Ethereum Profitability Turns Around: Nearly 60% Of Holders In Profit Now

On-chain data shows the Ethereum investor profitability has seen a sharp turnaround following the latest rally in the asset’s price.

Ethereum Holder Profitability Has Observed A Dramatic Reversal Recently

In a new post on X, the institutional DeFi solutions provide Sentora (formerly IntoTheBlock) has talked about how the profit-loss situation has changed on the Ethereum network.

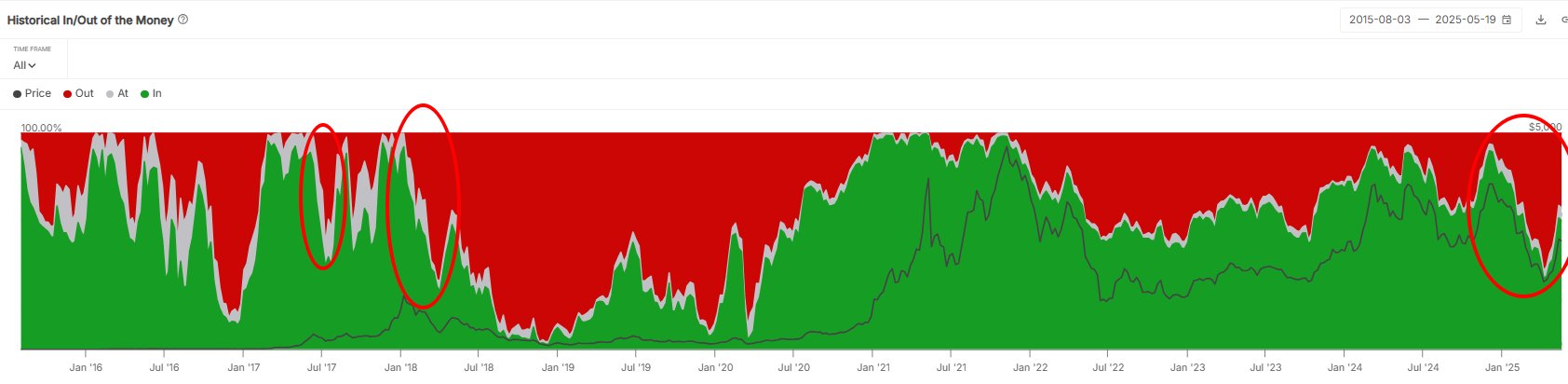

The on-chain indicator of relevance here is the “Historical In/Out of the Money,” which tells us about what part of the ETH userbase is in profit (“in the money”), loss (“out of the money”) and just breaking even (“at the money”).

The metric works by going through the on-chain history of each address on the network to see what average price it acquired its coins at. If this average cost basis is lower than the spot price for any wallet, then that particular user is considered to be in the money. Similarly, the address is assumed to be out of the money in the opposite case and at the money when the two prices are equal.

Now, here is a chart that shows the trend in the Ethereum Historical In/Out of the Money over the past decade:

As displayed in the above graph, the in the money Ethereum investors had observed a steep drop following the selloff that started in December 2024. Prior to this drawdown, the metric was sitting above 90%, implying the vast majority of the users were holding unrealized gains. By April 2025, however, the situation had completely flipped for the investors as this value had come down to just 32%.

Now, yet another shift seems to have occurred for the cryptocurrency’s addresses, as the ETH price has this time seen a sharp rally. Almost 60% of the holders are now back in the money, which, while still not quite near the same level as late last year, is significantly higher than the low.

In the chart, the analytics firm has highlighted when Ethereum last saw such sharp swings in profitability. “The asset hasn’t witnessed volatility on this scale since the 2017 cycle,” notes Sentora.

In some other news, ETH has reclaimed two important on-chain levels following its recovery run, as the analytics firm Glassnode has discussed in its latest weekly report.

From the chart, it’s apparent that Ethereum reclaimed the Realized Price early on in the run. The Realized Price represents the average cost basis of all investors on the ETH network. Currently, this level is situated at $1,900, meaning that at the current exchange rate, the holders would be in notable profit.

The cryptocurrency has now also managed to surpass the True Market Mean located at $2,400, which is a model is similar to the Realized Price, except for the fact that it aims to find a more accurate average acquisition level for the market by excluding long-lost dormant supply.

Ethereum now has just one more level left to reclaim: the Active Realized Price at $2,900, which is again a model that iterates on the Realized Price.

ETH Price

Ethereum has climbed to the $2,660 mark following a rally of about 4% in the last week.