Fartcoin extends rebound, decoupling from broader market flash crash amid potential listing on Coinbase

- Fartcoin rebounds from $0.86, extending its recovery in the last 24 hours to trade above the $1.00 support.

- Coinbase adds Fartcoin to its listing roadmap, triggering notable market response.

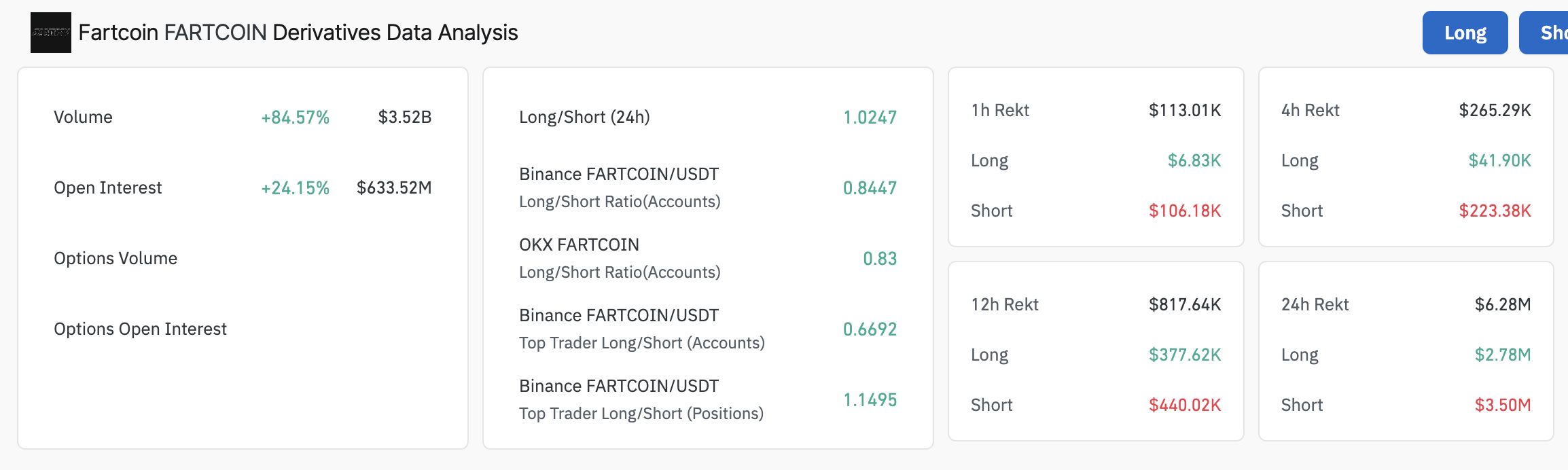

- The derivatives market's Open Interest surges 24% to $633 million, along with a trading volume increase to $3.52 billion.

Fartcoin (FARTCOIN), a Solana-based meme coin boasting a market capitalization of slightly over $1 billion, is extending its gains, trading at around $1.08 at the time of writing on Friday.

The uptrend has seen the token sustain gains exceeding 20% over the past 24 hours, backed by the positive market response after Coinbase announced Fartcoin's addition to its listing roadmap late Thursday.

Fartcoin's support on Coinbase listing roadmap triggers massive rebound

Coinbase announced in an X post at the end of the American session on Thursday that it has added Fartcoin and another token called Subsquid (SQD) to its roadmap.

The announcement is a part of Coinbase's effort to increase transparency by providing substantial information on assets being considered for trading on its platform.

Despite Coinbase highlighting that trading of the two assets has not started and "is contingent on market-making support" and sufficient technical infrastructure," Fartcoin saw a massive spike in trader interest, with the price rallying in double-digits over 24 hours.

Coinbase is expected to announce the official listing once all conditions have been satisfactorily met.

A 24% increase in the derivatives market Open Interest (OI) to $633 million, along with a massive 85% surge in trading volume to $3.52 billion, shows that trader interest in Fartcoin and market participation are rising in tandem.

Fartcoin derivatives market stats | Source: CoinGlass

Short position liquidations at $3.5 million exceeded long position liquidations at $2.8 million over the past 24 hours, indicating bullish momentum. Fartcoin's futures long-to-short ratio of 1.0247 shows that traders have a bullish bias amid expectations of a lasting uptrend.

Technical outlook: Fartcoin reclaims $1.00 support

Fartcoin's price hovers above $1.00 support at the time of writing, up 22% from the recent downturn to $0.86. The meme coin currently holds above the 100-day Exponential Moving Average (EMA) at approximately $0.95, and the 200-day EMA is located further down at $0.77.

The path of least resistance could stay firmly upward should the Relative Strength Index (RSI) lift above the 50 midline. Traders could also consider increasing exposure to FARTCOIN if the Moving Average Convergence Divergence (MACD) indicator flashes a buy signal with the blue MACD line crossing above the red signal line.

FARTCOIN/USDT daily chart

On the upside, support at $1.00 would go a long way to ascertain the uptrend's strength. A subsequent break above the 50-day EMA at $1.11 could compel traders to extend their bullish scope to $1.50, representing a 43% price increase from the current market value.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.