Nearly $200 million in ETH burned as Ethereum gears up for Dencun upgrade

- Ethereum worth $190 million was burned during the past week, effectively reducing the altcoin’s circulating supply.

- Ethereum’s Cancun-Deneb upgrade is scheduled to occur on March 13.

- Whales are accumulating the altcoin while retail investors and small-wallet holders appear to be taking profits following Ether’s rally.

Ethereum (ETH) price has increased sharply in the past week as investors appear to be pricing in the positive effects of the upcoming Dencun upgrade and the possibility that the US Securities and Exchange Commission (SEC) approves this year exchange-traded funds that track Ether. Meanwhile, on-chain data shows that almost $200 million in ETH were burned in the past week, another indicator of further price gains as it reduces the circulating supply of the altcoin.

Ethereum holders are anticipating the two catalysts that are likely to drive ETH price rally this cycle. The upcoming Cancun-Deneb (Dencun) Hard Fork and the SEC’s decision on the Spot Ethereum ETF are the two catalysts for the altcoin.

Ethereum price is $3,790 at the time of writing.

Also read: Ethereum price beats crypto market bloodbath nearly a week away from Dencun upgrade

Ethereum price gains could be triggered by these catalysts

Ethereum price rally to the psychologically important $4,000 target and beyond could be catalyzed by the upcoming Dencun upgrade, an important technical improvement that resolves the scalability aspect of the so-called “Blockchain Trilemma”.

The Blockchain Trilemma is the trade-off between three important aspects: security, scalability and decentralization. Ethereum has prioritized decentralization and security, meaning that the scalability aspect can be improved with upgrades and Hard Forks to the blockchain.

Find out more about why the Dencun upgrade is important and how it could reduce the transaction costs for Layer 2 chains, in this post.

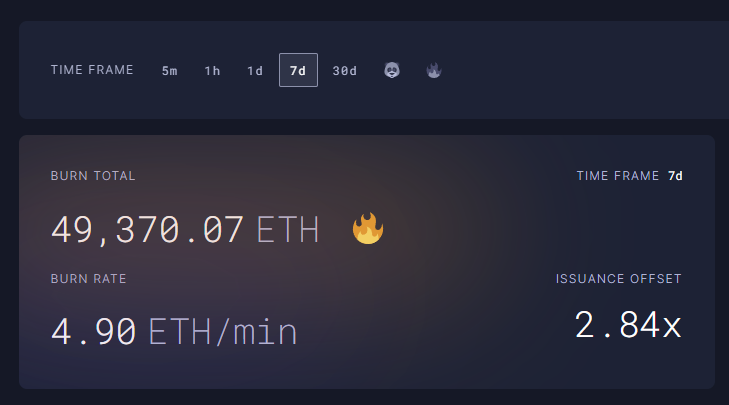

Looking at on-chain data, some indicators also signal upside momentum for Ethereum. The altcoin’s circulating supply, which plays a role in gauging the asset’s selling pressure, is declining. According to data from Ultrasound.money, $190 million worth of ETH was removed from the circulating supply by token burn.

Ether burned in the past week. Source: ultrasound.money

An analysis of the different cohorts of investors holding ETH, the so-called supply distribution, also signals the possibility of further price gains. While retail and small-wallet holders (those with 10 to 10,000 ETH) have shed their holdings and likely taken profits since the beginning of March, large-wallet investors are adding ETH to their holdings. Typically, whale accumulation has been a bullish sign for the asset and has preceded Ethereum price rally, as seen in the chart below.

%20[13.19.12,%2007%20Mar,%202024]-638453978808682999.png)

Ethereum Supply Distribution. Source: Santiment

%20[13.18.43,%2007%20Mar,%202024]-638453979042942719.png)

Ethereum Network Realized Profit/Loss. Source: Santiment

ETH holders are also awaiting the SEC’s decision about the potential approval of a Spot Ethereum ETF. The US regulator has several applications on the table, and the deadline to decide about them is May 23. Ethereum traders believe that an approval could usher institutional capital inflow and catalyze gains in ETH, as it has happened with Bitcoin.

At the time of writing, Ethereum’s price is $3,790, up nearly 13% in the past week.