Market Expert Projects ‘Undervalued’ Litecoin To Soar At Least 1,000% — Here’s How

The price of Litecoin has been somewhat indecisive this year, and the past week is a prime example of this disappointing trend. While the world’s largest cryptocurrency, Bitcoin, reached a new all-time high, LTC failed to capitalize on the injection of bullish momentum into the crypto market.

However, a prominent crypto expert has come forward with a claim that Litecoin might be the most undervalued asset in the market at the moment. Interestingly, the altcoin’s price seems set to enjoy a period of strong bullish impetus over the next few months.

Here’s Why LTC Price Could Be Set For An Extended Rally

Chartered Market Technician Tony Severino has put forward an exciting prediction for the price trajectory of Litecoin in the coming months. According to the crypto expert, the digital asset could be preparing for an extended bull rally of at least 1,000% — and up to 2,000% — price growth.

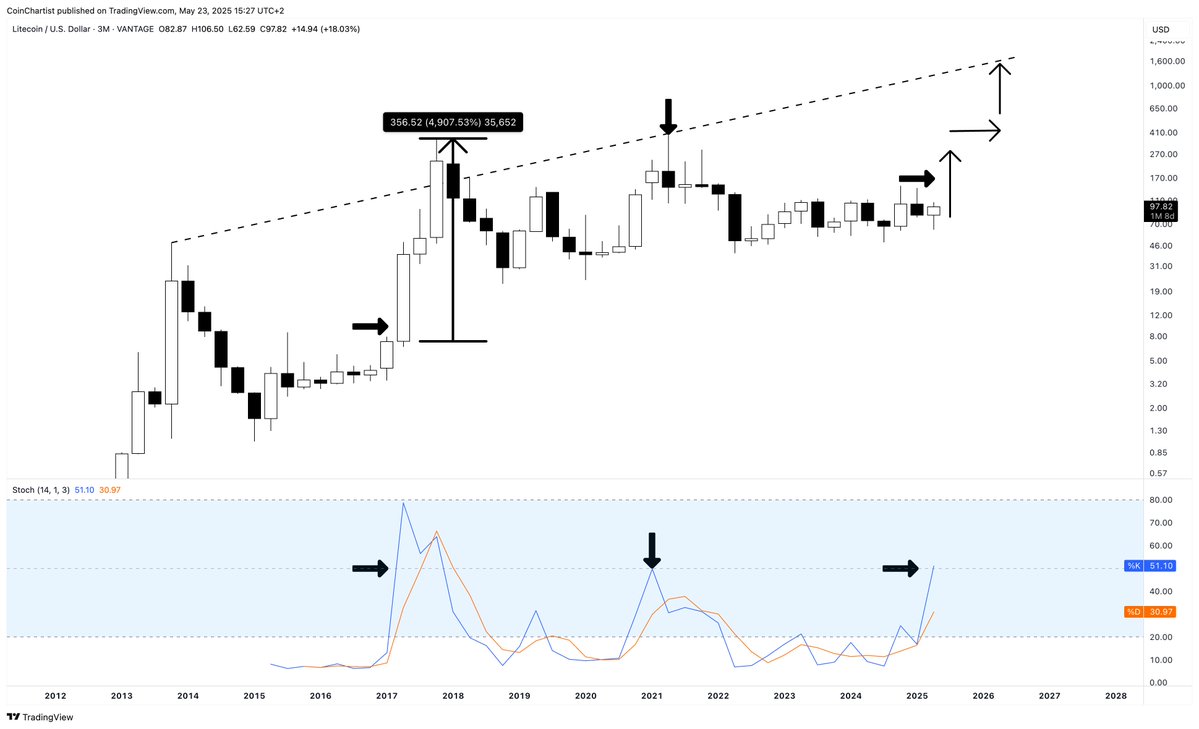

This bullish projection is based on the movement of the Stochastic Oscillator on the 3-month LTC price chart. The Stochastic Oscillator is an indicator used in technical analysis to gauge price momentum and pinpoint potential trend reversals.

The indicator is usually represented by two lines: %K and %D. %K is a faster line while %D is a smoothed moving average of %K, and they both oscillate between 0 and 100. When the Stochastic Oscillator falls below 20, it implies an oversold market; while values above 80 often indicate an overbought market.

According to Severino, the Litecoin 3-month Stochastic is approaching the 50 mark, which signals rising bullish sentiment for the altcoin’s price. The indicator failed the last time it attempted to cross this level in 2021.

However, the successful breach of this 50 mark is still historically significant, as it has marked the start of substantial bull rallies in the past. For instance, the altcoin’s price grew by 4,900% when the Litecoin Stochastic crossed the level in 2017.

Severino noted that it is highly unlikely for the price of Litecoin to surge by nearly 5,000% from its current level if the Stochastic Oscillator crosses the 50 level. Nevertheless, the market expert believes the asset’s price could rise by at least 1,000% and up to 2,000% by the end of 2026.

Finally, Severino mentioned that the Litecoin price is in an interesting place, with the asset being one of the most undervalued crypto assets at the moment.

Litecoin Price At A Glance

As of this writing, the price of LTC stands at around $96, reflecting an over 5% decline in the past 24 hours.