Trump Bows Down! Cryptocurrencies Frenzy Hits, Bitcoin Soars Over 6%!

TradingKey - Trump’s softer approach brings a flood of funds into the Cryptocurrencies market. Cryptocurrencies rebound strongly. Bitcoin breaks past $90,000.

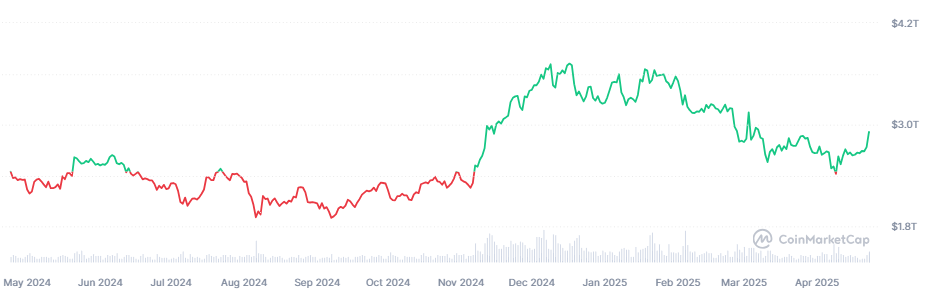

On Wednesday, April 23, money flowed into Cryptocurrencies. Nearly $200 billion entered. Market capitalization rose from $2.72 trillion to $2.91 trillion, reaching early March highs.

Cryptocurrencies market capitalization changes, Source: CoinMarketCap.

Trump signaled a tariff easing and showed no intention of firing Powell. This sparked a wave of investments, driving Cryptocurrencies prices up. In the last 24 hours, Bitcoin (BTC)

surged 6.38%, now at $93,301. Ethereum (ETH) skyrocketed 12%, now at $1,782. Ripple (XRP)rose 6.22%, now at $2.21. Solana (SOL) soared 18%, now at $148.

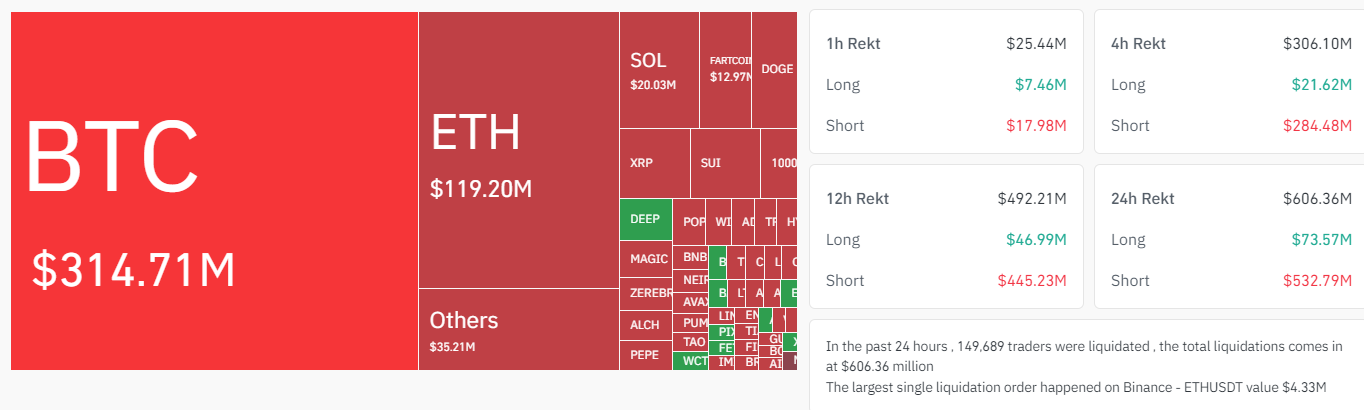

The Cryptocurrencies market's rebound led to massive short liquidations. According to CoinGlass, nearly 150,000 traders faced liquidations in the past 24 hours. Total losses reached $606 million, with shorts accounting for $532 million, or 88%.

Cryptocurrencies market liquidation data, Source: Coinglass.