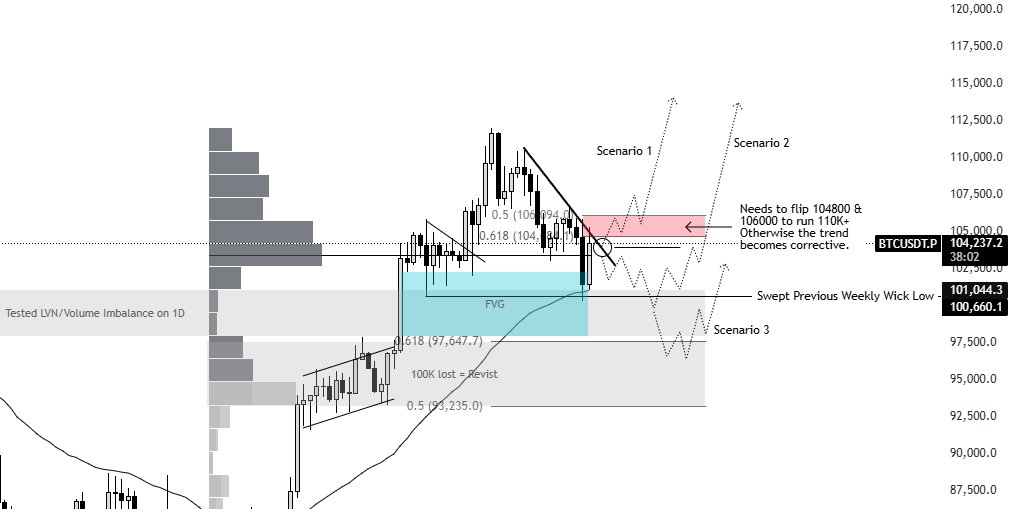

In an X post on June 7, KillaXBT provides a profound technical analysis of the Bitcoin market discussing the recent price rebound and potential developments moving forward. After reaching a new all-time high near $112,000 on May 22, BTC entered a corrective phase falling by an estimated 10% into the $100,000 price range, before it’s recent rebound in the past two days. KillaXBT explains this rebound is not random and was driven by a combination of technical and market factors. These factors include the daily FVG and volume imbalances which are price filled inefficiencies left behind on the chart.

Furthermore, there was a liquidity sweep as Bitcoin’s steady decline pushed prices below the previous weekly lows triggering many stop-losses from long positions. This development created a flush of liquidity for big players which served as a fuel in driving a market rebound. Finally, KillaXBT talks on a short squeeze setup whereby the Bitcoin market turned short heavy when traders expected a further downside following the initial price bounce from $100,000. When prices started going up, these short traders had to buy back to cover their losses, adding more fuel to the rally.

What Next For BTC?

Looking to the future, KillaXBT has highlighted three potential scenarios for BTC. Presently, the analysts states the premier cryptocurrency is retesting a resistance zone between $104,800-$106,000 which aligns with the 0.5-0.618 Fibonacci retracement levels of the recent price drop. For the first scenario, KillaXBT foresees a bullish continuation only if Bitcoin breaks and holds above this resistance region. Such a move could trap short sellers once again, potentially fueling further upside momentum. However, if Bitcoin faces rejection at this specified resistance area, the second scenario comes into play, in which the price is likely to decline and retest the $100,000 support level. The third, final and worst case scenario includes a price break below the $100,000 leading Bitcoin to retest support zones around the $97,000 price region. Interestingly, KillaXBT’s personal projection expects market makers to continue driving Bitcoin’s price higher, capitalizing on the recent sharp rebound that caught many short traders off guard. With no clear “safe” long entry yet available, the analyst suggests that pushing prices further would trap more short sellers while forcing sidelined bulls to chase the rally At press time, BTC continues to trade at $105,600 reflecting a 1.16% gain in the past day.