Base’s Jesse Pollak introduces content coins as alternative to memes, ‘Base is for everyone’ coin causes stir

- Jesse Pollak, founder of Base, introduced an idea for a new stream of cryptocurrencies known as content coins.

- Content coins are tokens that represent a single piece of content that the owners control.

- A "Base is for everyone" content coin plunged sharply after launching on the Zora protocol.

Base founder Jesse Pollak introduced the idea of content coins in a series of X posts on Wednesday. The idea behind this new class of tokens has drawn mixed reactions from community members, as some suggest that content coins are a rephrased version of meme coins. Meanwhile, Base came under fire following a plunge in the content coin related to its "Base is for everyone" post on the Zora protocol.

Jesse Pollak promotes new breed of tokens based on content

Jesse Pollak initiated a conversation on X around an idea for a new class of tokens called content coins. This new breed of tokens stems from random content ideas brought on-chain to drive community engagement.

Base founder emphasized that content coins allow creators to control and earn from the value that their content generates. These coins, which are primarily launched on Zora — an on-chain social network that turns content into coins — thrive based on engagements from other users.

Jesse stated that the tokens will benefit collectors who buy them to support creators and traders who get in early. He further noted that content coins will thrive entirely on engagement — the higher the engagement, the higher the valuation.

"I think it will create more funding for creators and artists and therefore bring more creativity on-chain. I also think it has the potential to create a mainstream consumer behavior that has virality," Jesse stated on X.

The experiment drew mixed reactions from crypto community members. Some stated their intent to begin tokenizing their content, while others argued it's the same as meme coins, which have no intrinsic value and thrive based on speculation.

David Phelps, co-founder of JokeRace, stated that content coins match every definition of meme coins. Marco Peyfuss, founder of Transient Labs, also shared that coining content promotes activities such as gambling as posts would be turned into financial instruments.

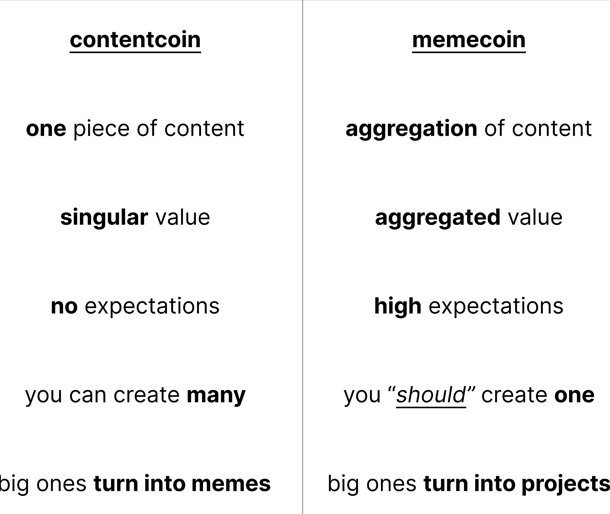

Jesse responded to queries on the similarities between the two token classes with a picture differentiating both, stating that "not all coins are the same."

Content Coins vs Meme Coins. Source: Jesse Pollak

Meanwhile, Base and Jesse faced heavy criticism after Base released a content coin for the "Base is for everyone" post on Zora. The team's post led many users to immediately begin investing in the token, which rose to a market cap of $21.25 million before crashing to $13.62 million within a few hours, according to data from Coinmarketcap.

The Base team responded to negative comments, stating that the post and associated content coin were part of a broader attempt to "experiment in public" and do not in any way represent an official token from Base or Coinbase.

“To be clear, Base will never sell these tokens, and these are not official network tokens for Base, Coinbase, or any other related product. The content we share is creative, and we're going to keep bringing culture on-chain,” Base posted on X. "If we want the future to be on-chain, we have to be willing to experiment in public. That's what we're doing," the post added.

Meanwhile, the excitement surrounding Base's content coin exploration sent Zora's total revenue to an all-time high of about $140,000, with 54% of the revenue going back to creators, per Bockworks data. Zora runs on the Base network.